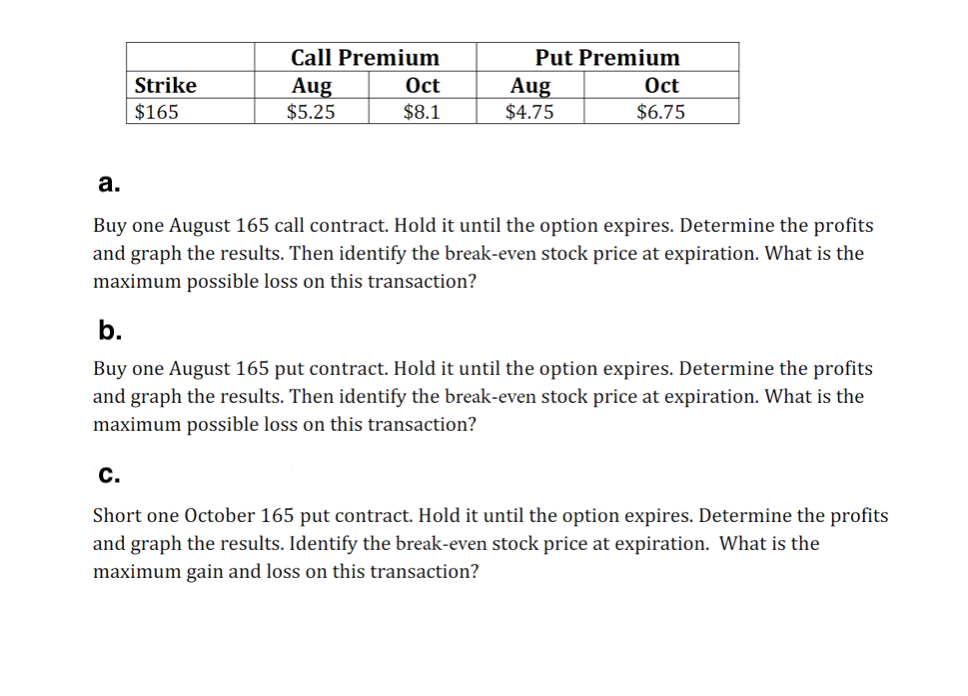

Call Premium Put Premium Strike Oct Aug $5.25 Aug $4.75 Oct $165 $8.1 $6.75 а. Buy one August 165 call contract. Hold it until the option expires. Determine the profits and graph the results. Then identify the break-even stock price at expiration. What is the maximum possible loss on this transaction? b. Buy one August 165 put contract. Hold it until the option expires. Determine the profits and graph the results. Then identify the break-even stock price at expiration. What is the maximum possible loss on this transaction? с. Short one October 165 put contract. Hold it until the option expires. Determine the profits and graph the results. Identify the break-even stock price at expiration. What is the maximum gain and loss on this transaction?

Call Premium Put Premium Strike Oct Aug $5.25 Aug $4.75 Oct $165 $8.1 $6.75 а. Buy one August 165 call contract. Hold it until the option expires. Determine the profits and graph the results. Then identify the break-even stock price at expiration. What is the maximum possible loss on this transaction? b. Buy one August 165 put contract. Hold it until the option expires. Determine the profits and graph the results. Then identify the break-even stock price at expiration. What is the maximum possible loss on this transaction? с. Short one October 165 put contract. Hold it until the option expires. Determine the profits and graph the results. Identify the break-even stock price at expiration. What is the maximum gain and loss on this transaction?

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter18: Derivatives And Risk Management

Section18.A: Valuation Of Put Options

Problem 1P

Related questions

Question

100%

please answer all the 3 sub parts

Transcribed Image Text:Call Premium

Put Premium

Strike

Oct

Oct

Aug

$5.25

Aug

$4.75

$165

$8.1

$6.75

а.

Buy one August 165 call contract. Hold it until the option expires. Determine the profits

and graph the results. Then identify the break-even stock price at expiration. What is the

maximum possible loss on this transaction?

b.

Buy one August 165 put contract. Hold it until the option expires. Determine the profits

and graph the results. Then identify the break-even stock price at expiration. What is the

maximum possible loss on this transaction?

с.

Short one October 165 put contract. Hold it until the option expires. Determine the profits

and graph the results. Identify the break-even stock price at expiration. What is the

maximum gain and loss on this transaction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 9 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning