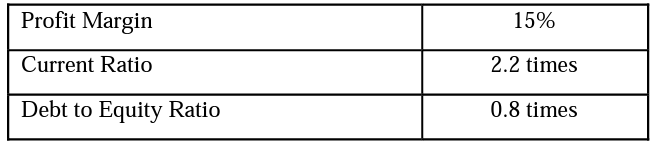

The below information relates to Drake Ltd which manufactures and sells commercial kitchen equipment. The company is constantly profitable. Drake Ltd’s financial statement ratios are as follows: For each of the following transactions or events, indicate the directional effect (increase, decrease, no change) on the Profit Margin, Current Ratio and Debt to Equity in the table below. Note that you must write either ‘increase’, ‘decrease’ or ‘no change’. Consider each transaction independently of all the other transactions. a. Drake Ltd borrowed an additional $200,000 as short-term, 6-month loan from the bank. b. Sold obsolete inventory purchased for $75,000 for $50,000 cash c. Paid $100,000 dividends to shareholders (previously declared)

The below information relates to Drake Ltd which manufactures and sells commercial kitchen equipment. The company is constantly profitable. Drake Ltd’s financial statement ratios are as follows:

For each of the following transactions or events, indicate the directional effect (increase, decrease, no change) on the Profit Margin,

a. Drake Ltd borrowed an additional $200,000 as short-term, 6-month loan from the bank.

b. Sold obsolete inventory purchased for $75,000 for $50,000 cash

c. Paid $100,000 dividends to shareholders (previously declared)

Trending now

This is a popular solution!

Step by step

Solved in 4 steps