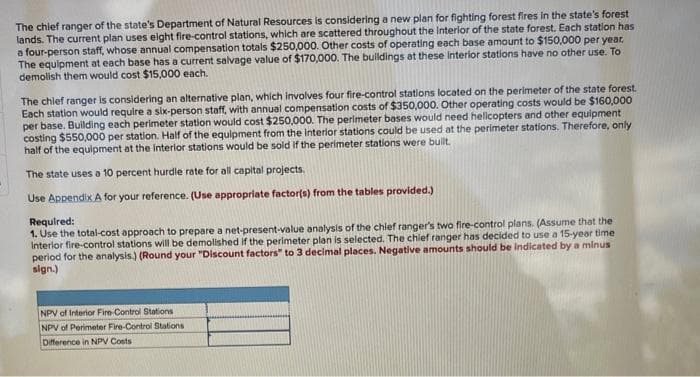

The chief ranger of the state's Department of Natural Resources is considering a new plan for fighting forest fires in the state's forest lands. The current plan uses eight fire-control stations, which are scattered throughout the Interior of the state forest. Each station has a four-person staff, whose annual compensation totals $250,000. Other costs of operating each base amount to $150,000 per year. The equipment at each base has a current salvage value of $170,000. The buildings at these interior stations have no other use. To demolish them would cost $15,000 each. The chief ranger is considering an alternative plan, which involves four fire-control stations located on the perimeter of the state forest. Each station would require a six-person staff, with annual compensation costs of $350,000. Other operating costs would be $160,000 per base. Building each perimeter station would cost $250,000. The perimeter bases would need helicopters and other equipment costing $550,000 per station. Half of the equipment from the Interior stations could be used at the perimeter stations. Therefore, only half of the equipment at the interior stations would be sold if the perimeter stations were built. The state uses a 10 percent hurdle rate for all capital projects. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Use the total-cost approach to prepare a net-present-value analysis of the chief ranger's two fire-control plans. (Assume that the Interior fire-control stations will be demolished if the perimeter plan is selected. The chief ranger has decided to use a 15-year time period for the analysis.) (Round your "Discount factors" to 3 decimal places. Negative amounts should be indicated by a minus sign.) NPV of Interior Fire-Control Stations NPV of Perimeter Fire-Control Stations Difference in NPV Costs

The chief ranger of the state's Department of Natural Resources is considering a new plan for fighting forest fires in the state's forest lands. The current plan uses eight fire-control stations, which are scattered throughout the Interior of the state forest. Each station has a four-person staff, whose annual compensation totals $250,000. Other costs of operating each base amount to $150,000 per year. The equipment at each base has a current salvage value of $170,000. The buildings at these interior stations have no other use. To demolish them would cost $15,000 each. The chief ranger is considering an alternative plan, which involves four fire-control stations located on the perimeter of the state forest. Each station would require a six-person staff, with annual compensation costs of $350,000. Other operating costs would be $160,000 per base. Building each perimeter station would cost $250,000. The perimeter bases would need helicopters and other equipment costing $550,000 per station. Half of the equipment from the Interior stations could be used at the perimeter stations. Therefore, only half of the equipment at the interior stations would be sold if the perimeter stations were built. The state uses a 10 percent hurdle rate for all capital projects. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Use the total-cost approach to prepare a net-present-value analysis of the chief ranger's two fire-control plans. (Assume that the Interior fire-control stations will be demolished if the perimeter plan is selected. The chief ranger has decided to use a 15-year time period for the analysis.) (Round your "Discount factors" to 3 decimal places. Negative amounts should be indicated by a minus sign.) NPV of Interior Fire-Control Stations NPV of Perimeter Fire-Control Stations Difference in NPV Costs

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 51P: Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new...

Related questions

Question

Transcribed Image Text:The chief ranger of the state's Department of Natural Resources is considering a new plan for fighting forest fires in the state's forest

lands. The current plan uses eight fire-control stations, which are scattered throughout the Interior of the state forest. Each station has

a four-person staff, whose annual compensation totals $250,000. Other costs of operating each base amount to $150,000 per year.

The equipment at each base has a current salvage value of $170,000. The buildings at these interior stations have no other use. To

demolish them would cost $15,000 each.

The chief ranger is considering an alternative plan, which involves four fire-control stations located on the perimeter of the state forest.

Each station would require a six-person staff, with annual compensation costs of $350,000. Other operating costs would be $160,000

per base. Building each perimeter station would cost $250,000. The perimeter bases would need helicopters and other equipment

costing $550,000 per station. Half of the equipment from the Interior stations could be used at the perimeter stations. Therefore, only

half of the equipment at the interior stations would be sold if the perimeter stations were built.

The state uses a 10 percent hurdle rate for all capital projects.

Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.)

Required:

1. Use the total-cost approach to prepare a net-present-value analysis of the chief ranger's two fire-control plans. (Assume that the

Interior fire-control stations will be demolished if the perimeter plan is selected. The chief ranger has decided to use a 15-year time

period for the analysis.) (Round your "Discount factors" to 3 decimal places. Negative amounts should be indicated by a minus

sign.)

NPV of Interior Fire-Control Stations

NPV of Perimeter Fire-Control Stations

Difference in NPV Costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College