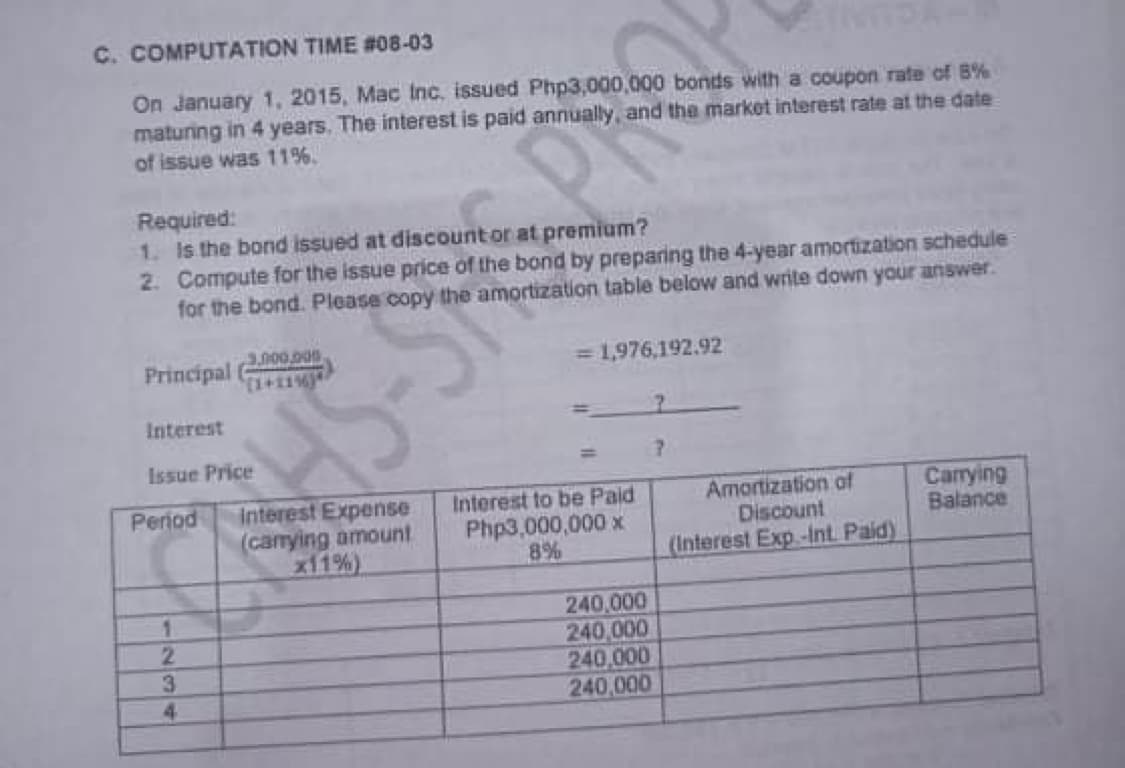

C. COMPUTATION TIME #08-03 On January 1, 2015, Mac Inc, issued Php3,000,000 bonds with a coupon rate of B% maturing in 4 years. The interest is paid annually, and the market interest rate at the date of issue was 11%. Required: 1. Is the bond issued at discount or at premium? 2. Compute for the issue price of the bond by preparing the 4-year amortization schedule for the bond. Please copy the amortization table below and write down your answer. 3.900.000 Principal = 1,976,192.92

C. COMPUTATION TIME #08-03 On January 1, 2015, Mac Inc, issued Php3,000,000 bonds with a coupon rate of B% maturing in 4 years. The interest is paid annually, and the market interest rate at the date of issue was 11%. Required: 1. Is the bond issued at discount or at premium? 2. Compute for the issue price of the bond by preparing the 4-year amortization schedule for the bond. Please copy the amortization table below and write down your answer. 3.900.000 Principal = 1,976,192.92

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:C. COMPUTATION TIME #08-03

On January 1, 2015, Mac Inc, issued Php3,000,000 bonds with a coupon rate of B%

maturing in 4 years. The interest is paid annually, and the market interest rate at the date

of issue was 11%

Required:

1. Is the bond issued at discountor at premium?

2. Compute for the issue price of the bond by preparing the 4-year amortization schedule

for the bond. Please copy the amortization table below and write down your answer.

3,000.000.

Principal

=1,976,192.92

Interest

Issue Price

Interest Expense

(carrying amount

x11%)

Carying

Balance

Period

Interest to be Paid

Php3,000,000 x

8%

Amortization af

Discount

(Interest Exp.-Int. Paid)

240,000

240,000

240,000

240,000

2.

3

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT