C. d. a. cost. b. PRICE 126 C. d. 84 72 40 C. d. 30 8. Refer to Figure above. A benevolent social planner would prefer a. a $48 price to any other price. b. 140 units to any other quantity of output. a subsidy of $52 per unit to a subsidy of $54 per unit. a tax of $54 per unit to a subsidy of $54 per unit. O 80 QUANTITY 140 9. Flu shots provide a positive externality. Suppose that the market for vaccinations is perfectly competitive. Without government intervention in the vaccination market, which of the following statements is correct? At the current output level, the marginal social cost exceeds the marginal private $8,820. $1,620. Supply Social Value The current output level is inefficiently high. A per-shot tax could turn an inefficient situation into an efficient one. At the current output level, the marginal social benefit exceeds the marginal private benefit. Demand 10. Refer to Figure above. Taking into account private value and external benefits, the maximum total surplus that can be achieved in this market is a. $2,880. b. $2,940.

C. d. a. cost. b. PRICE 126 C. d. 84 72 40 C. d. 30 8. Refer to Figure above. A benevolent social planner would prefer a. a $48 price to any other price. b. 140 units to any other quantity of output. a subsidy of $52 per unit to a subsidy of $54 per unit. a tax of $54 per unit to a subsidy of $54 per unit. O 80 QUANTITY 140 9. Flu shots provide a positive externality. Suppose that the market for vaccinations is perfectly competitive. Without government intervention in the vaccination market, which of the following statements is correct? At the current output level, the marginal social cost exceeds the marginal private $8,820. $1,620. Supply Social Value The current output level is inefficiently high. A per-shot tax could turn an inefficient situation into an efficient one. At the current output level, the marginal social benefit exceeds the marginal private benefit. Demand 10. Refer to Figure above. Taking into account private value and external benefits, the maximum total surplus that can be achieved in this market is a. $2,880. b. $2,940.

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter7: Consumers, Producers, And The Efficiency Of Markets

Section: Chapter Questions

Problem 9PA

Related questions

Question

Solve only 10 in typed answer

Transcribed Image Text:a.

b.

C.

d.

a.

cost.

b.

PRCE

126

C.

d.

84

72

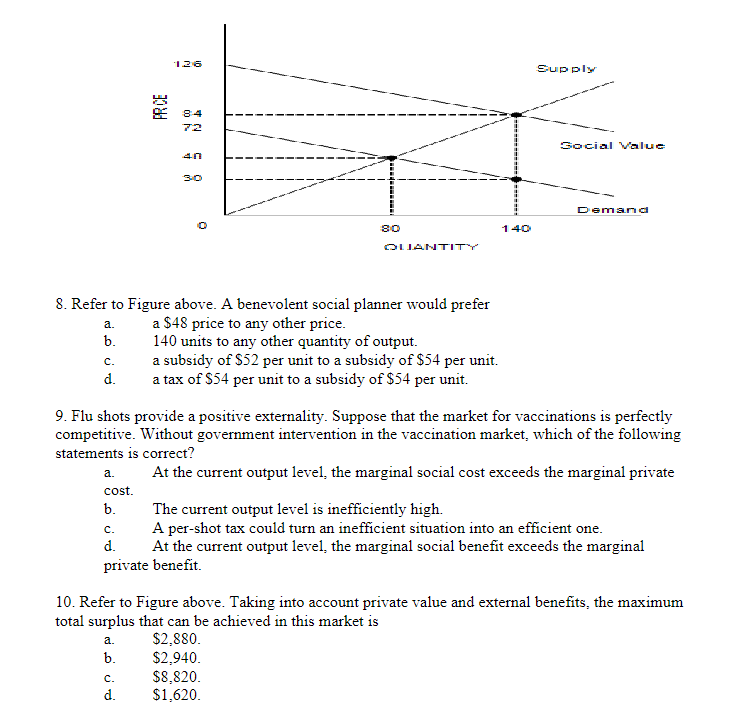

8. Refer to Figure above. A benevolent social planner would prefer

a $48 price to any other price.

40

C.

d.

30

80

QUANTITY

140 units to any other quantity of output.

a subsidy of $52 per unit to a subsidy of $54 per unit.

a tax of $54 per unit to a subsidy of $54 per unit.

140

9. Flu shots provide a positive externality. Suppose that the market for vaccinations is perfectly

competitive. Without government intervention in the vaccination market, which of the following

statements is correct?

At the current output level, the marginal social cost exceeds the marginal private

$8,820.

$1,620.

Supply

Social Value

The current output level is inefficiently high.

A per-shot tax could turn an inefficient situation into an efficient one.

At the current output level, the marginal social benefit exceeds the marginal

private benefit.

Demand

10. Refer to Figure above. Taking into account private value and external benefits, the maximum

total surplus that can be achieved in this market is

a.

$2,880.

b.

$2,940.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning