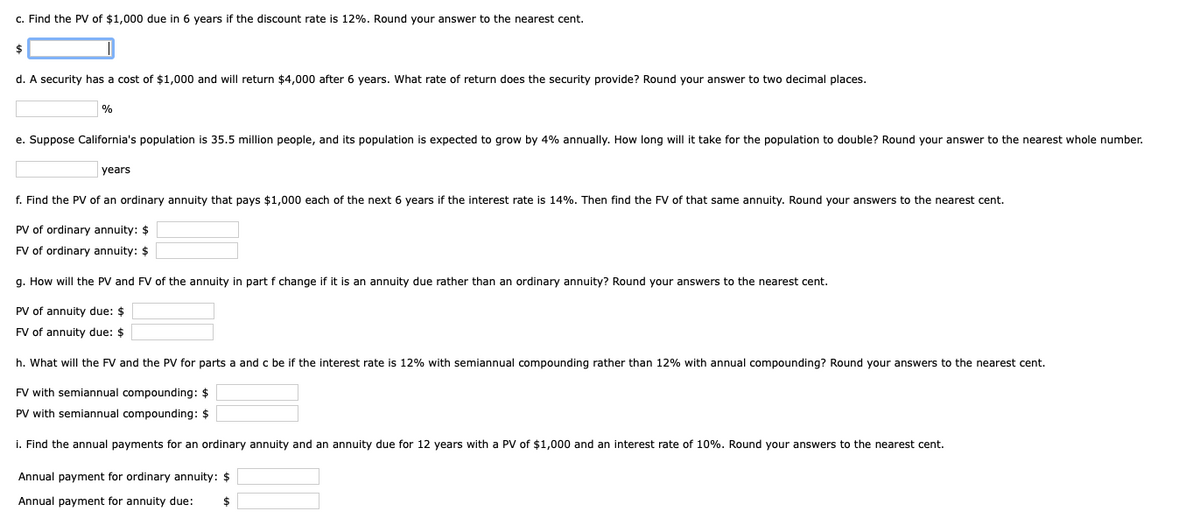

c. Find the PV of $1,000 due in 6 years if the discount rate is 12%. Round your answer to the nearest cent. $ d. A security has a cost of $1,000 and will return $4,000 after 6 years. What rate of return does the security provide? Round your answer to two decimal places. % e. Suppose California's population is 35.5 million people, and its population is expected to grow by 4% annually. How long will it take for the population to double? Round your answer to the nearest whole number. years f. Find the PV of an ordinary annuity that pays $1,000 each of the next 6 years if the interest rate is 14%. Then find the FV of that same annuity. Round your answers to the nearest cent. PV of ordinary annuity: $ FV of ordinary annuity: $ g. How will the PV and FV of the annuity in part f change if it is an annuity due rather than an ordinary annuity? Round your answers to the nearest cent. PV of annuity due: $ FV of annuity due: $ h. What will the FV and the PV for parts a and c be if the interest rate is 12% with semiannual compounding rather than 12% with annual compounding? Round your answers to the nearest cent. FV with semiannual compounding: $ PV with semiannual compounding: $ i. Find the annual payments for an ordinary annuity and an annuity due for 12 years with a PV of $1,000 and an interest rate of 10%. Round your answers to the nearest cent. Annual payment for ordinary annuity: $

c. Find the PV of $1,000 due in 6 years if the discount rate is 12%. Round your answer to the nearest cent. $ d. A security has a cost of $1,000 and will return $4,000 after 6 years. What rate of return does the security provide? Round your answer to two decimal places. % e. Suppose California's population is 35.5 million people, and its population is expected to grow by 4% annually. How long will it take for the population to double? Round your answer to the nearest whole number. years f. Find the PV of an ordinary annuity that pays $1,000 each of the next 6 years if the interest rate is 14%. Then find the FV of that same annuity. Round your answers to the nearest cent. PV of ordinary annuity: $ FV of ordinary annuity: $ g. How will the PV and FV of the annuity in part f change if it is an annuity due rather than an ordinary annuity? Round your answers to the nearest cent. PV of annuity due: $ FV of annuity due: $ h. What will the FV and the PV for parts a and c be if the interest rate is 12% with semiannual compounding rather than 12% with annual compounding? Round your answers to the nearest cent. FV with semiannual compounding: $ PV with semiannual compounding: $ i. Find the annual payments for an ordinary annuity and an annuity due for 12 years with a PV of $1,000 and an interest rate of 10%. Round your answers to the nearest cent. Annual payment for ordinary annuity: $

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 5FPE

Related questions

Question

100%

Transcribed Image Text:c. Find the PV of $1,000 due in 6 years if the discount rate is 12%. Round your answer to the nearest cent.

$

d. A security has a cost of $1,000 and will return $4,000 after 6 years. What rate of return does the security provide? Round your answer to two decimal places.

%

e. Suppose California's population is 35.5 million people, and its population is expected to grow by 4% annually. How long will it take for the population to double? Round your answer to the nearest whole number.

years

f. Find the PV of an ordinary annuity that pays $1,000 each of the next 6 years if the interest rate is 14%. Then find the FV of that same annuity. Round your answers to the nearest cent.

PV of ordinary annuity: $

FV of ordinary annuity: $

g. How will the PV and FV of the annuity in part f change if it is an annuity due rather than an ordinary annuity? Round your answers to the nearest cent.

PV of annuity due: $

FV of annuity due: $

h. What will the FV and the PV for parts a and c be if the interest rate is 12% with semiannual compounding rather than 12% with annual compounding? Round your answers to the nearest cent.

FV with semiannual compounding: $

PV with semiannual compounding: $

i. Find the annual payments for an ordinary annuity and an annuity due for 12 years with a PV of $1,000 and an interest rate of 10%. Round your answers to the nearest cent.

Annual payment for ordinary annuity: $

Annual payment for annuity due: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning