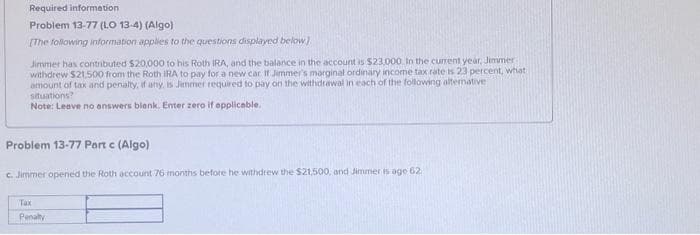

c. Jimmer opened the Roth account 76 months before he withdrew the $21.500, and Jimmer is age 62. Tax Penalty

Q: On January 1, 2024. Byner Company purchased a used tractor. Byner paid 55,000 down and signed a…

A: The question is related to Acquisition Journal Entry of Tractor. The details are given as under Down…

Q: Required information [The following information applies to the questions displayed below.] Marco…

A: The overhead is applied to the production on the basis of the pre-determined overhead rate. The…

Q: At December 31, 2023, Albrecht Corporation had outstanding 233,000 shares of common stock and 12,000…

A: EARNINGS PER SHARE Earnings Per Share is the ratio between net income for common shareholders &…

Q: Buffalo Corporation adopted the dollar-value LIFO retail inventory method on January 1, 2024. At…

A: The inventory can be valued using various methods as FIFO, LIFO and average method. Using LIFO, the…

Q: At the beginning of 2020, the Museum of History receives a documented promise to contribute $20,000…

A: Jan1, 2020 ParticularsDebitCreditPromise to Contribute a/c $20,000…

Q: Mountain Sports Inc. assembles and sells snowmobile engines. The company began operations on March 1…

A: The company's financial performance over a specific time period is explained in the income…

Q: Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,450,000 in…

A: The cost of depleting natural resources is deducted from profits. The mining, lumber, and oil and…

Q: Marvel Parts, Incorporated, manufactures auto accessories. One of the company's products is a set of…

A: The variance is the difference between the standard and actual cost data. The variance can be…

Q: Instructions Complete the missing data in these financial statements: (a) Total expenses (b) Net…

A: Accounting equation is a statement which represents the effect of each transaction on the balance…

Q: How much must you invest today at 10% interest in order to see your investment grow to $15,000 in 3…

A: Present value (PV) is the current value of a future sum of money or stream of cash flows given a…

Q: Penny and Mary Hardaway are married and live in Tennessee, a community-property state. For their…

A: Answer:- Taxable gift refers to the gifts on which the IRS imposes tax. The IRS considers everything…

Q: Exercise 17-30 (Static) Sales Mix and Quantity Variances (LO 17-4) Olivet Devices sells two models…

A: Variance arises when there is difference between actual costs and standard costs.The variance is…

Q: JDC Engineering Co. provided the following information for their business year ending June 30th,…

A: Variance arises when the actual costs differ from the standard costs. The results are favorable…

Q: Worldwide Credit Card Inc. uses standards to control the labour time involved in opening mail from…

A: Direct labor variance is the difference between standard direct labor cost for actual production and…

Q: Lawrence Plastics manufactures custom park furniture and signage from recycled plastics (primarily…

A: The objective of the question is to calculate the total cost of the Jefferson County job and to…

Q: Breakfasttime Cereal Company manufactures two breakfast cereals in a joint process. Cost and…

A: net realizable value method which will allocates the separable costs to combined costs based on…

Q: Green and White Company reported the following monthly data: Units produced Sales price 3,600 units…

A: Contribution Margin = Sale Revenue - Variable Expenses

Q: At the beginning of the current fiscal year, the balance sheet of Cummings Company showed…

A: Net income contributes to the retained earnings account, which is a key component of the owner's…

Q: Given the following case, calculate the independent effects of a 1 percent increase in Gross Margin,…

A: A profitability metric called net income counts the remaining profits a business has after deducting…

Q: Sales Salaries and commissions 1500, Depreciation of Building 500, office and officeers Salaries…

A: Administration expenses: Administration expenses are those expenses which are not directly related…

Q: Exercise 14-4 (Algo) Uncertain Future Cash Flows [LO14-4] Lukow Products is investigating the…

A: The question is related Capital Budgeting. The Net Present value is the excess of Present Value of…

Q: On January 1, Wildhorse Corporation purchased a 25% equity investment in Shane Corporation for…

A: Cash dividends are payments made by a company to its shareholders in the form of cash. These…

Q: Required information [The following information applies to the questions displayed below.] Evergreen…

A: Depreciation in accounting refers to the systematic allocation of the cost of a tangible asset over…

Q: Blaster, Inc. recently conducted a least-squares regression analysis to predict selling expenses.…

A: equation: Y = 339,000 + 8.30X Here the variable X represents the number of units sold And total…

Q: Jojo Ltd. purchased a machinery on January 1, 2020. . Cost = $15,000 • Expected salvage value =…

A: DEPRECIATION EXPENSEDepreciation means gradual decrease in value of assets due to normal wear and…

Q: A company decides to obtain a small-business loan of $237,000. The financial institution from which…

A: The money can be borrowed and repaid in installments. The interest and principal portions are paid…

Q: Stock Dividends Penguin Company has the following information regarding its common stock: $17 par,…

A: dividend is declared to the shareholders from an retained earnings of the business. The retained…

Q: Use the following information for the Quick Study below. (Algo) [The following information applies…

A: An estimated or projected or sales value and cost estimate can be included in a budget that is…

Q: Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31,…

A: Closing entries are required to close the temporary accounts after making financial statements…

Q: Frenchroast Company earned net income of $93,000 during the year ended December 31, 2020. On…

A: The objective of the question is to calculate the total dividends paid by Frenchroast Company during…

Q: Required information [The following information applies to the questions displayed below.] Rubio…

A: Lets understand the basics.The income generated by a taxpayer from sources other than employment…

Q: Ivanhoe Desalination Ltd. needed to raise $165,000,000 of additional capital to finance the design,…

A:

Q: $17,490 12,060 24,450 $16,160 16,082 16,550

A: The unrealized gain or loss calculated from difference between the fair value and cost is recogized…

Q: Assume a target income of 12% of average assets. Compute residual income for each center. Note:…

A: Residual income is the difference between income and target return on investment.. Target return on…

Q: Almarai Company Ltd manufactures two types of Sprizzer - Classic and Luxury. Each product requires…

A: Part-AThe traditional costing system is an accounting method used to determine the cost of making…

Q: f this year Eloise Ltd. had sales of $750,000, fixed costs of $150,000, and variable costs of…

A: The break-even sales are calculated as the fixed costs divided by the contribution margin ratio. The…

Q: Chapter 10- Bond Vocabulary - Match each of the following terms with appropriate definitions: 1200…

A: A bond is a type of loan where an investor lends money to a borrower, typically a corporation or…

Q: Required: a-1. Prepare all journal entries for Shandra Corporation related to this transaction and…

A: Cash flow hedge accounting utilizes financial instruments to mitigate risks linked to forthcoming…

Q: At January 1, 2025, Pembina Imports Inc. reported this information on its balance sheet. $696,000…

A: Receivable turnover ratio measures how quickly a company collects payment from its customers. The…

Q: LeMond Incorporated, a Wisconsin corporation, runs bicycle tours in several states. LeMond also has…

A: Sales Tax Liability:The total amount of sales taxes that a company has amassed from customers on…

Q: Headland Company sold 202 color laser copiers on July 10, 2025, for $4,270 apiece, together with a…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: Calculate the amount of increase or decrease and the percent change of each item. Note: Round the…

A: Horizontal analysis of balance sheet is a analysis of balance sheet in which balance sheet of…

Q: Required information [The following information applies to the questions displayed below.] Sandra's…

A: As per periodic inventory system inventory records are not updated regularly after every…

Q: 88 b. Accumulated E & P Beginning Current E & Cash Distributions (All on Last of Year Day of Year)…

A: We go into the deep intricacies of shareholder dividends and earnings and profits for five separate…

Q: Calaveras Tire exchanged equipment for two pickup trucks. The book value and fair value of the…

A: For exchange transactions, the asset given up is recorded at the book value and asset acquired is…

Q: Bellevue City's printing shop had the following trial balance on January 1, 20X2: Debit Credit $…

A: A journal entry is a basic accounting record that is used to chronologically track financial…

Q: ROI RI $ EVA $ East 0.0450 (44,000) (66,600) West Fourth quarter operating income needed 0.0720 East…

A: ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss)…

Q: Prepare the entries to record any amortization at December 31, assuming Carla Vista records…

A: Journal entries are made to record the transactions as the first process in the books of accounts…

Q: Required: How much total revenue is estimated if the expected value approach is used?

A: There can be two parts of the consideration to be received from a contract: 1. Fixed consideration…

Q: Data regarding Rock Corp.'s available-for-sale securities follows: Cost December 31, year 8 $80,000…

A: Consolidated income could refer to the combined or aggregated income of a group of entities. In the…

6

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- LO.3, 4, 5 Using the legend provided below, classify each statement under 2019 tax law. a. A foreign tax credit is available. b. The deduction of charitable contributions is subject to percentage limitation(s). c. Excess charitable contributions can be carried forward for five years. d. On the contribution of inventory to charity, the full amount of any appreciation can be claimed as a deduction. e. Excess capital losses can be carried forward indefinitely. f. Excess capital losses cannot be carried back. g. A net short-term capital gain is subject to the same tax rate as ordinary income. h. The deduction for qualified business income may be available. i. A dividends received deduction is available. j. The like-kind exchange provisions of 1031 are available. k. A taxpayer with a fiscal year of May 1April 30 has a due date for filing a Federal income tax return of July 15. l. Estimated Federal income tax payments may be required.Trudy's AGI last year was $366,000. Her Federal income tax came to $109,800, paid through both withholding and estimated payments. This year, her AGI will be $549,000, with a projected tax liability of $82,350, all to be paid through estimates. Trudy wants to pay the least amount of tax that does not incur a penalty. Note: Ignore the annualized income method. If required, round intermediate calculations to two decimal place and your final answer to the nearest dollar. a. Compute Trudy's total estimated tax payments for this year.Under the current-year method: $Under the prior-year method: $ b. Assume instead that Trudy's AGI last year was $86,000 and resulted in a Federal income tax of $17,200. Determine her total estimated tax payments for this year.Under the current-year method: $Under the prior-year method: $suppose a certain a government employee earns a cna of 18,000 290 1.0.9 at 13th month pay of 27891 has other group from benefits amounting to 10,000, how much of his benefit s is taxable? How much is non taxable? If his tax is 0.08. How much is his tax and what is his net amount for his benefit?

- Q40. In 2021, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2022, Marvin received a $1,500 refund when he filed his 2021 state income tax return. Marvin was in the 12% marginal tax bracket in 2021 but was in the 35% marginal tax bracket in 2022. How much must Marvin include in his gross income for 2022?Heiman, a VAT registered taxpayer, had the following data in 2022:Deferred input taxes, December 2021, P6,200Sales (net of VAT): January, P620,000 February, P430,000 March, P540,000 Purchases (net of VAT): January, P508,000 February, P432,000 March, P314,500 How much is the VAT payable for the month of March? P26,820 P34,090 P20,860 P26,580 P25,6201) Nancy has cumulative earnings of $104,500 and earns $7,800 during the current pay period.If the FICA rate is 4.2 percent for Social Security, with a limit of $106,800, and 1.45 percent forMedicare, applied to all earnings, calculate the total FICA tax to be withheld for this pay period.a. $440.70.b. $209.70.c. $113.10.d. $96.60.e. $231.00. 2) Ernie White has $6,800 cumulative earnings during the calendar year and earned $950 duringthe current pay period. If the state unemployment tax is 5.4 percent of the first $7,000, the federalunemployment tax is 0.6 percent of the first $7,000, the FICA Social Security tax is 6.2 percent ofthe first $106,800, and FICA Medicare tax is 1.45 percent on all earnings, the amounts placed inthe Taxable Earnings columns of the payroll register are: a. state unemployment, $0; federal unemployment, $0; Social Security, $850; Medicare,$850.b. state unemployment, $950; federal unemployment, $950; Social Security, $950; Medicare,$950.c. state unemployment,…

- Graham has wages of $165,000 and $400 of deductible expenses. He has a tax offset of $100. He has private hospital health insurance. His PAYG withholding tax was $50,600. Thus his income tax payable / refundable in the current income tax year is: a. None of the options are correct. b. $1,164.67 c. $979.00 d. $961.22 e. $1,135.546 Jason incurs the following: state income tax withholding, $12,000; property taxes, $9,000. His schedule A deduction for taxes would be? Also, What would be the deduction for AMT? Please Explain. $12,000 $21,000 $9,000 $10,000You are filling out your 1040 form for tax season. You find that you paid $3,296.44 in Federal Taxes. Using your taxable income and the tax table, you find you should have paid $3,016 in Federal Taxes. Do you get a refund or do you owe the government money? Why?

- Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2020. She estimates her required annual estimated income tax payment for 2020 to be $8,468. She was required to pay $254 when she timely filed her prior year tax return. Complete the first quarter voucher below for Sherina for 2020. Form1040-ESDepartment of the TreasuryInternal Revenue Service 2020 Estimated Tax Payment Voucher 1 OMB No. 1545-0074 File only if you are making a payment of estimated tax by check or money order. Mail this voucher with your check or money order payable to “United States Treasury.” Write your social security number and “2020 Form 1040-ES” on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with this voucher. Calendar year—Due April 15, 2020 Amount of estimated tax you are paying by check or money order. Dollars Cents fill in the blank 1Hepfer, Inc. is a calendar year-end, accrual method taxpayer. It provides financial services for various clients. Hepfer, Inc. had the following transactions in 2020. Determine the tax treatment for each transaction. For credit, you must round your answer to the NEAREST DOLLAR. Do NOT enter the dollar sign in your answer - only enter the numbers (e.g., X,XXX). For example, one thousand dollars should be entered as 1,000. Enter zero (i.e., “0”) where necessary. (a) Hepfer, Inc. rents a small single house in downtown Dallas and uses it as the business office. On June 15, 2020, Hepfer, Inc. paid $24,000 for the next 12 months of rent. The rental period associated with the payment starts on July 1, 2020. How much (if any) of the payment can Hepfer, Inc. deduct in 2020? $N4 Samuel invested $10,000 a year into his retirement plan from his before tax earnings (that is, he received a deduction for these contributions and was not taxed on the income). His employer contributed $5,000 a year to Samuel’s retirement fund. After 30 years of contributions, Samuel retires and receives a distribution of $900,000, the balance in his retirement fund. Samuel must include what amount in gross income? Group of answer choices $ 0 $450,000 $600,000 $900,000