c. The refinery can purchase an additional 200,000 liters of cylinder stock. The usual bargaining process will determine the final price. Management is interested in knowing how high a price it can pay and still make a profit. The stock purchased would be processed into conventional bright stock and sold as such. The process would require the following operations- solvent dewaxing, solvent extraction, and filtering. Additional information is as follows:

c. The refinery can purchase an additional 200,000 liters of cylinder stock. The usual bargaining process will determine the final price. Management is interested in knowing how high a price it can pay and still make a profit. The stock purchased would be processed into conventional bright stock and sold as such. The process would require the following operations- solvent dewaxing, solvent extraction, and filtering. Additional information is as follows:

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter13: Lean Manufacturing And Activity Analysis

Section: Chapter Questions

Problem 3BE

Related questions

Question

please help me letter c, thank you

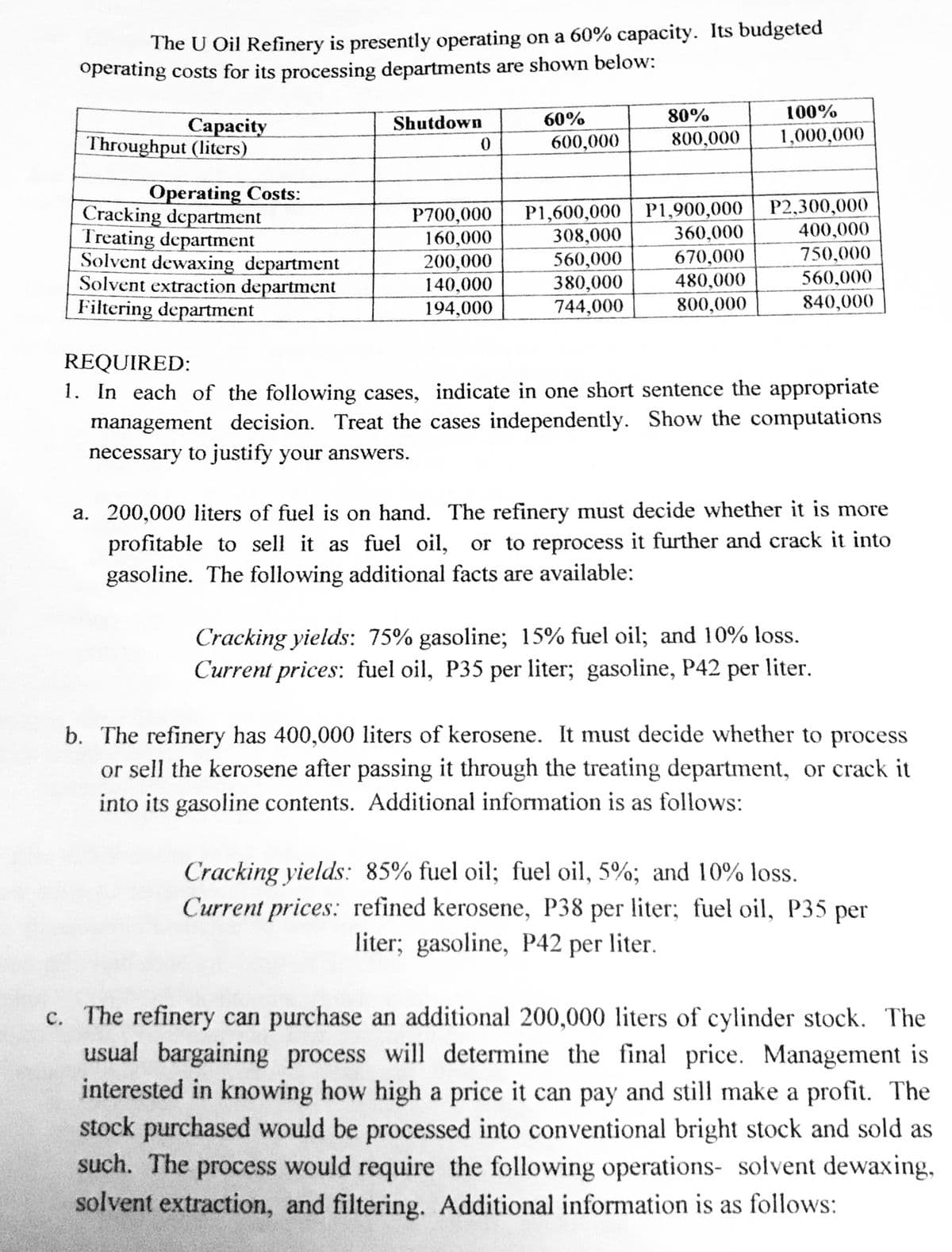

Transcribed Image Text:The U Oil Refinery is presently operating on a 60% capacity. Its budgeted

operating costs for its processing departments are shown below:

60%

80%

100%

Shutdown

Сарасity

Throughput (liters)

600,000

800,000

1,000,000

Operating Costs:

Cracking department

Treating department

Solvent dewaxing department

Solvent extraction department

Filtering department

P2,300,000

400,000

750,000

560,000

P700,000

160,000

P1,600,000

308,000

P1,900,000

360,000

670,000

200,000

140,000

560,000

380,000

744,000

480,000

194,000

800,000

840,000

REQUIRED:

1. In each of the following cases, indicate in one short sentence the appropriate

management decision. Treat the cases independently. Show the computations

necessary to justify your answers.

a. 200,000 liters of fuel is on hand. The refinery must decide whether it is more

profitable to sell it as fuel oil, or to reprocess it further and crack it into

gasoline. The following additional facts are available:

Cracking yields: 75% gasoline; 15% fuel oil; and 10% loss.

Current prices: fuel oil, P35 per liter; gasoline, P42 per liter.

b. The refinery has 400,000 liters of kerosene. It must decide whether to process

or sell the kerosene after passing it through the treating department, or crack it

into its gasoline contents. Additional information is as follows:

Cracking yields: 85% fuel oil; fuel oil, 5%; and 10% loss.

Current prices: refined kerosene, P38 per liter; fuel oil, P35

liter; gasoline, P42 per liter.

per

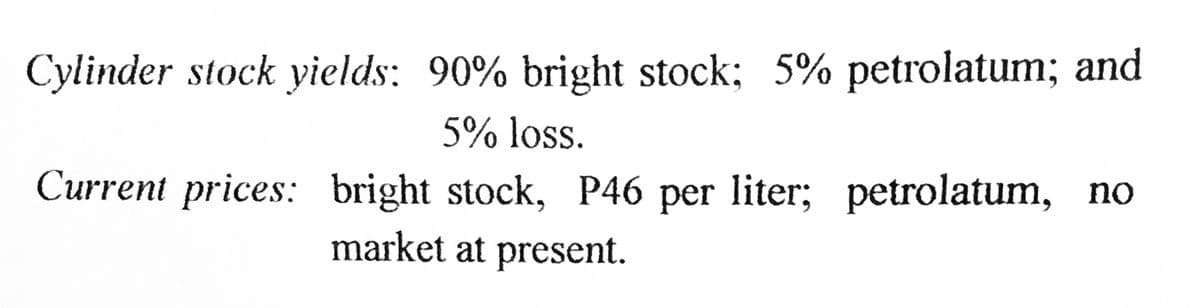

c. The refinery can purchase an additional 200,000 liters of cylinder stock. The

usual bargaining process will determine the final price. Management is

interested in knowing how high a price it can pay and still make a profit. The

stock purchased would be processed into conventional bright stock and sold as

such. The process would require the following operations- solvent dewaxing,

solvent extraction, and filtering. Additional information is as follows:

Transcribed Image Text:Cylinder stock yields: 90% bright stock; 5% petrolatum; and

5% loss.

Current prices: bright stock, P46 per liter; petrolatum, no

market at present.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,