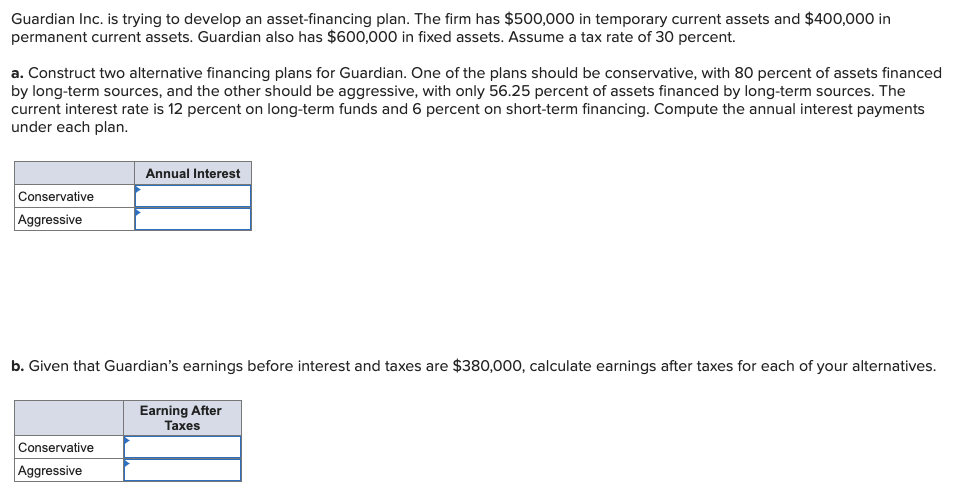

c. What would the annual interest and earnings after taxes for the conservative and aggressive strategies be if the short-term and long- term interest rates were reversed? Conservative Aggressive Total interest Earnings after taxes

c. What would the annual interest and earnings after taxes for the conservative and aggressive strategies be if the short-term and long- term interest rates were reversed? Conservative Aggressive Total interest Earnings after taxes

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:c. What would the annual interest and earnings after taxes for the conservative and aggressive strategies be if the short-term and long-

term interest rates were reversed?

Conservative

Aggressive

Total interest

Earnings after taxes

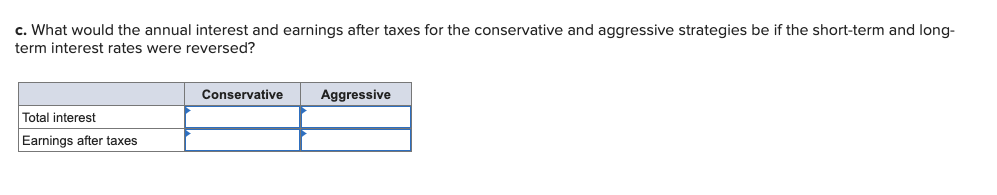

Transcribed Image Text:Guardian Inc. is trying to develop an asset-financing plan. The firm has $500,000 in temporary current assets and $400,000 in

permanent current assets. Guardian also has $600,000 in fixed assets. Assume a tax rate of 30 percent.

a. Construct two alternative financing plans for Guardian. One of the plans should be conservative, with 80 percent of assets financed

by long-term sources, and the other should be aggressive, with only 56.25 percent of assets financed by long-term sources. The

current interest rate is 12 percent on long-term funds and 6 percent on short-term financing. Compute the annual interest payments

under each plan.

Annual Interest

Conservative

Aggressive

b. Given that Guardian's earnings before interest and taxes are $380,000, calculate earnings after taxes for each of your alternatives.

Earning After

Taxes

Conservative

Aggressive

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning