(c1) * Your answer is incorrect. Compute the production cost per unit under each plan. (Round answers to 2 decimal places, eg. 1.25.) Plan A Plan B Production cost per unit 4.00 4.00 Attempts: 1 of 2 used Submit Answer Save for Later Using multiple attempts will impact your score. 25% score reduction after attempt 1 %24

(c1) * Your answer is incorrect. Compute the production cost per unit under each plan. (Round answers to 2 decimal places, eg. 1.25.) Plan A Plan B Production cost per unit 4.00 4.00 Attempts: 1 of 2 used Submit Answer Save for Later Using multiple attempts will impact your score. 25% score reduction after attempt 1 %24

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter16: Financial Planning And Forecasting

Section: Chapter Questions

Problem 14P: EXCESS CAPACITY Krogh Lumbers 2019 financial statements are shown here. Krogh Lumber: Balance Sheet...

Related questions

Question

100%

I don't understand how to compete the production cost per unit

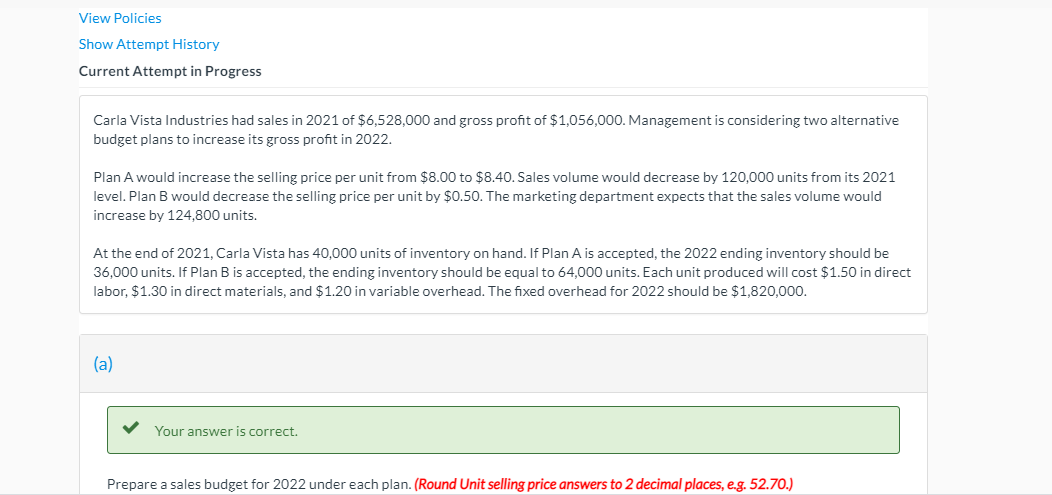

Transcribed Image Text:View Policies

Show Attempt History

Current Attempt in Progress

Carla Vista Industries had sales in 2021 of $6,528,000 and gross profit of $1,056,000. Management is considering two alternative

budget plans to increase its gross profit in 2022.

Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 120,000 units from its 2021

level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would

increase by 124,800 units.

At the end of 2021, Carla Vista has 40,000 units of inventory on hand. If Plan A is accepted, the 2022 ending inventory should be

36,000 units. If Plan B is accepted, the ending inventory should be equal to 64,000 units. Each unit produced will cost $1.50 in direct

labor, $1.30 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2022 should be $1,820,000.

(a)

Your answer is correct.

Prepare a sales budget for 2022 under each plan. (Round Unit selling price answers to 2 decimal places, e.g. 52.70.)

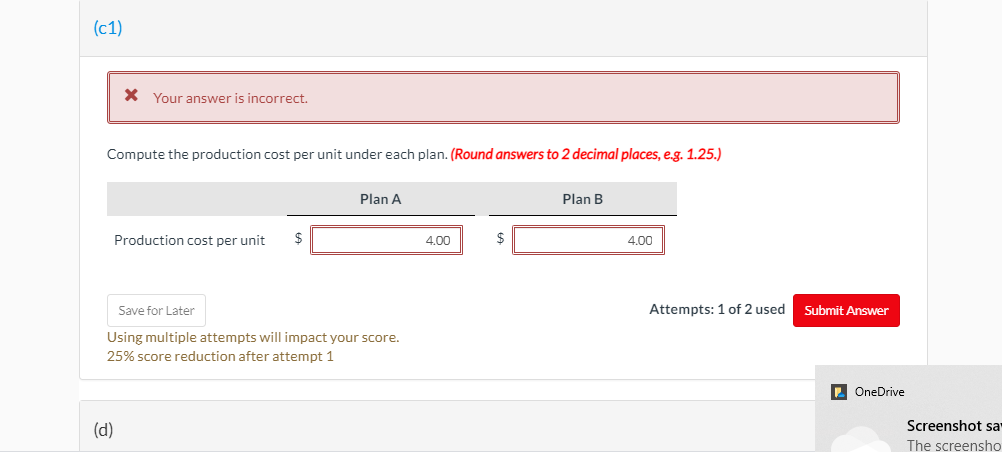

Transcribed Image Text:(c1)

X Your answer is incorrect.

Compute the production cost per unit under each plan. (Round answers to 2 decimal places, e.g. 1.25.)

Plan A

Plan B

Production cost per unit

4,00

2$

4,00

Save for Later

Attempts: 1 of 2 used

Submit Answer

Using multiple attempts will impact your score.

25% score reduction after attempt 1

OneDrive

(d)

Screenshot sa

The screensho

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning