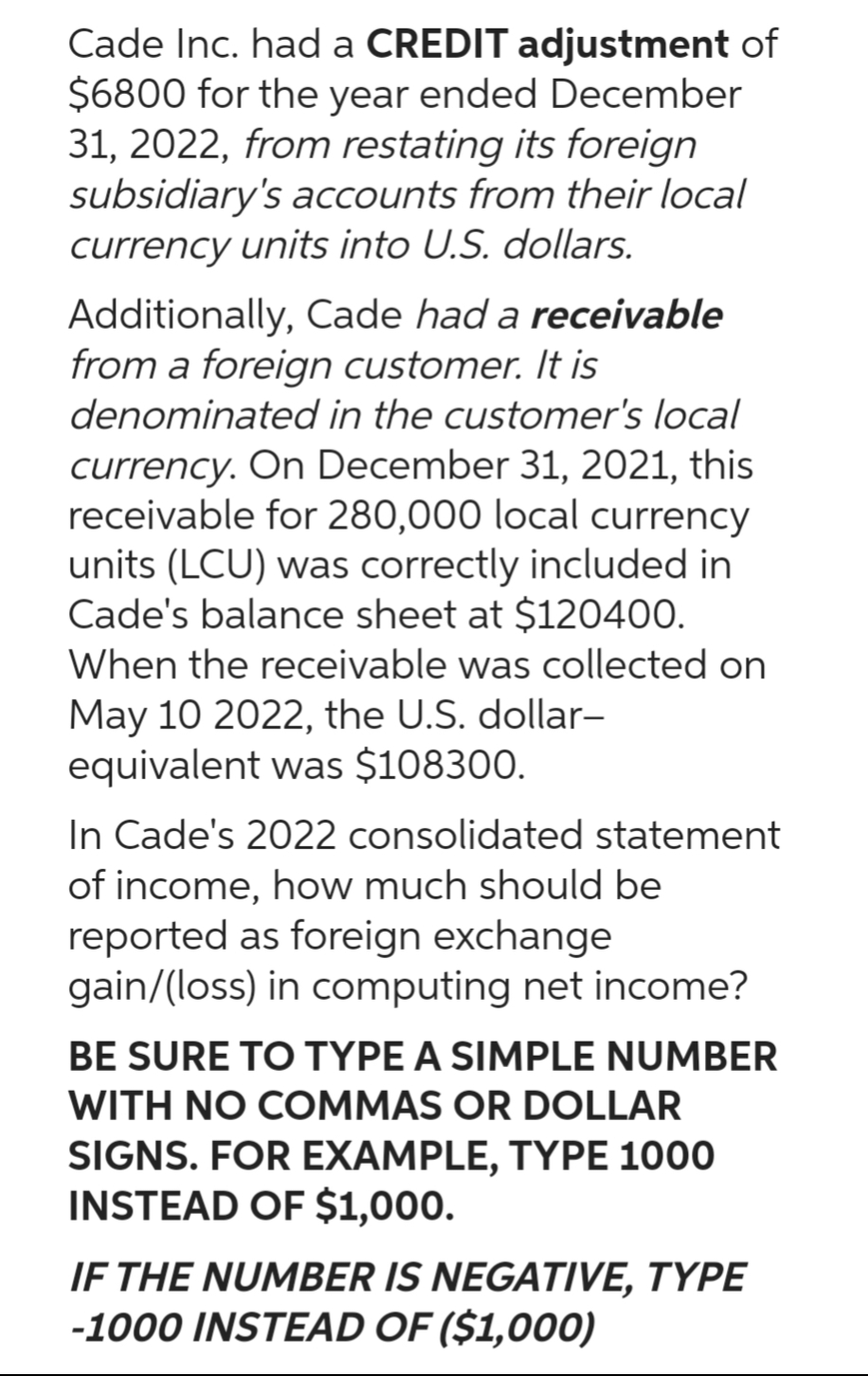

Cade Inc. had a CREDIT adjustment of $6800 for the year ended December 31, 2022, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars.

Q: ABC Incorporation provides the following information for November 2018 Budgeted Production = 200…

A: Material price variance: It occurs when the actual price paid for materials is different from the…

Q: Two individuals who are forming a partnership ask you how they should divide the income and losses…

A: A partnership is a type of business structure in which two or more individuals own and operate a…

Q: he Umbrella company is planning to purchase a substance known as Serum Serum A would cost $45,000…

A: Internal rate of return is breakeven rate at which net present value is zero that means the present…

Q: Suppose a BMW executive in Germany is trying to decide whetherthe company should continue to…

A: Direct materials are raw materials that are directly used in the production of a finished product.…

Q: During the taking of its physical inventory on December 31, 2014, Barry's Bike Shop incorrectly…

A: Given, Bike shop incorrectly counted it's inventory as $216,669 instead of correct amount of…

Q: Redfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two…

A: Formula used: Predetermined overhead rate=Total manufacturing overheadAllocation base×100

Q: Grouper Chance Co. sells computers and video game systems. The business is divided into two…

A: CONTRIBUTION MARGIN Contribution Margin is the Difference Between Total Sales & Variable Cost.…

Q: If a company had a contribution margin of $1,000,000 and a contribution Margin of 40%, total…

A: To calculate the total variable costs, we need to use the contribution margin ratio and the total…

Q: Belle Company reports the following information for the current year. All beginning inventory…

A: The cost of a product refers to the total amount of expenses incurred to produce or acquire a…

Q: 5 Mini, Inc., earns pretax book net income of $750,000 in 2021, its first year of operations. Mini…

A: Deferred tax benefit it refers to the form of an asset reflect on the balance sheet of a company…

Q: Tom and Dick Partnership agree to admit Harry. Capital balances of Tom and Dick are $92,000 and…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: Explain how is it possible for a business to earn a gross profit but still incur a net loss.

A: Profit is a financial measure that shows a business's financial performance and how much money it…

Q: c-2. Has net accounts receivable changed from December 31, 2020? Complete this question by entering…

A: ACCOUNT RECEIVABLE Account Receivable is the Amount which is Receivable from the Customers. Account…

Q: Scotland Beauty Products manufactures face cream, body lotion, and liquid soap in a joint…

A: JOINT PRODUCT Joint products are the result of utilization of the same raw material and same…

Q: Please do not give solution in image format thanku

A: A financial indicator called inventory turnover ratio is used to assess how well a firm manages its…

Q: The Lux Company experiences the following unrelated events and transactions during Year 1. The…

A: Lets understand the basics. Ratio analysis is used to evaluate management performance in…

Q: What is the stock to sale ratio for the sleepwear department for May if sales are planned at…

A: Stock to sale ratio is the measure which helps the entity in determining the inventory of the…

Q: Problem #7: Operating Budgets Marker Products, Inc. sells all of its products on credit. The company…

A: Cash collection budget :— This budget is prepared to estimate the collection of cash from customer…

Q: Save-the-Earth Co. reports the following income statement accounts for the year ended December 31.…

A: Income statement :— It is one of the financial statement that shows profitability, total revenue and…

Q: Sept. 1 Oct. 1 Oct. 1 (a) Purchased inventory from Encino Company on account for $46,800. Crane…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub-parts for…

Q: Break-even sales and sales to realize operating income For the current year ended March 31, Kadel…

A: BREAKEVEN POINT Break Even means the volume of production or sales where there is no profit or loss.…

Q: Kiona Company set up a petty cash fund for payments of small amounts. The following transactions…

A: A journal entry frequently has supporting documents attached, is printed, and is preserved in a…

Q: (1) the individual earning the income directly without the use of a corporation and (2) earning…

A: The question is asking whether it is more beneficial for an individual shareholder to earn active…

Q: On July 15, it was discovered that the following errors took place in journalizing and posting…

A: Errors in the initial journal entries that were entered into the accounting system can be fixed by…

Q: Required information [The following information applies to the questions displayed below] Portions…

A:

Q: Ay 1 Fill in the missing amounts from the following chart regarding the estimation of Bean…

A: Incomplete question- Complete question is :- Cost Retail Merchandise Inventory, October 1…

Q: Required info [The following information applies to the questions displayed below.] For the current…

A: FIFO Method: Which is one of the method used in cost accounting to value inventory. In which…

Q: Splish Brothers Limited is a private company that follows ASPE. It is authorized to issue an…

A: Return on Equity (ROE) is a financial ratio that measures the profitability of a company in relation…

Q: Aaron Company has a process costing system. All materials are introduced when conversion costs reach…

A: Cost accounting is a mechanism adopted by entities to find out the true cost of a specific service,…

Q: Preston, Incorporated, manufactures wooden shelving units for collecting and sorting mail. The…

A: The direct materials budget is the budget that is prepared to estimate the total material required…

Q: Timp, Inc. had the following common stock balances and transactions during year 1 1/1/Y1 2/1/Y1…

A: Weighted average shares refer to the number of outstanding shares of a company's stock that are…

Q: All the information you need is in the photos so the questions should not be rejected. Please do not…

A: Amortization refers to the reduction in the book value of Intangible assets, generally few methods…

Q: Selected information from Logic Company's December 31, 2022 and 2021 financial statements is…

A: Profit Margin is a financial ratio that measures the percentage of each dollar of sales that results…

Q: a. The cash balance on December 1 is $44,400. b. Actual sales for October and November and expected…

A: Expected cash collection for the month = Cash sales + Collection of credit sales in the month…

Q: Last Chance Mine (LCM) purchased a coal deposit for $1,108,250. It estimated it would extract 17,050…

A: It is given that total tons of coal available with LCM is 17,050. Therefore, in order to get that…

Q: context of reporting requirements regarding the fair value accounting option, the following…

A: Fair value accounting is an accounting practice where companies measure and report their assets and…

Q: Indicate whether each of the receivables turnover and average collection period is better or worse…

A: ACCOUNT RECEIVABLE TURNOVER RATIO Account Receivable Turnover ratio is the Ratio Between Net Credit…

Q: Maple Co. provides for bad debts expense at the rate of 5.64% of ending Accounts Receivable. On Jan…

A: Allowance for bad debts includes the amount which is estimated by the entity to remain uncollectible…

Q: On January 1, 2023, Hole Company purchased 600 of $1,000 face value, 8% bonds of Lid Corp., for…

A: Bond :— It is one of the type of securities that pays fixed periodic interest and face value amount…

Q: (Click the icon to view the production and selling price information.) Required Allocate the…

A: In the NRV (Net realizable value method), the allocation is done using the NRV of every product as…

Q: [The following information applies to the questions displayed below.] The following unadjusted trial…

A: The liquidity ratios include current ratio, quick ratio and working capital. The profitability…

Q: Required information [The following information applies to the questions displayed below.] Listed…

A: Lets understand the basics. Manufacturing Costs: The total cost incurred while production of goods…

Q: Sheniqua, a single taxpayer, had taxable income of $80,528. Her employer withheld $12,884 in federal…

A: Income tax liability is the amount of tax that an individual or entity owes to the government based…

Q: Each project requires an investment of $900,000. A rate of 15% has been selected for the net present…

A: Payback period and net present values are capital budgeting tools. They are used to determine the…

Q: When auditing product warranty liabilities, when should the warranty cost be recognized? Question 1…

A: Answer:- Warranty liability:- A warranty liability is an account that a business uses to record the…

Q: Mrs. King, a single taxpayer, earns a $42,000 annual salary and pays 15 percent in state and federal…

A: Introduction:- The following basic information as follows:- Mrs. King, a single taxpayer, earns a…

Q: Assets sh counts receivable (net) estments entory paid rent Total current assets $ 65 178 53 203 28…

A: Current ratio is based on Current assets and current liabilities of the company. It generally…

Q: Brice Company completed the following transactions in Year 1, the first year of operation: Issued…

A: Accounting Equation: According to the accounting formula, a company's total assets equal the sum of…

Q: Sheridan Recreation Products sells the Amazing Foam Frisbee for $19. The variable cost per unit is…

A: Break even point sales is when all cost are recovered both fixed cost and variable cost. There is no…

4

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Brief, Inc., had a receivable from a foreign customer that is payable in the customer's local currency. On December 31, 2017, Brief correctly included this receivable for 200,000 local currency units (LCU) in its balance sheet at $110,000. When Brief collected the receivable on February 15, 2018, the U.S. dollar equivalent was $120,000. In Brief's 2018 consolidated income statement, how much should it report as a foreign exchange gain?$25,000$15,000$10,000$0Brief, Inc., had a receivable from a foreign customer that is payable in the customer’s local currency. On December 31, 2017, Brief correctly included this receivable for 200,000 local currency units (LCU) in its balance sheet at $110,000. When Brief collected the receivable on February 15, 2018, the U.S. dollar equivalent was $120,000. In Brief’s 2018 consolidated income statement, how much should it report as a foreign exchange gain?a. $–0–b. $10,000c. $15,000d. $25,000On December 20, 2020, Momeier Company (a U.S.-based company) sold parts to a foreign customer at a price of 175,000 rials. Payment is received on January 10, 2021. Currency exchange rates are as follows: Date U.S. Dollar per Rial December 20, 2020 $ 1.27 December 31, 2020 1.24 January 10, 2021 1.20 How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier’s 2020 income statement?

- On December 20, 2020, Momeier Company (a U.S.-based company) sold parts to a foreign customer at a price of 45,000 rials. Payment is received on January 10, 2021. Currency exchange rates are as follows: Date U.S. Dollar per Rial December 20, 2020 $ 1.14 December 31, 2020 1.11 January 10, 2021 1.07 How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier’s 2020 income statement? How does the fluctuation in the U.S. dollar per rial exchange rate affect Momeier’s 2021 income statement?On July 1, 2020, Mifflin Company borrowed 200,000 euros from a foreign lender evidenced by an interest-bearing note due on July 1, 2021. The note is denominated in euros. The U.S. dollar equivalent of the note principal is as follows: LO 9-2 LO 9-2 LO 9-2 LO 9-2, 9-3 Problems 1. Which of the following combinations correctly describes the relationship between foreign currency transactions, exchange rate changes, and foreign exchange gains and losses? LO 9-1 Type of Transaction Foreign Currency Foreign Exchange Gain or Loss a. Export sale Appreciates Loss b. Import purchase Appreciates Gain c. Import purchase Depreciates Gain d. Export sale Depreciates Gain Date Amount July 1, 2020 (date borrowed). . . . . . . . . . . . . . . . . . . . . . . . . $225,000 December 31, 2020 (Mifflin’s year-end). . . . . . . . . . . . . . . . 220,000 July 1, 2021 (date repaid). . . . . . . . . . . . . . . . . . . . . . . . . . . . 210,000 In its 2021 income statement, what amount should Mifflin include as a…Ball Corp had the following foreign currency transactions during 2019: a) Merchandise was purchased from a foreign supplier on January 20, 2019, for the Philippine peso equivalent of P90,000. The invoice was paid on March 20, 2019, at the Philippine peso equivalent of P96,000. b) On July 1, 2019, Ball borrowed the Philippine peso equivalent of P500,000 evidenced by a note that was payable in the lender's local currency on July 1, 2020. On December 31, 2019, the Philippine peso equivalents of the principal amount and accrued interest were P520,000 and P26,000, respectively. Interest on the note is 10% per annum. In Ball's 2019 income statement, what amount should be included as a foreign exchange trasaction loss? a. P6,000 b. P21,000 c. P0 d. P27,000

- Choose the correct. Brief, Inc., had a receivable from a foreign customer that is payable in the customer’s local currency. On December 31, 2017, Brief correctly included this receivable for 200,000 local currency units (LCU) in its balance sheet at $110,000. When Brief collected the receivable on February 15, 2018, the U.S. dollar equivalent was $120,000. In Brief’s 2018 consolidated income statement, how much should it report as a foreign exchange gain?a. $–0–b. $10,000c. $15,000d. $25,000Winston Corp., a U.S. company, had the following foreign currency transactions during 2021: ( 1.) Purchased merchandise from a foreign supplier on July 16, 2021 for the U.S. dollar equivalent of $47,000 and paid the invoice on August 3, 2021 at the U.S. dollar equivalent of $54,000. (2.) On October 15, 2021 borrowed the U.S. dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15, 2022. The U.S. dollar equivalent of the note amount was $295,000 on December 31, 2021, and $299,000 on October 15, 2022. What amount should be included as a foreign exchange gain or loss from the two transactions for 2022?Tara Corporation issued a promissory note denominated in foreign currency for the purchase made from a supplierin England on December 1, for a 60-day, 12% promissory note for 100,000 pounds, at a selling rate of 1FC to P65.50. OnDecember 31, the selling spot rate is 1FC to P64.80. On January 30, the selling spot rate is 1FC to P65.45On the settlement date, how much is the foreign exchange loss?

- On December 20, 2017, Butanta Company (a U.S. company headquartered in Miami, Florida) sold parts to a foreign customer at a price of 50,000 ostras. Payment is received on January 10, 2018. Currency exchange rates for 1 ostra are as follows:a. How does the fluctuation in exchange rates affect Butanta’s 2017 income statement?b. How does the fluctuation in exchange rates affect Butanta’s 2018 income statement?ABC Company has the Philippine peso as its functional currency. The entity expects to purchase goods from USA for $50,000 on March 31, 2023. Accordingly, the entity is exposed to a foreign currency risk. If the dollar increases before the purchase takes place, the entity will have to pay more pesos to obtain the $50,000 that it will have to pay for the goods. On October 1, 2022, the entity entered into a foreign currency forward contract with a bank speculator to purchased $50,000 in six months for a fixed amount of P2,050,000 or P41 to $1. This forward contract is designated as cash flow hedge of the entity’s exposure to increase in dollar exchange rate. On December 31, 2022, the exchange rate is P42 to $1 and on March 31, 2023, the exchange rate is P44 to $1. How much is the derivative asset (liability) on October 1, 2022?On March 1, 2019, a U.S. company made a credit sale requiring payment in 30 days from a Malaysian company, Hamac Sdn. Bhd., of 20,000 Malaysian ringgits. Assuming the exchange rate between Malaysian ringgits and U.S. dollars is $0.4538 on March 1 and $0.4899 on March 31, prepare the entries to record the sale on March 1 and the cash receipt on March 31.