Required information [The following information applies to the questions displayed below] Portions of the financial statements for Parnell Company are provided below. PARNELL COMPANY Income Statement For the Year Ended December 31, 2024 ($ in thousands) Revenues and gains: Sales Gain on sale of building Expenses and loss: Cost of goods sold Salaries Insurance Depreciation Interest expense Loss on sale of equipment Income before tax Income tax expense Net income Cash Accounts receivable Inventory Prepaid insurance Accounts payable Salaries payable Deferred tax liability Bond discount 2024 PARNELL COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2024 and 2023 ($ in thousands) Year $ 134 324 321 66 210 $ 800 102 60 190 11 $ 300 120 40 123 50 12 2023 $ 100 216 425 88 117 93 52 200 $ 811 645 166 78 $ 88 Change $ 34 108 (104) (22) 93 9 8 (10)

Required information [The following information applies to the questions displayed below] Portions of the financial statements for Parnell Company are provided below. PARNELL COMPANY Income Statement For the Year Ended December 31, 2024 ($ in thousands) Revenues and gains: Sales Gain on sale of building Expenses and loss: Cost of goods sold Salaries Insurance Depreciation Interest expense Loss on sale of equipment Income before tax Income tax expense Net income Cash Accounts receivable Inventory Prepaid insurance Accounts payable Salaries payable Deferred tax liability Bond discount 2024 PARNELL COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2024 and 2023 ($ in thousands) Year $ 134 324 321 66 210 $ 800 102 60 190 11 $ 300 120 40 123 50 12 2023 $ 100 216 425 88 117 93 52 200 $ 811 645 166 78 $ 88 Change $ 34 108 (104) (22) 93 9 8 (10)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 7C

Related questions

Question

Please do not give solution in image format thanku

![Required information

[The following information applies to the questions displayed below.]

Portions of the financial statements for Parnell Company are provided below.

Revenues and gains:

Sales

For the Year Ended December 31, 2024

($ in thousands)

PARNELL COMPANY

Income Statement

Gain on sale of building

Expenses and loss:

Cost of goods sold

Salaries.

Insurance

Depreciation

Interest expense

Loss on sale of equipment

Income before tax

Income tax expense

Net income

December 31, 2024 and 2023

($ in thousands)

Cash

Accounts receivable

Inventory

Prepaid insurance

Accounts payable

Salaries payable

Deferred tax liability

Bond discount

2024

PARNELL COMPANY

Selected Accounts from Comparative

Balance Sheets

Year

$ 134

324

321

66

210

102

60

$ 800

11

190

$ 300

120

40

123

50

12

2023

$ 100

216

425

88

117

93

52

200

$ 811

645

166

78

$88

Change

$ 34

108

(104)

(22)

93

9

8

(10)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Faed3de54-433a-4da2-b51c-03cbeee1d515%2F401859bd-e238-407a-8fc0-b10899bc33bd%2Fc5wdfxp_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Portions of the financial statements for Parnell Company are provided below.

Revenues and gains:

Sales

For the Year Ended December 31, 2024

($ in thousands)

PARNELL COMPANY

Income Statement

Gain on sale of building

Expenses and loss:

Cost of goods sold

Salaries.

Insurance

Depreciation

Interest expense

Loss on sale of equipment

Income before tax

Income tax expense

Net income

December 31, 2024 and 2023

($ in thousands)

Cash

Accounts receivable

Inventory

Prepaid insurance

Accounts payable

Salaries payable

Deferred tax liability

Bond discount

2024

PARNELL COMPANY

Selected Accounts from Comparative

Balance Sheets

Year

$ 134

324

321

66

210

102

60

$ 800

11

190

$ 300

120

40

123

50

12

2023

$ 100

216

425

88

117

93

52

200

$ 811

645

166

78

$88

Change

$ 34

108

(104)

(22)

93

9

8

(10)

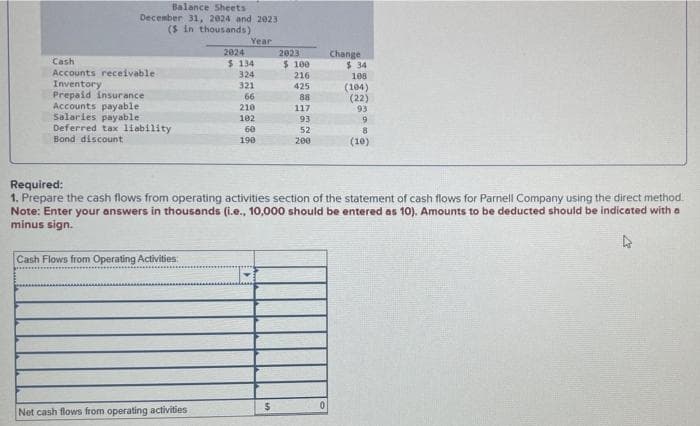

Transcribed Image Text:Balance Sheets

December 31, 2024 and 2023

($ in thousands)

Year

Cash

Accounts receivable

Inventory

Prepaid insurance

Accounts payable

Salaries payable

Deferred tax liability

Bond discount

Cash Flows from Operating Activities:

2024

Net cash flows from operating activities

$ 134

324

321

66

210

102

60

190

2023

$

$ 100

216

425

88

117

93

52

200

Required:

1. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method

Note: Enter your answers in thousands (i.e., 10,000 should be entered as 10). Amounts to be deducted should be indicated with a

minus sign.

4

Change

0

$34

108

(104)

(22)

93

9

8

(10)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,