Caesar Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the sales journal. June 5 Purchased $2,200 of merchandise on credit from Roman Corporation June 9 Sold merchandise costing $645 to R. June 12 Sold merchandise costing $450 to J. June 19 Received $1,075 cash from R. Allen June 27 Sold merchandise costing $595 to B. Allen for $1,075, terms n/10, Invoice Number 2080. Meyer for $750 cash, Invoice Number 2081. to pay for the June 9 purchase. Kraft for $850, terms n/10, Invoice Number 2082.

Caesar Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the sales journal. June 5 Purchased $2,200 of merchandise on credit from Roman Corporation June 9 Sold merchandise costing $645 to R. June 12 Sold merchandise costing $450 to J. June 19 Received $1,075 cash from R. Allen June 27 Sold merchandise costing $595 to B. Allen for $1,075, terms n/10, Invoice Number 2080. Meyer for $750 cash, Invoice Number 2081. to pay for the June 9 purchase. Kraft for $850, terms n/10, Invoice Number 2082.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter9: Sales And Purchases

Section: Chapter Questions

Problem 8E: Toby Company had the following sales transactions for March: Mar. 6Sold merchandise on account to...

Related questions

Topic Video

Question

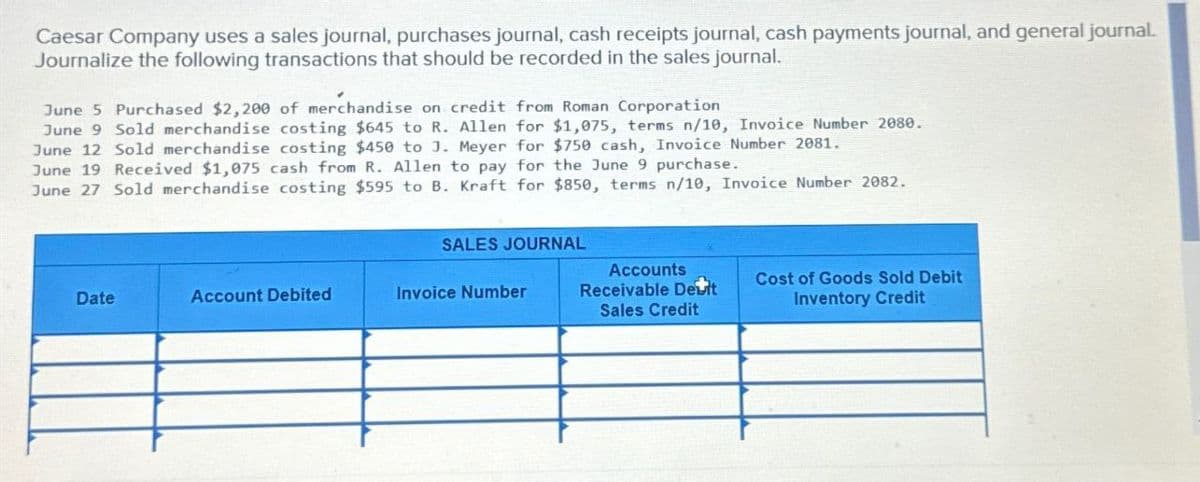

Transcribed Image Text:Caesar Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal.

Journalize the following transactions that should be recorded in the sales journal.

June 5 Purchased $2,200 of merchandise on credit from Roman Corporation

June 9 Sold merchandise costing $645 to R. Allen for $1,075, terms n/10, Invoice Number 2080.

June 12 Sold merchandise costing $450 to J. Meyer for $750 cash, Invoice Number 2081.

June 19 Received $1,075 cash from R. Allen to pay for the June 9 purchase.

June 27 Sold merchandise costing $595 to B. Kraft for $850, terms n/10, Invoice Number 2082.

SALES JOURNAL

Date

Account Debited

Invoice Number

Accounts

Receivable Deat

Cost of Goods Sold Debit

Sales Credit

Inventory Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College