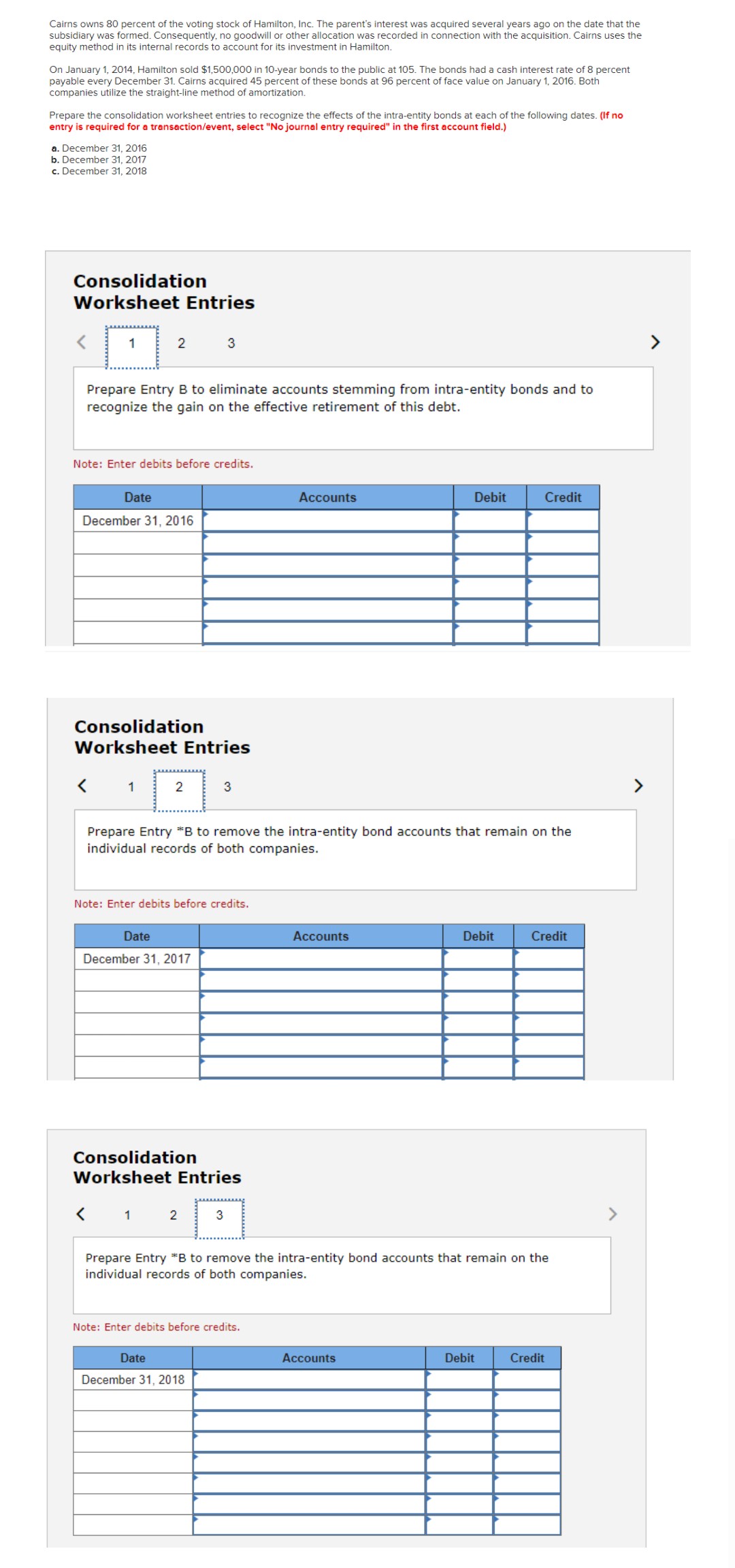

Cairns owns 80 percent of the voting stock of Hamilton, Inc. The parent's interest was acquired several years ago on the date that the subsidiary was formed. Consequently, no goodwill or other allocation was recorded in connection with the acquisition. Cairns uses the equity method in its internal records to account for its investment in Hamilton. On January 1, 2014, Hamilton sold $1,500,000 in 10-year bonds to the public at 105. The bonds had a cash interest rate of 8 percent payable every December 31. Cairns acquired 45 percent of these bonds at 96 percent of face value on January 1, 2016. Both companies utilize the straight-line method of amortization. Prepare the consolidation worksheet entries to recognize the effects of the intra-entity bonds at each of the following dates. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. December 31, 2016 b. December 31, 2017 c. December 31, 2018

Cairns owns 80 percent of the voting stock of Hamilton, Inc. The parent's interest was acquired several years ago on the date that the subsidiary was formed. Consequently, no goodwill or other allocation was recorded in connection with the acquisition. Cairns uses the equity method in its internal records to account for its investment in Hamilton. On January 1, 2014, Hamilton sold $1,500,000 in 10-year bonds to the public at 105. The bonds had a cash interest rate of 8 percent payable every December 31. Cairns acquired 45 percent of these bonds at 96 percent of face value on January 1, 2016. Both companies utilize the straight-line method of amortization. Prepare the consolidation worksheet entries to recognize the effects of the intra-entity bonds at each of the following dates. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. December 31, 2016 b. December 31, 2017 c. December 31, 2018

Chapter7: Corporations: Reorganizations

Section: Chapter Questions

Problem 27P

Related questions

Question

Transcribed Image Text:Cairns owns 80 percent of the voting stock of Hamilton, Inc. The parent's interest was acquired several years ago on the date that the

subsidiary was formed. Consequently, no goodwill or other allocation was recorded in connection with the acquisition. Cairns uses the

equity method in its internal records to account for its investment in Hamilton.

On January 1, 2014, Hamilton sold $1,500,000 in 10-year bonds to the public at 105. The bonds had a cash interest rate of 8 percent

payable every December 31. Cairns acquired 45 percent of these bonds at 96 percent of face value on January 1, 2016. Both

companies utilize the straight-line method of amortization.

Prepare the consolidation worksheet entries to recognize the effects of the intra-entity bonds at each of the following dates. (If no

entry is required for a transaction/event, select "No journal entry required" in the first account field.)

a. December 31, 2016

b. December 31, 2017

c. December 31, 2018

Consolidation

Worksheet Entries

1

2

Prepare Entry B to eliminate accounts stemming from intra-entity bonds and to

recognize the gain on the effective retirement of this debt.

Note: Enter debits before credits.

Date

December 31, 2016

<

Consolidation

Worksheet Entries

1

3

2

Date

December 31, 2017

3

Note: Enter debits before credits.

Prepare Entry *B to remove the intra-entity bond accounts that remain on the

individual records of both companies.

Consolidation

Worksheet Entries

< 1 2 3

Date

December 31, 2018

Accounts

Note: Enter debits before credits.

Accounts

Debit

Accounts

Debit

Prepare Entry *B to remove the intra-entity bond accounts that remain on the

individual records of both companies.

Credit

Debit

Credit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT