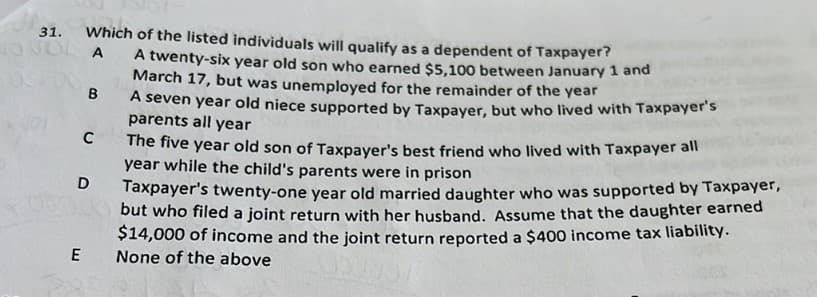

31. Which of the listed individuals will qualify as a dependent of Taxpayer? A twenty-six year old son who earned $5,100 between January 1 and March 17, but was unemployed for the remainder of the year A A seven year old niece supported by Taxpayer, but who lived with Taxpayer's parents all year E B C D The five year old son of Taxpayer's best friend who lived with Taxpayer all year while the child's parents were in prison Taxpayer's twenty-one year old married daughter who was supported by Taxpayer, but who filed a joint return with her husband. Assume that the daughter earned $14,000 of income and the joint return reported a $400 income tax liability. None of the above

31. Which of the listed individuals will qualify as a dependent of Taxpayer? A twenty-six year old son who earned $5,100 between January 1 and March 17, but was unemployed for the remainder of the year A A seven year old niece supported by Taxpayer, but who lived with Taxpayer's parents all year E B C D The five year old son of Taxpayer's best friend who lived with Taxpayer all year while the child's parents were in prison Taxpayer's twenty-one year old married daughter who was supported by Taxpayer, but who filed a joint return with her husband. Assume that the daughter earned $14,000 of income and the joint return reported a $400 income tax liability. None of the above

Chapter3: Tax Formula And Tax Determination : An Overview Of Property Transactions

Section: Chapter Questions

Problem 14DQ

Related questions

Question

Transcribed Image Text:de

31.

Which of the listed individuals will qualify as a dependent of Taxpayer?

OJOL A

A twenty-six year old son who earned $5,100 between January 1 and

March 17, but was unemployed for the remainder of the year

B

E

C

D

A seven year old niece supported by Taxpayer, but who lived with Taxpayer's

parents all year

The five year old son of Taxpayer's best friend who lived with Taxpayer all

year while the child's parents were in prison

Taxpayer's twenty-one year old married daughter who was supported by Taxpayer,

but who filed a joint return with her husband. Assume that the daughter earned

$14,000 of income and the joint return reported a $400 income tax liability.

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT