Calculate Earning before interest Tax

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Calculate Earning before interest Tax

Transcribed Image Text:17:59 A &e

LTE2 .ll

Vo)

READ ONLY - This is an older file format. To ..

Find...

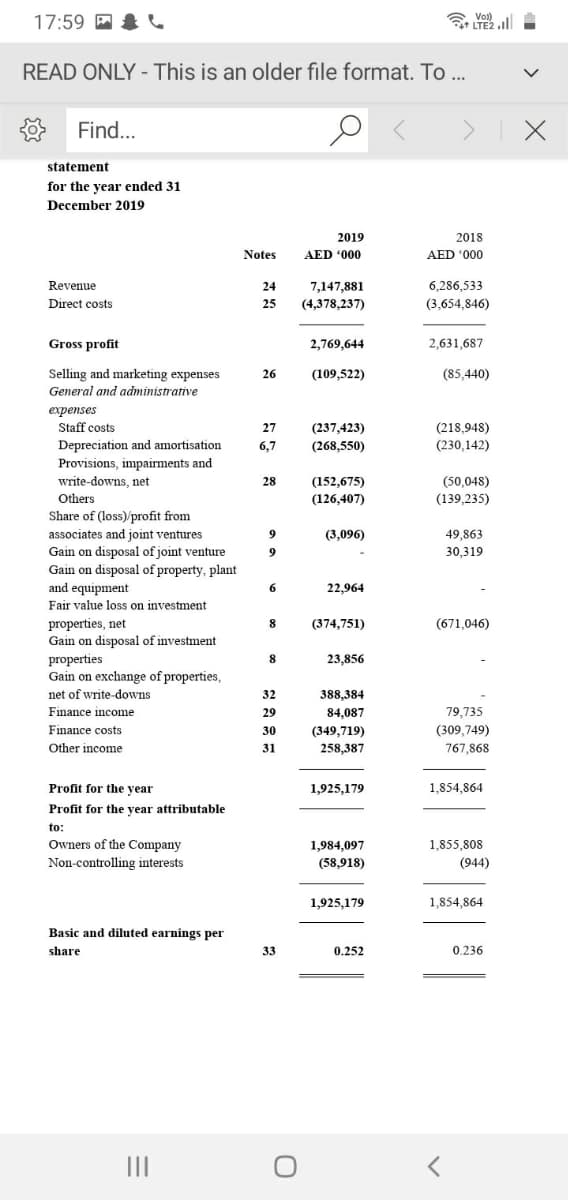

statement

for the year ended 31

December 2019

2019

2018

Notes

AED 000

AED '000

Revenue

24

7,147,881

6,286,533

Direct costs

25

(4,378,237)

(3,654,846)

Gross profit

2,769,644

2,631,687

Selling and marketing expenses

General and administrative

26

(109,522)

(85,440)

expenses

Staff costs

(218,948)

(230,142)

27

(237,423)

Depreciation and amortisation

Provisions, impairments and

write-downs, net

Others

6,7

(268,550)

28

(152,675)

(50,048)

(126,407)

(139,235)

Share of (loss)/profit from

associates and joint ventures

Gain on disposal of joint venture

Gain on disposal of property, plant

and equipment

9

(3,096)

49,863

9

30,319

22,964

Fair value loss on investment

properties, net

Gain on disposal of investment

properties

Gain on exchange of properties,

8

(374,751)

(671,046)

8

23,856

net of write-downs

32

388,384

Finance income

29

84,087

79,735

Finance costs

30

(349,719)

(309,749)

Other income

31

258,387

767,868

Profit for the year

1,925,179

1,854,864

Profit for the year attributable

to:

Owners of the Company

1,984,097

1,855,808

Non-controlling interests

(58,918)

(944)

1,925,179

1,854,864

Basic and diluted earnings per

share

33

0.252

0.236

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education