Calculate Hasbro's and UHS's ROE for each fiscal year. Verify if the answers below are correct if not, show the correct answer. 2019 2018 Hasbro's ROE: 17% 13% UHS ROE: 15% 15%

Calculate Hasbro's and UHS's ROE for each fiscal year. Verify if the answers below are correct if not, show the correct answer. 2019 2018 Hasbro's ROE: 17% 13% UHS ROE: 15% 15%

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 7C

Related questions

Question

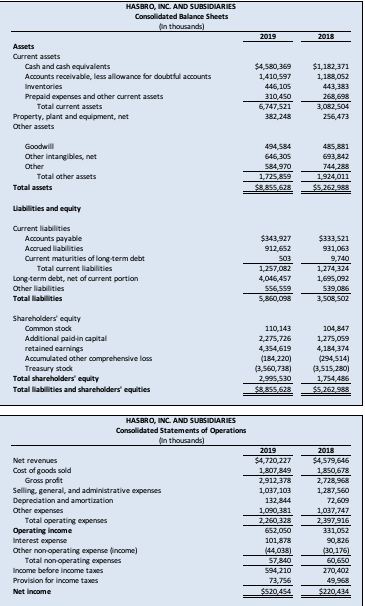

a.) Calculate Hasbro's and UHS's ROE for each fiscal year. Verify if the answers below are correct if not, show the correct answer.

| 2019 | 2018 | |

| Hasbro's ROE: | 17% | 13% |

| UHS ROE: | 15% | 15% |

Transcribed Image Text:Assets

Current assets

Cash and cash equivalents

Accounts receivable, less allowance for doubtful accounts

Inventories

Prepaid expenses and other current assets

Total current assets

plant and equipment, net

Property,

Other assets

Goodwill

Other intangibles, net

Other

Total other assets

Total assets

Uabilities and equity

Current liabilities

Accounts payable

Accrued liabilities

Current maturities of long-term debt

Total current liabilities

Long-term debt, net of current portion

Other liabilities

Total liabilities

Shareholders' equity

Common stock

Additional paid-in capital

retained earnings

Accumulated other comprehensive loss

Treasury stock

Total shareholders' equity

Total liabilities and shareholders' equities

HASBRO, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(in thousands)

Other expenses

Net revenues

Cost of goods sold

Gross profit

Selling, general, and administrative expenses

Depreciation and amortization

Total operating expenses

Operating income

HASBRO, INC. AND SUBSIDIARIES

Consolidated Statements of Operations

(in thousands)

Interest expense

Other non-operating expense (income)

Total non-operating expenses

Income before income taxes

Provision for income taxes

Net Income

2019

$4,580,369

1,410,597

446,105

310,450

6,747,521

382,248

494,584

646,305

584,970

1,725,859

$8,855,628

$343,927

912,652

503

1,257,082

4,046,457

556,559

5,860,098

110,143

2,275,726

4,354,619

(184,220)

(3,560,738)

2,995,530

$8,855,628

2019

$4,720,227

1,807,849

2,912,378

1,037,103

132,844

1,090,381

2,260,328

652,050

101,878

(44,038)

57,840

594,210

73,756

$520,454

2018

$1,182,371

1,188,052

443,383

268,698

3,082,504

256,473

485,881

693,842

744,288

1,924,011

$5,262,988

$333,521

931,063

9,740

1,274,324

1,695,092

539,086

3,508,502

104,847

1,275,059

4,184,374

(294,514)

(3,515,280)

1,754,486

$5,262,988

2018

$4,579,646

1,850,678

2,728,968

1,287,560

72,609

1,037,747

2,397,916

331,052

90,826

(30,176)

60,650

270,402

49,968

$220,434

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub