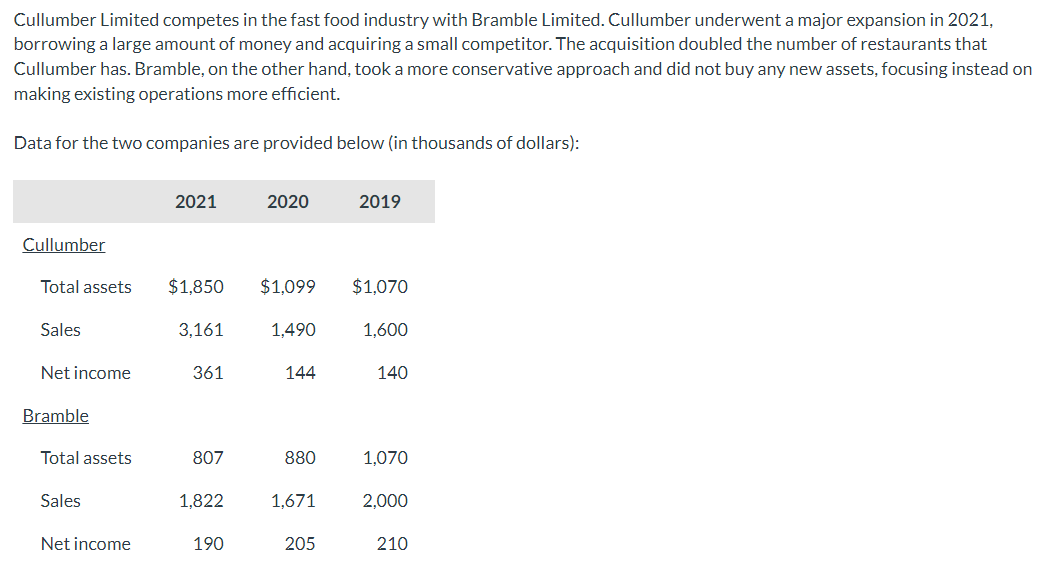

Cullumber Limited competes in the fast food industry with Bramble Limited. Cullumber underwent a major expansion in 2021, borrowing a large amount of money and acquiring a small competitor. The acquisition doubled the number of restaurants that Cullumber has. Bramble, on the other hand, took a more conservative approach and did not buy any new assets, focusing instead on making existing operations more efficient. Data for the two companies are provided below (in thousands of dollars): Cullumber Total assets Sales Net income 2021 $1,850 3,161 361 2020 $1,099 1,490 144 2019 $1,070 1,600 140

Cullumber Limited competes in the fast food industry with Bramble Limited. Cullumber underwent a major expansion in 2021, borrowing a large amount of money and acquiring a small competitor. The acquisition doubled the number of restaurants that Cullumber has. Bramble, on the other hand, took a more conservative approach and did not buy any new assets, focusing instead on making existing operations more efficient. Data for the two companies are provided below (in thousands of dollars): Cullumber Total assets Sales Net income 2021 $1,850 3,161 361 2020 $1,099 1,490 144 2019 $1,070 1,600 140

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 1aM

Related questions

Question

Transcribed Image Text:Cullumber Limited competes in the fast food industry with Bramble Limited. Cullumber underwent a major expansion in 2021,

borrowing a large amount of money and acquiring a small competitor. The acquisition doubled the number of restaurants that

Cullumber has. Bramble, on the other hand, took a more conservative approach and did not buy any new assets, focusing instead on

making existing operations more efficient.

Data for the two companies are provided below (in thousands of dollars):

Cullumber

Total assets

Sales

Net income

Bramble

Total assets

Sales

Net income

2021

$1,850

3,161

361

807

1,822

190

2020

$1,099 $1,070

1,490

144

880

1,671

2019

205

1,600

140

1,070

2,000

210

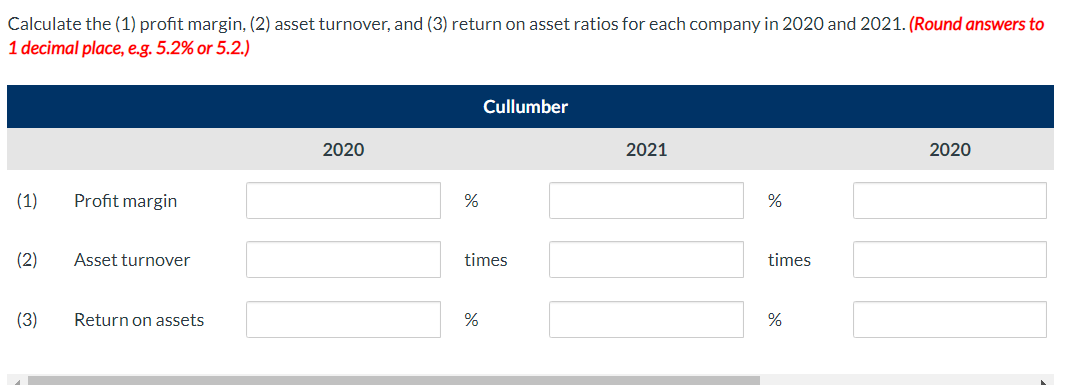

Transcribed Image Text:Calculate the (1) profit margin, (2) asset turnover, and (3) return on asset ratios for each company in 2020 and 2021. (Round answers to

1 decimal place, e.g. 5.2% or 5.2.)

(1)

(2)

Profit margin

Asset turnover

(3) Return on assets

2020

%

Cullumber

times

%

2021

%

times

%

2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning