Calculate Nazeer's monthly UIF contribution if his gross annual salary is R130 000,00. Moosa earns R145 215,00 per annum. Calculate the total annual UIF contribution based on this income. Mavis earns R2 320,00 per month. What is her UIF contribution? a b. What is the total contribution to UIF? Employee Name Moykahe Rueben Period Company Halo Halo Telephones 30/11/12 Status Empl No Sex 038 Male Married EARNINGS DEDUCTIONS Amount Description Basic Salary Amount Description 8 705,25 SITE tax 1 395,00 Pension_Income 741,35 PAYE 482,10 Med Aid Income 645,00 UIF 87,50 TOTAL EARNINGS TOTAL DEDUCTIONS NET PAY Using the pay slip provided, answer the following questions: How much does Reuben contribute to the UIF every month? What percentage of his gross income does he contribute to the UIF? Use the pay slip to calculate Reuben's: total earnings a ii total deductions iii net pay. Samson is a gardener, who works for one employer twice a week. How many hours must he work per work day to be able to contribute to a the UIF? b If Samson earns R150,00 per day, what should the total monthly contribution to UIF be? What will the total contribution be per day?

Calculate Nazeer's monthly UIF contribution if his gross annual salary is R130 000,00. Moosa earns R145 215,00 per annum. Calculate the total annual UIF contribution based on this income. Mavis earns R2 320,00 per month. What is her UIF contribution? a b. What is the total contribution to UIF? Employee Name Moykahe Rueben Period Company Halo Halo Telephones 30/11/12 Status Empl No Sex 038 Male Married EARNINGS DEDUCTIONS Amount Description Basic Salary Amount Description 8 705,25 SITE tax 1 395,00 Pension_Income 741,35 PAYE 482,10 Med Aid Income 645,00 UIF 87,50 TOTAL EARNINGS TOTAL DEDUCTIONS NET PAY Using the pay slip provided, answer the following questions: How much does Reuben contribute to the UIF every month? What percentage of his gross income does he contribute to the UIF? Use the pay slip to calculate Reuben's: total earnings a ii total deductions iii net pay. Samson is a gardener, who works for one employer twice a week. How many hours must he work per work day to be able to contribute to a the UIF? b If Samson earns R150,00 per day, what should the total monthly contribution to UIF be? What will the total contribution be per day?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 10P: Bonus Obligation and Income Tax Expense James Kimberley, president of National Motors, receives a...

Related questions

Question

Transcribed Image Text:19 August

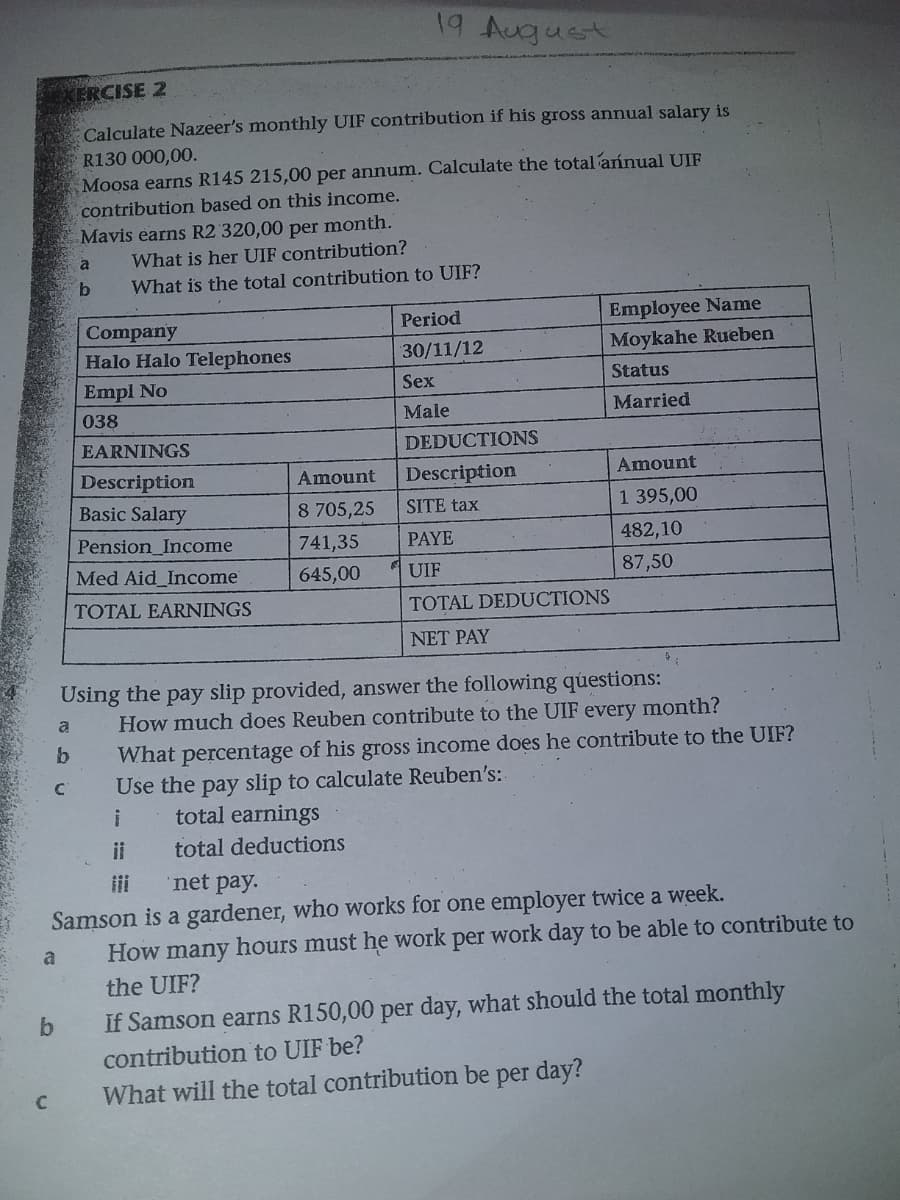

KERCISE 2

Calculate Nazeer's monthly UIF contribution if his gross annual salary is

R130 000,00.

Moosa earns R145 215,00 per annum. Calculate the total annual UIF

contribution based on this income.

Mavis earns R2 320,00 per month.

What is her UIF contribution?

a

What is the total contribution to UIF?

Employee Name

Moykahe Rueben

Period

Company

Halo Halo Telephones

30/11/12

Empl No

Sex

Status

038

Male

Married

EARNINGS

DEDUCTIONS

Description

Amount

Description

Amount

Basic Salary

8 705,25

SITE tax

1 395,00

Pension_Income

741,35

PAYE

482,10

Med Aid_Income

645,00

UIF

87,50

TOTAL EARNINGS

TOTAL DEDUCTIONS

NET PAY

Using the pay slip provided, answer the following questions:

How much does Reuben contribute to the UIF every month?

What percentage of his gross income does he contribute to the UIF?

Use the pay slip to calculate Reuben's:

total earnings

a

ii

total deductions

ii

net pay.

Samson is a gardener, who works for one employer twice a week.

How many hours must he work per work day to be able to contribute to

a

the UIF?

If Samson earns R150,00 per day, what should the total monthly

contribution to UIF be?

What will the total contribution be per day?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning