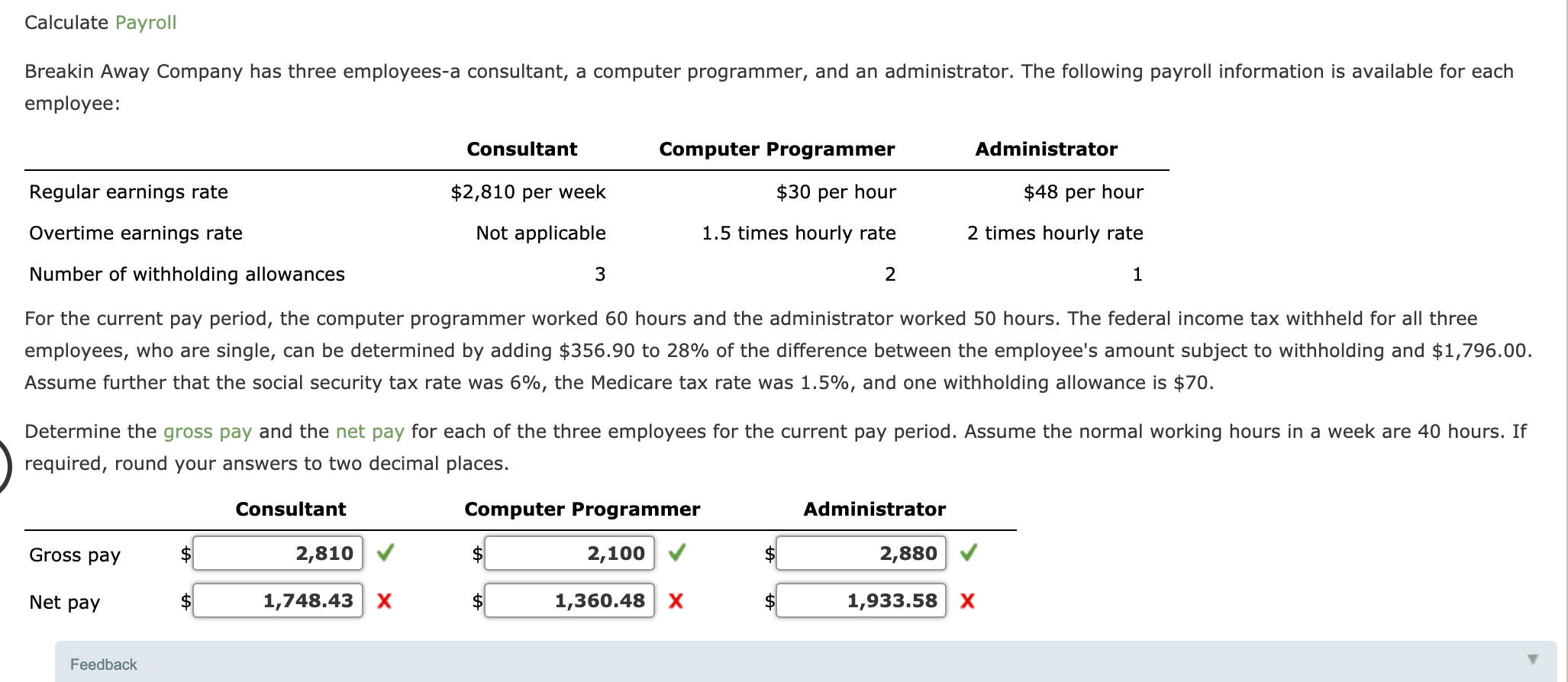

Čalculate Payroll Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer Administrator Regular earnings rate $2,810 per week $30 per hour $48 per hour Overtime earnings rate Not applicable 1.5 times hourly rate 2 times hourly rate Number of withholding allowances 1 For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheld for all three employees, who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withholding and $1,796.00. Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding allowance is $70. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places. Consultant Computer Programmer Administrator Gross pay 2,810 $ 2,100 $ 2,880 Net pay 1,748.43 X $ 1,360.48 X $4 1,933.58 X

Čalculate Payroll Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: Consultant Computer Programmer Administrator Regular earnings rate $2,810 per week $30 per hour $48 per hour Overtime earnings rate Not applicable 1.5 times hourly rate 2 times hourly rate Number of withholding allowances 1 For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheld for all three employees, who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withholding and $1,796.00. Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding allowance is $70. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places. Consultant Computer Programmer Administrator Gross pay 2,810 $ 2,100 $ 2,880 Net pay 1,748.43 X $ 1,360.48 X $4 1,933.58 X

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section: Chapter Questions

Problem 2AP

Related questions

Question

I'm not understanding how I ended up with the incorrect Net Pay for all three employees.

Transcribed Image Text:Čalculate Payroll

Breakin Away Company has three employees-a consultant, a computer programmer, and an administrator. The following payroll information is available for each

employee:

Consultant

Computer Programmer

Administrator

Regular earnings rate

$2,810 per week

$30 per hour

$48 per hour

Overtime earnings rate

Not applicable

1.5 times hourly rate

2 times hourly rate

Number of withholding allowances

1

For the current pay period, the computer programmer worked 60 hours and the administrator worked 50 hours. The federal income tax withheld for all three

employees, who are single, can be determined by adding $356.90 to 28% of the difference between the employee's amount subject to withholding and $1,796.00.

Assume further that the social security tax rate was 6%, the Medicare tax rate was 1.5%, and one withholding allowance is $70.

Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If

required, round your answers to two decimal places.

Consultant

Computer Programmer

Administrator

Gross pay

2,810

$

2,100

$

2,880

Net pay

1,748.43 X

$

1,360.48 X

$4

1,933.58 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning