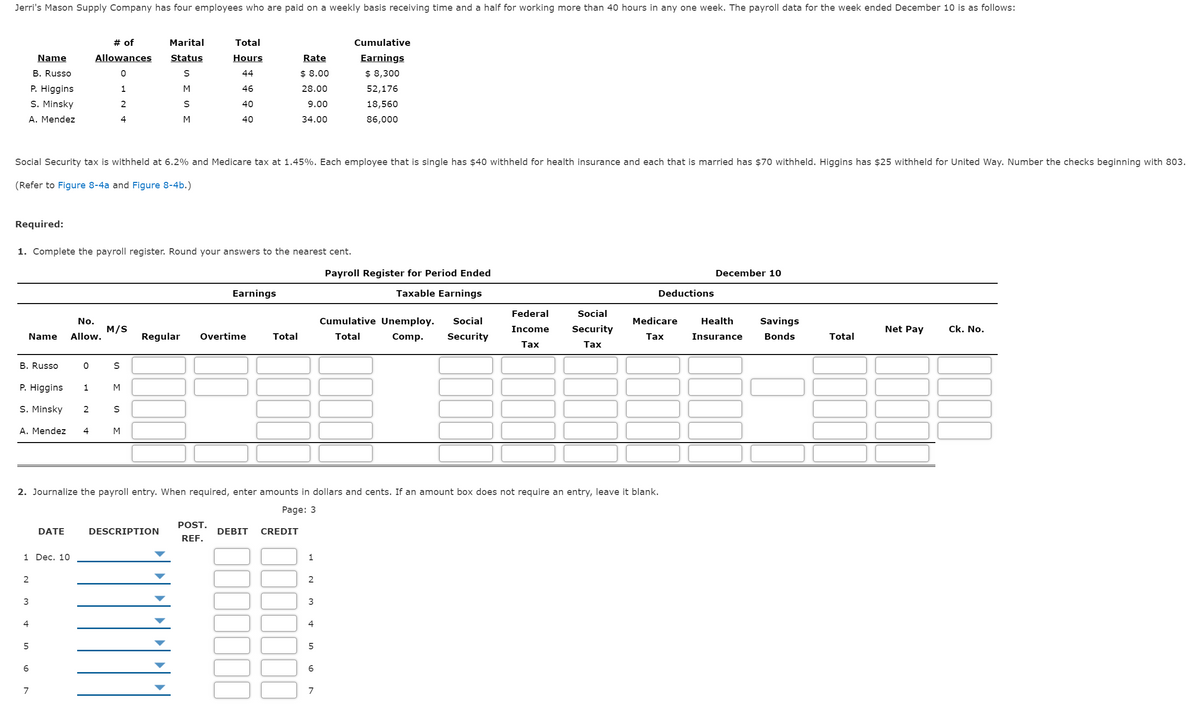

Jerri's Mason Supply Company has four employees who are paid on a weekly basis receiving time and a half for working more than 40 hours in any one week. The payroll data for the week ended December 10 is as follows: Name # of Allowances Marital Status Total Hours Rate Cumulative Earnings B. Russo 0 S 44 $ 8.00 $ 8,300 P. Higgins 1 M 46 28.00 52,176 S. Minsky 2 S 40 9.00 18,560 A. Mendez 4 M 40 34.00 86,000 Social Security tax is withheld at 6.2% and Medicare tax at 1.45%. Each employee that is single has $40 withheld for health insurance and each that is married has $70 withheld. Higgins has $25 withheld for United Way. Number the checks beginning with 803. (Refer to Figure 8-4a and Figure 8-4b.)

Jerri's Mason Supply Company has four employees who are paid on a weekly basis receiving time and a half for working more than 40 hours in any one week. The payroll data for the week ended December 10 is as follows:

Name |

# of Allowances |

Marital Status |

Total Hours |

Rate |

Cumulative Earnings |

| B. Russo | 0 | S | 44 | $ 8.00 | $ 8,300 |

| P. Higgins | 1 | M | 46 | 28.00 | 52,176 |

| S. Minsky | 2 | S | 40 | 9.00 | 18,560 |

| A. Mendez | 4 | M | 40 | 34.00 | 86,000 |

Social Security tax is withheld at 6.2% and Medicare tax at 1.45%. Each employee that is single has $40 withheld for health insurance and each that is married has $70 withheld. Higgins has $25 withheld for United Way. Number the checks beginning with 803.

(Refer to Figure 8-4a and Figure 8-4b.)

Required:

1. Complete the payroll register. Round your answers to the nearest cent.

2. Journalize the payroll entry. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps