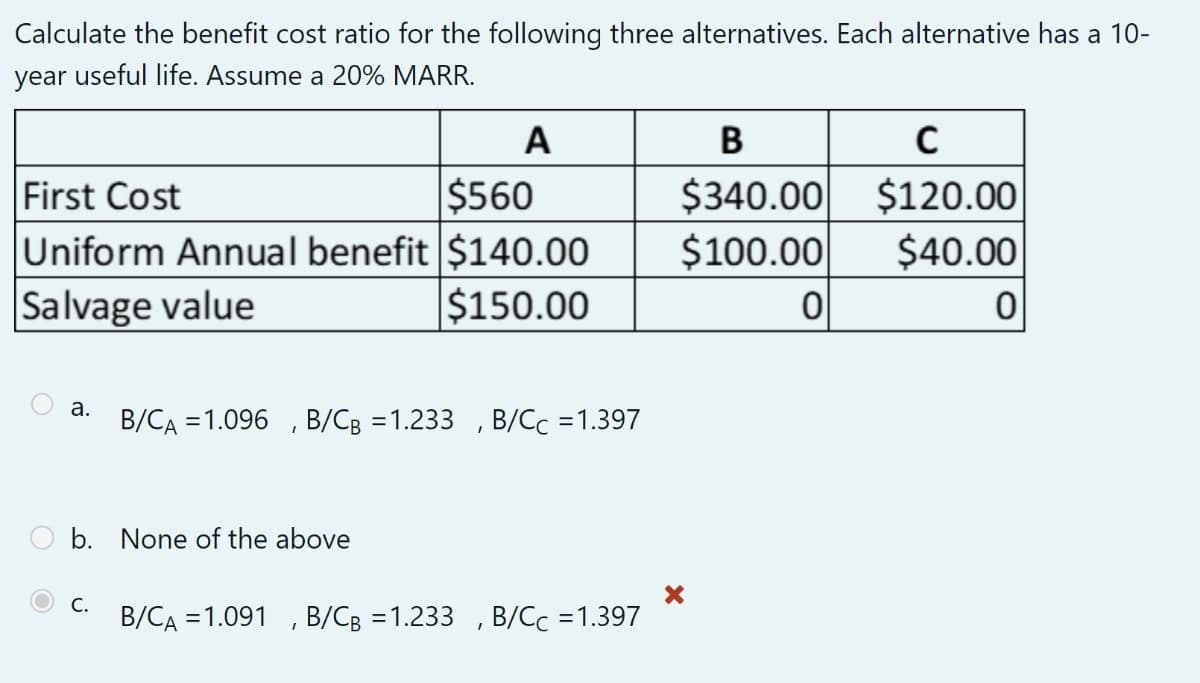

Calculate the benefit cost ratio for the following three alternatives. Each alternative has a 10- year useful life. Assume a 20% MARR. A First Cost $560 Uniform Annual benefit $140.00 Salvage value $150.00 a. B/CA = 1.096, B/CB =1.233, B/Cc =1.397 B $340.00 $100.00 0 C $120.00 $40.00 0

Q: Price Level Ps P₂ P₁ Y₁ LRAS Y₂ an increase in taxes O a reduction of the money supply O revision…

A: Leftward shift in SRAS shows decrease in aggregate supply.

Q: 13. Use the Quantity Theory of Money to explain how long run inflation occurs. If the Federal…

A: Quantity theory of money expresses that money supply and cost level in an economy are in direct…

Q: Country A produces GDP according to the following equation: GDP = 5√K. The country has a savings…

A:

Q: Economic growth typically results in rising standards of living and prosperity. However, it also…

A: The model's dependent variables are regulations like approachable and inaccessible locations,…

Q: If trumpets are normal goods, explain what will happen to price and quantity of trumpets when income…

A: In the mentioned question we have been asked about the effects of normal goods when income in…

Q: Question 1: Suppose that we are in the labour market. Labour is used as an input in the production…

A: Equilibrium in the labor market is when p * MPL = wWhere p = Final price of the product, MPL =…

Q: 6. Show the likely paths of monetary policy transmission process taking an example of interest rate…

A: Monetary Policy is designed by the Central Bank to control the flow of money into the economy. The…

Q: Price ↑ Level Ps P₂ P₁ Y₁ LRAS Y₂ Y SRAS2 SRAS AD₂ AD₁ Quantity of Output Starting from P2 & Y3…

A: Answer to the question is as follows:

Q: Moving to the next question prevents changes to this answer. Question 18 Say's Law applies only in…

A: Say's Law of Markets is theory from classical economics contending that the capacity to purchase…

Q: (1) The following table summarizes information, which are associated with three new 3D Printers…

A: A cash flow analysis decides an organization's functioning capital — how much cash is accessible to…

Q: Consider the competitive market for titanium. Assume that, regardless of how many firms are in the…

A: Answer: The supply curve of a perfectly competitive firm: the short-run supply curve of a perfectly…

Q: n the early 1970s, a group called the "Club of Rome" published a ook entitled The Limits to Growth…

A: Technology can be utilized to safeguard monetary information, secret leader choices, and other…

Q: The Coffee Korner, a small cafe near campus, sells lattes for $3.00 and biscotti for $1.50 each.…

A: The cost of the next best option available which is forgone is opportunity cost.

Q: hat is the future worth of P 6000.00 deposited at the end of every month for four years if the…

A:

Q: The Next four Questions Are Based On The Following Information: In a recent marketing experiment,…

A: In a recent marketing experiment, consumers were given one of four different types of dishwashing…

Q: A financial instrument that represents actual ownership in a corporation is a(n) A. Equity…

A: Debt and equity are the two instruments to raise funds in the financial market.

Q: 5.25% per year, compounded quarterly. If he does this for 25 years, how much will be in the account?

A:

Q: part from its economic strategies, Coca Cola Amatil has identified three main CSR objectives:…

A: Social Corporate Responsibility: Corporate Social Responsibility is an administration idea by which…

Q: The short-run aggregate supply curve shows: O What happens to the level of real GDP suppliers are…

A: Hi! Thank you for the question As per the honor code, We’ll answer the first question since the…

Q: The marginal cost for a company to produce q items is given by MC(q)=0.004q2−0.6q+620. The…

A: Answer: Given, Marginal cost function: MCq=0.004q2-0.6q+620 Fixed cost= $8500 To find the marginal…

Q: Which of the following statements applies to a monopolist but not to a perfectly competitive firm at…

A: Profit maximization occurs at the point where the marginal revenue and marginal cost are equal.

Q: The risk-free rate is 3.7%, and expected inflation is 2.2%. If inflation expectations change such…

A: new risk free rate is the rate where risk is zero on investment , means that this is the rate at…

Q: Economic analysis is limited in its ability to forecast precise choices of a given individual…

A: Economic analysis refers to the observation and understanding of the given data to get relevant…

Q: 1. Complete the chart below. 2. Demand Function for Good X: Price 10 22 32 Qd = 200-5P Quantity…

A: The measure that depicts the change in quantity being demanded of a good with respect to change in…

Q: Highest price where quantity of output is equal to zero = R1200 P*= R650 MC at Q*= R260 AVC at Q*=…

A: AVC at Q*= R150 AFC at Q*= R300Now,ATC at Q*=AVC at Q*+AFC at Q*ATC at Q*=150+300ATC at Q*=R450

Q: 24 EX 16 price 10 b. $16. 70 O c. $6. O d. $24. 100 D Refer to Figure 6-18. The effective price that…

A: Equilibrium in the market is reached at the intersection of demand and supply curves

Q: The Federal Budget 2022-23 has halved the excise tax for the next six months on petroleum frc 4…

A: Excise tax on the petroleum is also known as gasoline tax and such tax is imposed on the seller. The…

Q: How will exchange rates change in a country A where prices double year after year in comparison with…

A: The demand and supply for currency in the foreign exchange market determine the exchange rate of a…

Q: A household has $6 in wealth, which allocates between consumption and savings. The MB from…

A: The marginal benefit is the pleasure a buyer feels after acquiring an additional commodity or…

Q: Use the following table to calculate the price elasticity of supply for computers Use the following…

A: Elasticity is an economic term that refers to the change in quantity needed or given as a result of…

Q: Suppose New York wants to build a new facility to replace Madison Square Garden. Assume that the…

A: The difference between the present value of cash inflows and outflows over time is called net…

Q: u₁(x11, X12) = X11X12, W₁ = (8,16) U₂(X21,x22) = X21x22 W₂ = (8,16) Individual 1's consumption in a…

A: Given u1(x11,x12)=x11x12 .... (1) utility function for the second individual: u2=x21x22…

Q: Which component(s) of U.S. real GDP decreased in size relative to total U.S. real GDP from 1900 to…

A: Usually the sectors of economy are divided into following parts : agriculture, industrial and…

Q: What would happen if the United States government had to devalue the dollar? O It would lower the…

A: depreciation :-The monetary value of an asset decreases over time due to use, wear and tear or…

Q: Suppose a firm’s conditional factor demand functions (the inputs needed to produce q at minimum…

A: Given, A firm’s conditional factor demand functions for labor is given below: L = L(w, q, r) = 4rq…

Q: Trader’s always earn a profit when an option expires “in-the-money.” true or falsa An option…

A: Note:- Since we can only answer one question at a time, we'll answer the first one. Please repost…

Q: We can produce widgets with two inputs – labour and capital. The two inputs are perfect substitutes.…

A: Inputs of production refer to the various inputs that are used in the process of production of a…

Q: Amit is using his money to buy assets like house , commercial land and machines . Write what is he…

A: Disposable Income: Disposable income is the income that remains after subtracting the taxes and this…

Q: Suppose the revenue for a certain company for the years 2010–2014 is shown in the following table.…

A: The consumer price index (CPI) measures changes after some time in the general degree of prices of…

Q: people tend to spend more money when the economy experience a

A: The overall condition of the economy as it progresses through four stages in a cyclical manner is…

Q: n 2021, the Woodland Republic Bureau of Statistics publication indicated thatthe Consumer Price…

A: Given information: Consumer price index in 2021 = 109.2 Consumer price index in 2020 = 106.5 To find…

Q: estion 15 hich one of the following statements is incorrect about the costs of inflation? It creates…

A: The cost of inflation affects the import and export of a country when there is an inflation the raw…

Q: This is on the basics of the IS-LM model. The model is given by the following system of equations Y…

A: Answer: The movement along the IS curve takes place only due to a change in the interest rate. The…

Q: The long run aggregate supply curve (LRAS) has a verticle slope indicating that changes in the price…

A: Vertical LRAS implies that firms produce natural level of output in the long run.

Q: Suppose that Luigi is a monopolistic competitor whose marginal cost of a jacket is $100 and at one…

A: A monopolistic competitive market is the market in which there are many buyers and sellers. Each…

Q: 10 9 8 7 6 5 4 3 2 1 0 0 P ($) SB 1 2 3 4 5 6 7 8 9 10 The graph above shows a market with an…

A: Positive externalities occur when the consumption of a good results in positive spillover effects on…

Q: J 7 Conduct an analysis of market structures: Are perfectly competitive markets and their outcomes…

A: Market is the place where buyers and sellers interact and exchange the goods and seervi at certain…

Q: Calculate the future worth (FW) at 10% of a project that will save $25K per year for 20 years. The…

A: In the future worth analysis, we find the future value of all the cash flows. In the present worth…

Q: If a bank gives an interest rate of 5% annually. What is the sum of money after 2 years if the…

A: Interest rate of bank = 5% Difference between compound interest compounded annually and the simple…

Q: A council is considering improving the watershed. It hires an agency to determine the feasibility of…

A: Introduction A counsel wants to consider improvement in the watershed. It hires an agency to…

Step by step

Solved in 2 steps with 2 images

- Calculate the conventional benefit-cost ratio for the alternative: Initial Investment 250000 Revenues 80000 Costs 22000 Salvage Value 50000 Useful life 9 MARR 0.1.I want you to provide me the Cash Flow diagram of the problem. Only cash flow diagram, the solution is already there. Thanks in advance! The annual estimated cash flow is $140,000. The salvage value will be 12% of the initial price after 5 years. The discount rate (r) is 18% Let us assume the initial price of the doughnut machine be X. PV of cash inflows=PV of cash outflows$140,000×PVAF4,18%+.12X×PVF5,18%=X$140,000×2.69006180465+.12X×0.43710921621=X$376,608.652651=X-0.05245310594$376,608.652651=0.94754689406XX=$397,456.479475 The maximum purchase price of the doughnut machine is $397,456.48.Quilts R Us (QRU) is considering an investment in a new patterning attachment with the cash flow profile shown in the table below. QRU’s MARR is 13.5%/yr. Solve, a. What is the external rate of return of this investment? b. What is the decision rule for judging the attractiveness of investments based on external rate of return? c. Should QRU invest?

- The Larkspur Furniture Company needs a new grinder. Compute the present worth for these mutually exclusive alternatives and identify which you would recommend given i = 6% per year. Larkspur uses a 10-year planning horizon.Net present value (NPV) of the project =Single payoff x PVIAF (10.20%, 9 years) - initial outlay = $6,947 x 0.42340 - $2,182 = $759.39 What's the equation for the bolded item?Engineering economy - ENGR 3322 A new municipal refuse-collection truck can be purchased for $84,000. Its expected useful life is six years, at which time its market value will be zero. Annual receipts less expenses will be approximately $18,000 per year over the six-year study period. At MARR of 19%, calculate the benefit-cost ratio of the project a. 53 b. 63 c. 73 d. None of the choices

- Consider a proposed project that has the following costs and benefits. Using linear interpolation, what is the project's simple or conventional payback period? Year Costs Benefits 0 $4,000 1 2,000 2 $1,500 3 1,500 4 1,500 5 2,300 6 2,300 A. 6.58 years B. 4.65 years C. 3.98 years D. 5.41 yearsThree different alternatives shown in the table below are being considered by Kal Tech Engineering systems. Assume that alternatives X and Z are replaced at the end of their lives. Data Alternative X Alternative Y Alternative Z Initial Cost $6,000 $1,000 $1,500 Uniform Annual Benefits $810 $125 $ 230 Useful Life in Years 20 ∞ (infinity) 10 MARR (Interest Rate) 12% Refer to the data above. The most desirable alternative is ________. Group of answer choices Do nothing Alt. Z Alt. Y Alt. X Quiz saved at 11:56pm Submit QuizRespond to the question with a concise and accurate answer, along with a clear explanation and step-by-step solution, or risk receiving a downvote. A company wants to buy a production device for their new factory. They have two alternatives, whose cash flows are given in the following table. Salvage value is 20% of the initial cost. According to these cash flows, choose the best alternative knowing their payback periods. Alternative A Alternative B Initial Cost Annual Income Useful Life P3,000,000 P3,500,000 P1,200,000 P1,000,000 4 vears 8 years

- 1 - Assuming an interest rate of 3% per year (effective), calculate the feasibility of each option. You can use either Present Worth Analysis or Equivalent Uniform Worth Analysis. In this part, your calculation should be done without the use of Excel. Show your equations and the results. 2 - Using linear interpolation, calculate the rate of return for each option. Here, your calculation should be implemented using Excel. 3 - Assuming that the initial equipment can be depreciated over the course of 20 years and usingDouble Decline Balance Depreciation, calculate the depreciation schedule for the equipment. 4- Assume a state income tax of 5%. Calculate the after-tax cashflow for each option assuming the depreciation used. Use only the depreciation on question 2.dont use excel i will 5 upvotes. Assuming a firm’s weighted average cost of capital is 12%, what is the discounted payback period of the following project? Year Net Cash Flow 0 -$375,000 1 $200,000 2 $200,000 3 $350,000 Group of answer choices a. 2.40 years b. 2.15 years c. 2.21 years d. 1.88 yearsa. A project costs $10 up front and has net benefits of $15 with probability 0.8 at the end of the second year and otherwise returns nothing. The discount rate is 0.035. What is the NPV? b. At what probability of returning $15 after year 2 would the ENPV be 0?