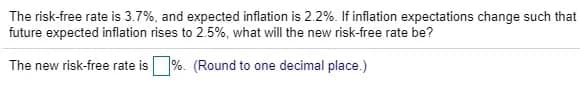

The risk-free rate is 3.7%, and expected inflation is 2.2%. If inflation expectations change such tha uture expected inflation rises to 2.5%, what will the new risk-free rate be? The new risk-free rate is%. (Round to one decimal place.)

Q: Use the information in this question to answer questions (36-40). Accenture Technologies, a…

A: In the question, it is given that In Europe QE = 900 – 2PEMRE = 450 – QE In the USAQW = 700 – PWMRW…

Q: 23 for 1st, 2nd..... unit of consumption C. A firm faces MR at $1.66, 1.52, 1.42, 1.34 and 1.28, for…

A:

Q: 3. In which country would you save if the nominal interest rate equals 4% in the U.S. and 1% in…

A: In economics a conversion scale is the rate at which one cash will be traded for another money.

Q: When workers move from one industry to another in response to demand changes, this is an example of…

A: Factors of production are the inputs used in the production of goods and services.

Q: Assume a bond with a remaining maturity of 3 years a. If the face value is $10,000 and coupon…

A: Given Face value of coupon bond FV =$10000 Coupon payment (C)= $500 per year yield to maturity…

Q: Highest price where quantity of output is equal to zero = R1200 P*= R650 MC at Q*= R260 AVC at Q*=…

A: AVC at Q*= R150 AFC at Q*= R300Now,ATC at Q*=AVC at Q*+AFC at Q*ATC at Q*=150+300ATC at Q*=R450

Q: Analysis of trade Without trade. PD = $30,000, Q = 400 In world markets. Pw = $15,000 Under free…

A: Free trade means exchange of goods and services with other countries without any tariff or non…

Q: Explain, using supply and demand analysis, why the price of sugar has been increasing recently. 2.…

A:

Q: The spending multiplier, m, is 1/(1-MPC). a) If the MPC is 0.9, what is the spending multiplier? b)…

A: Marginal Propensity to Consume is the proportion of an increase in income that gets spent on…

Q: The following graph represents the money market in a hypothetical economy. As in the United States,…

A: When the central bank decides to increase the target interest rate, it implements a contractionary…

Q: The table below sets out the production possibilities of a small Pacific island economy. An economy…

A: Production possibility curve shows the combination of two goods that can be produced with the given…

Q: A disadvantage of a statutory close corporation is that: a) it cannot distribute dividends to…

A: Close Corporation:- A close corporation is typically a smaller organisation that chooses to have…

Q: Which of the following events would increase the demand for cruise vacations? The price of cruises…

A: Demand for cruise vacations shows different combinations of price and number of cruise vacations…

Q: You are a U.S.-based treasurer with $1,000,000 to invest. The dollar-euro exchange rate is quoted as…

A: exchange rate, the cost of a country's cash is comparable to another nation's cash. An exchange rate…

Q: Economics Consider the money demand. Suppose that price changed. Because of the change, nominal…

A: In an economy, it is given that the nominal demand for money reduces due to the change in the price…

Q: Teresa spends her entire scholarship of PLN 600 for the purchase of drinks and food. 1. Draw…

A: Total Budget: PLN 600 Price of drink (x) = 5 zlotys Price of dinner (y) = 20 zlotys

Q: Apple cider is produced in a perfectly competitive market. Firms are identical and all have the…

A: Introduction Apple cider has produced in a perfectly competitive market. Cost and market demand of…

Q: ntral bank sells government securities from the private sector-money markets other things being…

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a…

Q: Suppose an economy has 100 units of capital, 100 units of labor, and the efficiency of each worker…

A: Given In an economy Capital K = 100 units Labor L= 100 units The efficiency of each worker =2 We…

Q: Question 2 Given the following information: 1= 150, G = 150, T-150 and C= 150 +0.75(Yd) At least 2…

A: Consumption function as a tournament consumption and induced consumption. Autonomous consumption…

Q: Do you think that someone could be a good systems manager but a poor project manager? What about the…

A: Meaning of Managerial Economics: The term managerial economics refers to the scenario of the…

Q: Economic Decision Making) Write a 100 to 150 - word response to one of the following questions :…

A: Privatization is the peculiarity of governments contracting exclusive, revenue driven organizations…

Q: A price-taking firm: O a. talks to rival firms to determine the best price for all of them to charge…

A: As per honor code, we’ll answer only one question at a time , we have answered the first question…

Q: Suppose that in an economy the structural unemployment rate is 2.1 percent, the frictional…

A: Cyclical unemployment is the type of unemployment where people loose their job as per economy trend…

Q: n 2021, the Woodland Republic Bureau of Statistics publication indicated thatthe Consumer Price…

A: CPI of the Woodland Republic in 2020 = 106.5 CPI of the Woodland Republic in 2021 = 109.2 Use the…

Q: Everyday-low pricing is a pricing strategy that is consistent with a goal of achieving long-term…

A: Answer: Everyday low pricing (EDLP): EDLP refers to the pricing strategy wherein the retailers or…

Q: actual output of the month was 9,000 raw material were used to produce this output. Required: a.…

A: Price variance is the actual unit cost of an item less its standard cost, multiplied by the quantity…

Q: Imagine you are a senior statistician with a national statistical agency. The economists who work…

A: Gross domestic product (GDP) refers to the entire market value of the products and services…

Q: 1.To what extent should the government intervene in the market?

A: Government intervention:- Government intervention is a supervisory strategy used by the state to…

Q: Rosaliz has been working for ten years in a food and institutional product distribution company that…

A: The designing and regulating portions of the production process are handled under the management…

Q: = 5√K and has a capital Country A produces GDP according to the following equation: GDP stock of…

A: The calculation of the total final value of all the products and services produced within the…

Q: Consider an economy which is in general equilibrium. Ann and Bob are (the only) two consumers in an…

A: Fairness in economics, particularly in relation to taxes or welfare economics, is the principle that…

Q: 892.8 834.9 725.8 growth rate of real GDP for 1930?

A: GDP of a country is the aggregate value of goods and services produced by the nation in a year. When…

Q: A weaver working with a handloom is able to produce 11 yards of fabric per day. The typical weaver…

A: Per day production by handloom = 11 yards Per day payment to worker =$10 Per day production by…

Q: Suppose a firm needs to combine 3 units of machines with 7 units of labor to produce one unit of…

A: Other things being constant, "the demand for the labor is inversely proportional to the wage rate…

Q: Price Level Ps P₂ P₁ Y₁ LRAS Y₂ an increase in taxes O a reduction of the money supply O revision…

A: Leftward shift in SRAS shows decrease in aggregate supply.

Q: 1. Aggregate demand, aggregate supply, and the Phillips Curve In the year 2023, aggregate demand and…

A: Goods market is in equilibrium when AD= AS which determines the price as well as output level shown…

Q: Country A produces GDP according to the following equation: GDP = 5√K. The country has a savings…

A: The measure that depicts the final value of goods and services produced in an economy during a…

Q: When interest rates in the U.S. increase, we could expect: Multiple Choice more foreigners…

A: Foreign investors gain considerable ownership stakes in domestic enterprises and assets due to these…

Q: Suppose a consumer has a budget for fast-food items of $60 per week and spends this money on two…

A: Budget line shows the different combinations of goods that a consumer can purchase with the given…

Q: When workers do not notice inflation has taken place they do not realize that their real wage has…

A: Answer to the question is as follows:

Q: Describe the impact of COVID 19 pandemic on economic growth and unemployment, use real world example…

A: Introduction COVID-19 has had a significant impact on the world economic and financial markets in…

Q: fer to the accompanying figure Assume the market is ongnally at point W. Movement to point X is the…

A: Equilibrium occurs at a point where the demand curve and the supply curve intersect each other.

Q: Consider a monopoly using a two part tariff against consumers with downward sloping individual…

A: Two-part tariff is one of the forms of price discrimination associated with the firm's decision.

Q: This is on the basics of the IS-LM model. The model is given by the following system of equations Y…

A: Answer: The movement along the IS curve takes place only due to a change in the interest rate. The…

Q: (1) Draw a generic Aggregate Supply (AS) and Aggregate Demand (AD) curve on a set of axes. Label…

A: Goods market is in equilibrium where aggregate demand and aggregate supply intersect at certain…

Q: acts as a monopolist in two different markets. When free to do so, it chooses different prices in…

A: Monopoly firm follows the price discrimination strategy to increase profit. Prices are set according…

Q: The spending multiplier, m, is 1/(1-MPC). a) If the MPC is 0.9, what is the spending multiplier? b)…

A: A multiplier is a numerical coefficient used in economics to illustrate how variations in total…

Q: (iii) State coase's theorem and evaluate the following statement in the relevance of the theorem.…

A: A negative externality occurs when an economic agent's consumption or production activities…

Q: The Woodland Republic’s Population Secretariat published the following information in 2021: Total…

A: Given the information: Total population = 30 million Labor force = 80% of the total population…

Step by step

Solved in 3 steps with 2 images

- Suppose that an economy has a constant nominal money supply, a constant level of real output Y = 1500, and a constant real interest rate r = 0.05, and it’s expected rate of inflation is 2%, i.e, πe = .02. Suppose that the income elasticity of money demand is ηY = 0.5 and the interest elasticity of demand ηi = –0.2. (a) Suppose that Y decreases to 1425, r remains constant at 0.05 and there is no change in the expected rate of inflation. What is the percentage change in the equilibrium price level? (b) Suppose that r increases to 0.06 and Y remains at 1500. Assuming that expected inflation remains at πe = .02, what is the percentage change in the equilibrium price level? (c) Suppose that r increases to 0.06. Assuming that πe = .02, what would real output have to be for the equilibrium price level to remain at its initial value?u are considering the choice between investing $50,000 in a conventional 1-year bank CD offering an interest rate of 5% and a 1-year Inflation-Plus CD offering 1.5% per year plus the rate of inflation. Which is the safer investment? Can you tell which offers the higher expected return? If you expect the rate of inflation to be 3% over the next year, which is the better investment? Why? If we observe a risk-free nominal interest rate of 5% per year and a risk-free real rate of 1.5% on inflation-indexed bonds, can we infer that the market's expected rate of inflation is 3.5% per year?There are two countries in the world, A and B. Suppose the central bank in country A has an annual inflation target pai = 0.02 while the central bank in country B has anannual inflation target pai = 0.03. In the long run, we would expect the nominalexchange rate of country A to appreciate against country B at a rate of about 1% per year.True or False? Explain.

- The risk-free rate is 4.8%, and expected inflation is 3.2%. If inflation expectation such that future expected inflation rises to 4.5%, what will the new risk-free rate beAfter graduating from college in 2020, Art Major's starting salary is $40757.0040757.00. Suppose Art Major has a cost of living adjustment (COLA) clause, or an escalator clause, in his labor contract so that he will be able to maintain this same level of purchasing power in real terms in 2021 and 2022. Using the information in the table, how much will Art Major earn in 2021 and 2022 if his salary keeps up with inflation? Round your answers to the nearest dollar. Year CPI 2020 101.77 2021 106.80 2022 109.35 What is Art Major's salary in 2021? $ What is Art Major's salary in 2022? $2. If a higher inflation is expected, what would you expect to happen to the shape of theyield curve? Why?

- If an economy always has inflation of 10 percent peryear, which of the following costs of inflation will itNOT suffer?a. shoeleather costs from reduced holdings of moneyb. menu costs from more frequent price adjustmentc. distortions from the taxation of nominal capitalgainsd. arbitrary redistributions between debtors andcreditorsSocial loss is L=(u-5)^2+(pi-2)^2Philips curve is u=7-(pi-pi_e), where pi is actual inflation rate, pi_e is expected inflation by the public. (1)If gov't is honest, then gov't should choose pi =____ (2)If gov't is sophisticated and public is naive, then gov't should announce pi_a =____ (3)If gov't is sophisticated and public is naive, then gov't should choose pi =____Assume that next year’s wage rate will be 3 percent higher than this year’s because of inflationary expectations. The actual inflation rate is 4 percent. At the beginning of next year, will the real wage be higher, lower, or the same as today? Explain. Assume that Mark gets a fixed-rate loan from a bank when the expected inflation rate is 3 percent. If the actual inflation rate turns out to be 4 percent, who benefits from the unexpected inflation: Mark, the bank, neither, or both? Explain. How does each of the following changes affect the real gross domestic product and price level of an open economy in the short run? Explain. The depreciation of the country’s currency in the foreign exchange market.

- Suppose the public believes that a newly announcedanti-inflation program will work and so lowers itsexpectations of future inflation. What will happen toaggregate output and the inflation rate in the short run?Suppose the statistical office of a country does a poorjob in measuring inflation and reports an annualizedinflation rate of 4% for a few months, while the trueinflation rate has been 2.5%. What will happen to thecentral bank’s credibility if it is engaged in inflation targeting and its target is around 2%?Expected inflation is 3%, and initially the output gap is zero (percent). A(surprise) tariff reduction on imported steel and aluminum- which are used widely in domestic production-results in (unexpected) cost-push inflation of -0.5%. Imports rise, leading to (unexpected) demand-pull inflation of -0.25%. The economy's actual rate of inflation is: A. 2.25% B. 2.50% C. 2.75% D. 3.00% E. 3.75%