Q: bank pays 6% interest per year, compounded quarterly. To what amount will a $5000 deposit grow if…

A: Solved using Financial Calculator N = 10 years * 4 quarters = 40 I/Y = 6/4 = 1.5 PV = - 5000 CPT FV…

Q: 35 Question 31 36 Given the financial data for New Electronic World, Inc. (NEW), compute the…

A: Operating cash flow is referred as the measurement of the cash amount, which helps in generating the…

Q: What is the expected return for asset X if it has a beta of 1.5, the expected market return is 15…

A: The expected return for the asset can be calculated with the help of CAPM equation

Q: It is desired to determine the present economic value of an old machine by considering of how it…

A: The difference between the present value of cash inflows and outflows over time is known as net…

Q: She arranged to receive $45,000 the first year. Because of inflation each year she will get $580…

A: A regular payment received by retired people is called pension. Inflation is the increase in general…

Q: If 1-year interest rates for the next three years are expected to be 6, 4, and 5 percent, and the…

A: The liquidity premium theory is one of the theories that attempts to explain the term structure of…

Q: Audi is selling at 30 per share. The most recent annual dividend paid was 0.5. Using the Gordon…

A: The expected dividend growth rate can be calculated as per the dividend growth rate.

Q: stabilising the global financial system

A: A Stable Financial System is able to allocate resources effectively analyze and control financial…

Q: A) Brock purchases equipment that has a fair value of $50,000. Brock pays $10,000 as a downpayment,…

A: Fair Value of Equipment is $50,000 Downpayment is $10,000 Principal amount of note is $60,000 Annual…

Q: How is your borrowing power affected when you are considered a "high risk"? O There is a good chance…

A: A high risk individual is the one who has bad credit history and who has defaulted payments in the…

Q: Alfred is a bachelor with a stable job. He is thinking of his future plans and one of his goal is to…

A: Future Value: The future value is the amount that will be received at the end of a certain period.…

Q: Suppose that you are in the fall of your senior year and are faced with the choice of either getting…

A: Present value of annuity with a growth rate With first payment (P), discount rate (r), growth rate…

Q: 24. Financial institutions that cut back on their lending are engaged in A) liability management B)…

A: Given, (Answer 24) Meaning of Deleveraging, Whenever a person or an organization focusses to lower…

Q: 1. A firm has the following capital structure: thousands € Liabilities and equity thousands € Assets…

A: WACC = kd*D/A+ke*1-D/Awhere, kd = Cost of debt or debt interest rateke = Cost of equityD/A =…

Q: BMW just paid an annual dividend of 2 per share. Management has promised shareholders to increase…

A: The current price of the stock can be calculated as per the dividend growth model

Q: pany is trying to determine its WACC. The following data is avail Bond rate yr. average return rice…

A: WACC is the weighted average cost of capital that includes the weighted cost of equity and weighted…

Q: 9. For the three-part question that follows, provide your answer to each part in the given…

A: Cost of Car is $18,000 Down Payment is $1,000 Monthly payments are $375 Total number of periods are…

Q: Cash conversion cycle of PETRON * STATEMENT OF FINANCIAL POSITION AND INCOME STATEMENT OF 3…

A: Formula: Cash conversion cycle=Days inventory outstanding+Days sales outstanding-Days payable…

Q: you want to buy a car for $8300 with $360 monthly payments for 4 years, what is the annual interest…

A: Interest rate is the rate which the customer would have to pay on the periodic payment of the…

Q: 11. Consider the actual dollar CFs of a project below. The real MARR is 3% and the general inflation…

A: Real MARR is 3% Inflation rate is 5% To Find: Discounted payback period

Q: Question 15 Which of the following answers was not one of the lending rules proposed by Walter…

A: Walter Bagehot was a British journalist, businessman. He wrote extensively about economics and…

Q: The following table represents the cashflows (in rand) of a company. Year Cash flows 3 40000 5…

A: The Modified Internal Rate of return: The modified rate of return is a useful measure to evaluate…

Q: Amy has invested ₱500,000 on March 1, 2022 at 10% interest compounded annually for 10 years. Compute…

A: The total amount of an investment earning a fixed rate of interest will be equal to the future value…

Q: Relate the 5 Set participants a. Cardholder b. Issuer c. Merchant d. Acquirer e. Certificate…

A: Secure Electronic Transaction (SET) is an open-source encryption and security standard for online…

Q: The price of a condominium is $88,000. The bank requires a 5% down payment and one point at the time…

A: Price of Condominium is $88,000 Down payment is 5% Time period is 30 years or 30×12 = 360 months…

Q: • Gantt chart or net present value (NPV). Year Annual benefits Annual operating costs 6% discount…

A: Net present value is the difference between Present Value of cash Inflows and present value of cash…

Q: The risk-free rate is 3%, the market risk premium (MRP) is 8%, and the Beta of Lotsa Dough common…

A: Risk free rate = 3% Market risk premium = 8% Beta = 0.90

Q: An entity has an investment which analyst think that there will be a 40% probability that the…

A: The following information has been provided in the question: Probability that expected return will…

Q: A loan of 6 semi-annual payments of 4,500 Php are to be made to pay for a loan at 5 1/2 % compounded…

A: Given That: semi-annual payments=4,500 Php n = 6 semi annual payments r =5.5%/2 = 2.75% semiannual.…

Q: What would be your realized yield to maturity if you sold the bond after 10 years?

A: Realized yield to maturity (YTM) refers to the yield or total return earned or realized by the…

Q: Management is considering buying a pump that costs $20,000 and could save them $7,500 per year over…

A: Solution:- The investment should be made or not will depend on the Net Present Value (NPV). If NPV…

Q: Find the future value of an annuity due for payments of $450 for 12 years with a rate of 0.24%…

A: Solution:- When an equal amount is paid each period at beginning of each period, it is called…

Q: here is a situation where investors in the US are looking to Japan as a place where they should…

A: Value of a currency is determined by aggregate demand and supply situation for that currency. Demand…

Q: a. Determine a present value factor for an annuity of $1 which can be used in determining the…

A: Internal rate of return (IRR) of an alternative refers to the rate at which the Net present value…

Q: Critically discuss over-investment and under-investment problems due to debt usage. What kinds of…

A: Capital structure means the amount of debt and equity which the firm has as its capital. The company…

Q: Which of the following is an asset of the Fed? Federal Reserve notes bank reserves

A: The assets of Federal reserve consist of Gold stock, Special drawing rights, reserve position in…

Q: 3b. Inflation is expected to average 2.4% per year for the next 44 years. What percentage of the…

A: We have to find the % loss in the purchasing power of the dollar under the given inflation scenario.

Q: new engine was installed by a textile plant at cost of P and projected to have a useful life of 15…

A: Capitalization describes the practice of depreciating the expenses of acquiring an asset throughout…

Q: Which of the following is an asset of the Fed? Federal Reserve notes

A: Federal reserve assets include Gold, Special drawing rights, reserve position in IMF, Foreign…

Q: If a company already owns the land on which it plans to build a factory, the land should be treated…

A: If a company already owns the land on which it plans to build a factory, the land should be treated…

Q: 1. a. A company with a MARR policy of 12% is trying to estimate the initial cost of a piece of…

A: Given, By using the table we are going to calculate the answer, No. of years MACRS Rate for 10…

Q: The Seattle Corporation has been presented with an investment oppore yield end of year cash flows of…

A: The NPV of the investment is calculated as present value of cash inflows less initial investment

Q: What is the net operating profit after taxes (NOPAT) for 2020? Enter your answer in millions. For…

A: NOPAT: Net operating profit after tax is a measure indicating the performance of a company through…

Q: Being tinancially illiterate will increase your chances of Having to file for Bankruptey O…

A: Being financially illiteracy can lead to a number of problems, such as accumulating debt burdens,…

Q: . Inflation is expected to average 2.4% per year for the next 44 years. How much money will be…

A: Inflation rate = 2.4% Period = 44 Years Value of goods and service today = $1

Q: You have your own practice as a trusts and estates attorney anda dient has sought your assistance…

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any…

Q: The following is an amortization schedule for a loan of $5000 to be repaid over two years at 7%…

A: Data given: Loan amount = $5000 N=2 years Rate = 7% compounded semiannually Working Note #1 Given…

Q: What is correct about rent control? Question 4 options: It often hurts those it tries to…

A: Rent control can be defined as the process which puts ceiling on the maximum limit of rent offered…

Q: NC Corp. holds three stocks in her portfolio: A, B, and C. The portfolio beta is 1.40. Stock A…

A: The new portfolio beta can be calculated by subtracting the beta contribution of Stock A in the…

Q: Average collection period of JFC * STATEMENT OF FINANCIAL POSITION AND INCOME STATEMENT OF 3…

A: Given, The total sales of JFC is 90,671. Total receivables is 7621

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

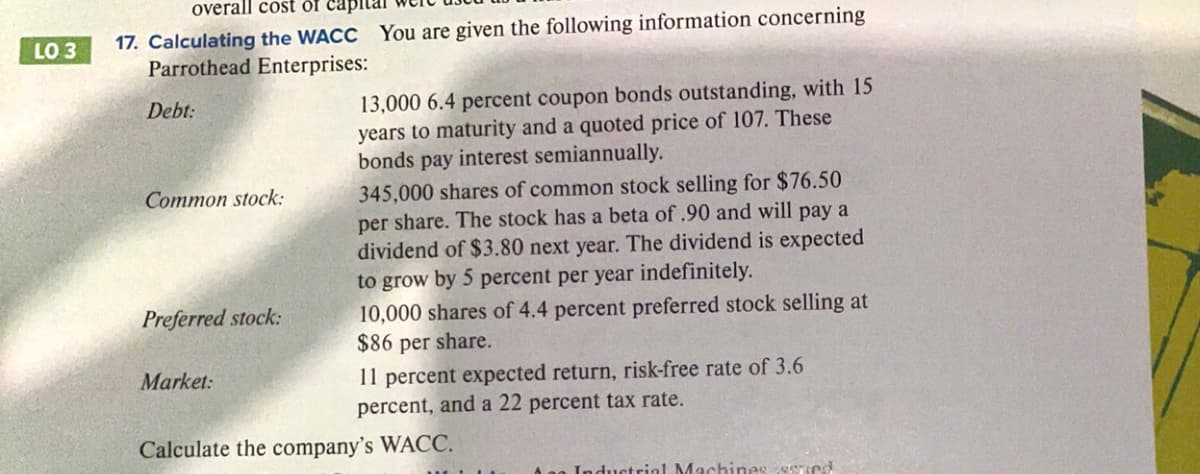

- WACC Estimation On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $30 million in new projects. The firm’s present market value capital structure, shown here, is considered to be optimal. There is no short-term debt. New bonds will have an 8% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders’ required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so the dividend yield is $1.20/$30 = 4%.) The marginal tax rate is 40%. In order to maintain the present capital structure, how much of the new investment must be financed by common equity? Assuming there is sufficient cash flow for Tysseland to maintain its target capital structure without issuing additional shares of equity, what is its WACC? Suppose now that there is not enough internal cash flow and the firm must issue new shares of stock. Qualitatively speaking, what will happen to the WACC? No numbers are required to answer this question.Hasting Corporation is interested in acquiring Vandell Corporation. Vandell has 1 million shares outstanding and a target capital structure consisting of 30% debt; its beta is 1.4 (given its target capital structure). Vandell has $10.82 million in debt that trades at par and pays an 8% interest rate. Vandell’s free cash flow (FCFJ is $2 million per year and is expected to grow at a constant rate of 5% a year. Vandell pays a 40% combined federal and state tax rate. The risk-free rate of interest is 5%, and the market risk premium is 6%. Hasting’s First step is to estimate the current intrinsic value of Vandell. What are Vandell’s cost of equity and weighted average cost of capital? What is Vandell’s intrinsic value of operations? [Hint: Use the free cash flow corporate valuation model from Chapter 8.) What is the current intrinsic value of Vandell’s stock?CALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skyes earnings per share last year were 3.20. The common stock sells for 55.00. last years dividend (D0) was 2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skyes preferred stock pays a dividend of 3.30 per share, and its preferred stock sells for 30.00 per share. The firms before-lax cost of debt is 10%, and its marginal tax rate is 25%. The firms currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skyes beta is 1.516. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals 1.2 million. a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.) d. If Skye continues to use the same market-value capital structure, what is the firms WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?

- RECAPITALIZATION Currently, Bloom Flowers Inc. has a capital structure consisting of 20% debt and 80% equity. Blooms debt currently has an 8% yield to maturity. The risk-free rate (rRF) is 5%, and the market risk premium (rM rRF) is 6%. Using the CAPM, Bloom estimates that its cost of equity is currently 12.5%. The company has a 40% tax rate. a. What is Blooms current WACC? b. What is the current beta on Blooms common stock? c. What would Blooms beta be if the company had no debt in its capital structure? (That is, what is Blooms unlevered beta, bU?) Blooms financial staff is considering changing its capital structure to 40% debt and 60% equity. If the company went ahead with the proposed change, the yield to maturity on the companys bonds would rise to 9 5%. The proposed change will have no effect on the companys tax rate. d. What would be the companys new cost of equity if it adopted the proposed change in capital structure? e. What would be the companys new WACC if it adopted the proposed change in capital structure? f. Based on your answer to Part e, would you advise Bloom to adopt the proposed change in capital structure? Explain.RECAPITALIZATION Currently, Forever flowers Inc. has a capital structure consisting of 25% debt and 75% equity. Forever's debt currently has a 7% yield to maturity. The risk-free rate (rRF) is 6%, and the market risk premium (rM - rRF) is 7%. Using the CAPM, Forever estimates that its cost of equity is currently 14.5%. The company has a 40% tax rate. a. What is Forever's current WACC? b. What is the current beta on Forever's common stock? c. What would Forever's beta be if the company had no debt in its capital structure? (That is, what is Forever's unlevered beta, bU?) Forever's financial staff is considering changing its capital structure to 40% debt and 60% equity. If the company went ahead with the proposed change, the yield to maturity on the company's bonds would rise to 10.5%. The proposed change will have no effect on the company's tax rate. d. What would be the company's new cost of equity if it adopted the proposed change in capital structure? e. What would be the company's new WACC if it adopted the proposed change in capital structure? f. Based on your answer to part e, would you advise Forever to adopt the proposed change in capital structure? Explain.The Cost of Equity and Flotation Costs Messman Manufacturing will issue common stock to the public for $30. The expected dividend and the growth in dividends are $3.00 per share and 5%, respectively. If the flotation cost is 10% of the issue’s gross proceeds, what is the cost of external equity, re?