Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 13EP

Related questions

Question

Give me answer within an hour please its very urgent I will give you upvotes ...thankyou..

Transcribed Image Text:Weighted Average Cost of Capital

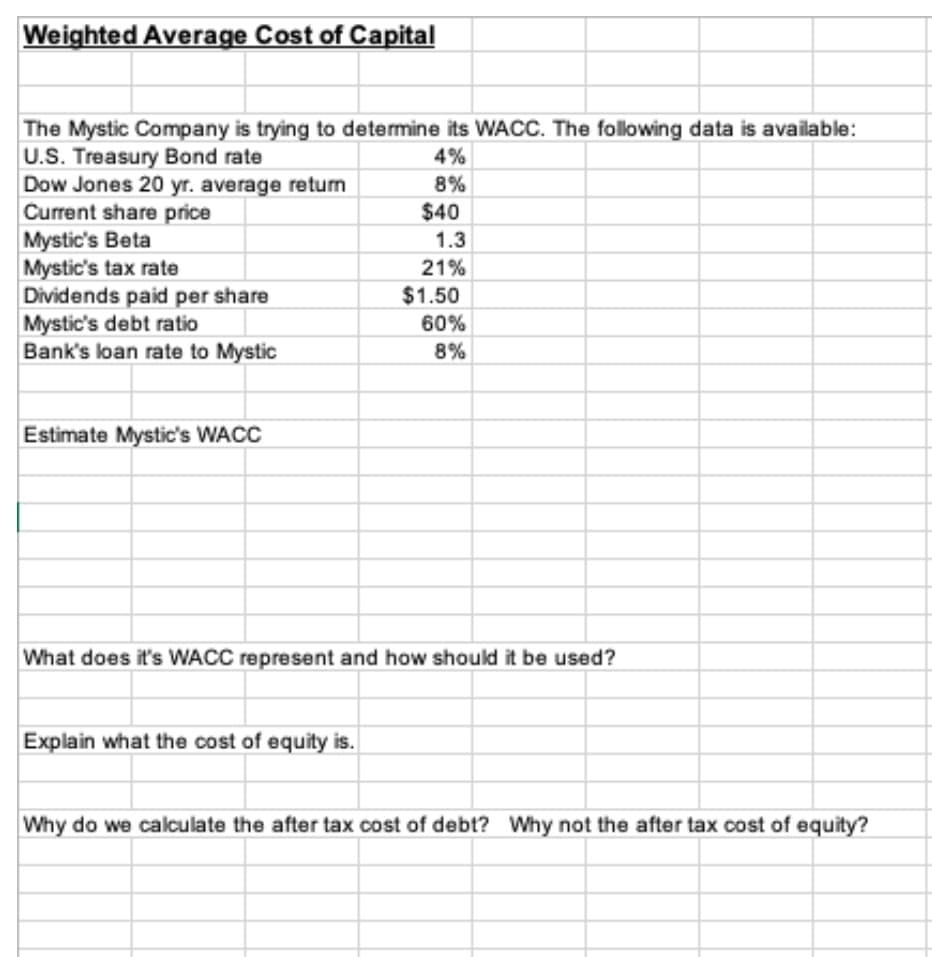

The Mystic Company is trying to determine its WACC. The following data is available:

U.S. Treasury Bond rate

Dow Jones 20 yr. average retun

Current share price

Mystic's Beta

Mystic's tax rate

Dividends paid per share

Mystic's debt ratio

Bank's loan rate to Mystic

4%

8%

$40

1.3

21%

$1.50

60%

8%

Estimate Mystic's WACC

What does it's WACC represent and how should it be used?

Explain what the cost of equity is.

Why do we calculate the after tax cost of debt? Why not the after tax cost of equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning