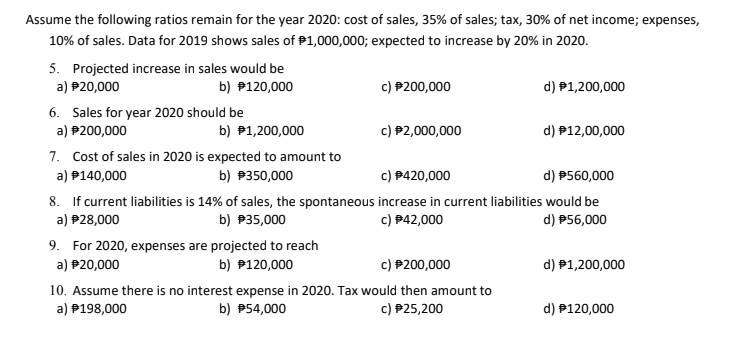

Assume the following ratios remain for the year 2020: cost of sales, 35% of sales; tax, 30% of net income; expenses, 10% of sales. Data for 2019 shows sales of P1,000,000; expected to increase by 20% in 2020. 5. Projected increase in sales would be a) P20,000 b) P120,000 c) P200,000 d) P1,200,000 6. Sales for year 2020 should be a) P200,000 b) P1,200,000 c) P2,000,000 d) P12,00,000 7. Cost of sales in 2020 is expected to amount to b) P350,000 a) P140,000 c) P420,000 d) P560,000 8. If current liabilities is 14% of sales, the spontaneous increase in current liabilities would be a) P28,000 b) P35,000 c) P42,000 d) P56,000 9. For 2020, expenses are projected to reach a) P20,000 b) P120,000 c) P200,000 d) P1,200,000 10. Assume there is no interest expense in 2020. Tax would then amount to a) P198,000 b) P54,000 c) P25,200 d) P120,000

Assume the following ratios remain for the year 2020: cost of sales, 35% of sales; tax, 30% of net income; expenses, 10% of sales. Data for 2019 shows sales of P1,000,000; expected to increase by 20% in 2020. 5. Projected increase in sales would be a) P20,000 b) P120,000 c) P200,000 d) P1,200,000 6. Sales for year 2020 should be a) P200,000 b) P1,200,000 c) P2,000,000 d) P12,00,000 7. Cost of sales in 2020 is expected to amount to b) P350,000 a) P140,000 c) P420,000 d) P560,000 8. If current liabilities is 14% of sales, the spontaneous increase in current liabilities would be a) P28,000 b) P35,000 c) P42,000 d) P56,000 9. For 2020, expenses are projected to reach a) P20,000 b) P120,000 c) P200,000 d) P1,200,000 10. Assume there is no interest expense in 2020. Tax would then amount to a) P198,000 b) P54,000 c) P25,200 d) P120,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 4CE: Refer to Cornerstone Exercises 2.2 and 2.3. Next year, Pietro expects to produce 50,000 units and...

Related questions

Question

Transcribed Image Text:Assume the following ratios remain for the year 2020: cost of sales, 35% of sales; tax, 30% of net income; expenses,

10% of sales. Data for 2019 shows sales of P1,000,000; expected to increase by 20% in 2020.

5. Projected increase in sales would be

a) P20,000

b) P120,000

c) P200,000

d) P1,200,000

6. Sales for year 2020 should be

a) P200,000

c) P2,000,000

b) P1,200,000

d) P12,00,000

7. Cost of sales in 2020 is expected to amount to

a) P140,000

b) P350,000

c) P420,000

d) P560,000

8. If current liabilities is 14% of sales, the spontaneous increase in current liabilities would be

a) P28,000

b) P35,000

c) P42,000

d) P56,000

9. For 2020, expenses are projected to reach

a) P20,000

b) P120,000

c) P200,000

d) P1,200,000

10. Assume there is no interest expense in 2020. Tax would then amount to

b) P54,000

a) P198,000

c) P25,200

d) P120,000

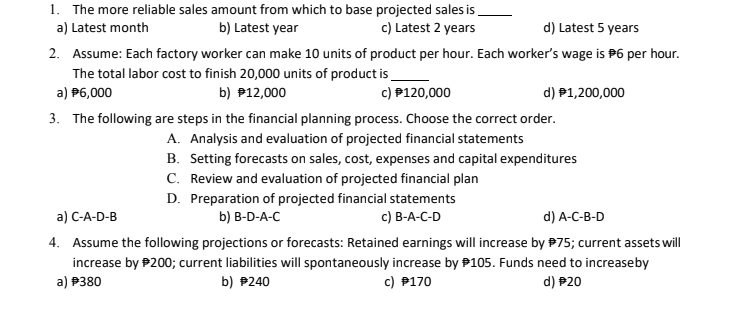

Transcribed Image Text:1. The more reliable sales amount from which to base projected sales is

b) Latest year

a) Latest month

c) Latest 2 years

d) Latest 5 years

2. Assume: Each factory worker can make 10 units of product per hour. Each worker's wage is P6 per hour.

The total labor cost to finish 20,000 units of product is

a) P6,000

b) P12,000

c) P120,000

d) P1,200,000

3. The following are steps in the financial planning process. Choose the correct order.

A. Analysis and evaluation of projected financial statements

B. Setting forecasts on sales, cost, expenses and capital expenditures

C. Review and evaluation of projected financial plan

D. Preparation of projected financial statements

с) В-А-С-D

a) C-A-D-B

b) В-D-A-C

d) A-C-B-D

4. Assume the following projections or forecasts: Retained earnings will increase by P75; current assets will

increase by P200; current liabilities will spontaneously increase by P105. Funds need to increaseby

a) P380

b) P240

c) P170

d) P20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub