Calculate the Gearing Ratio and Interest Coverage Ratio for 2021 and 2022

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 16MCQ

Related questions

Question

Calculate the Gearing Ratio and Interest Coverage Ratio for 2021 and 2022

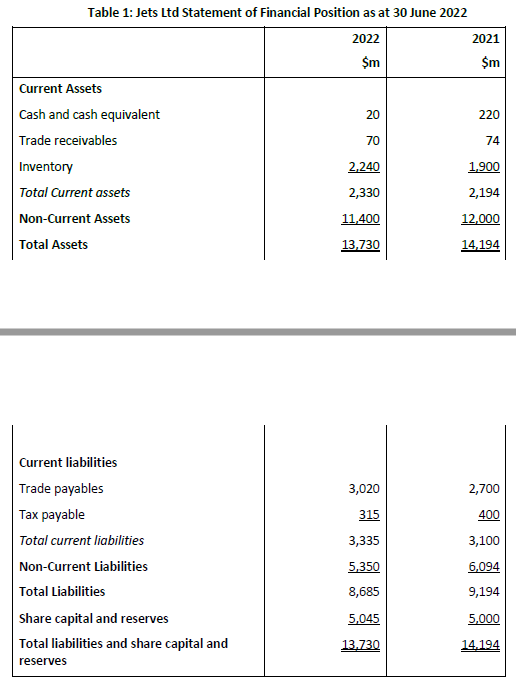

Transcribed Image Text:Table 1: Jets Ltd Statement of Financial Position as at 30 June 2022

2022

Current Assets

Cash and cash equivalent

Trade receivables

Inventory

Total Current assets

Non-Current Assets

Total Assets

Current liabilities

Trade payables

Tax payable

Total current liabilities

Non-Current Liabilities

Total Liabilities

Share capital and reserves

Total liabilities I share capital and

reserves

$m

20

70

2,240

2,330

11,400

13,730

3,020

315

3,335

5,350

8,685

5,045

13,730

2021

$m

220

74

1,900

2,194

12,000

14,194

2,700

400

3,100

6,094

9,194

5,000

14.194

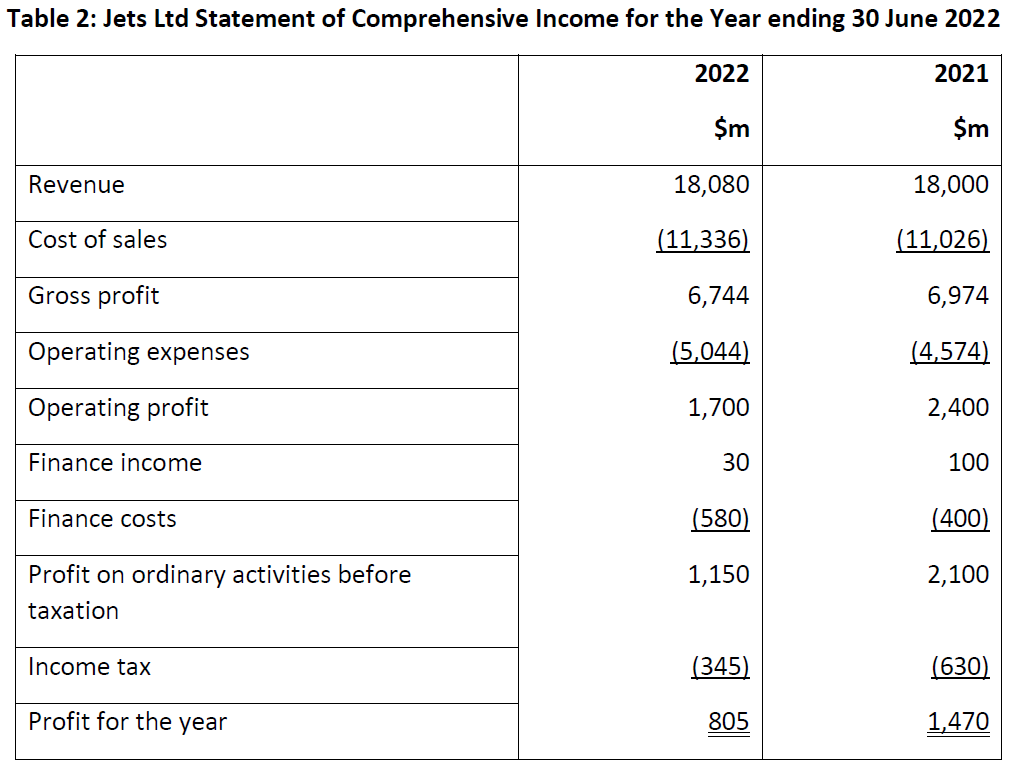

Transcribed Image Text:Table 2: Jets Ltd Statement of Comprehensive Income for the Year ending 30 June 2022

2022

2021

$m

$m

Revenue

Cost of sales

Gross profit

Operating expenses

Operating profit

Finance income

Finance costs

Profit on ordinary activities before

taxation

Income tax

Profit for the year

18,080

(11,336)

6,744

(5,044)

1,700

30

(580)

1,150

(345)

805

18,000

(11,026)

6,974

(4,574)

2,400

100

(400)

2,100

(630)

1,470

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning