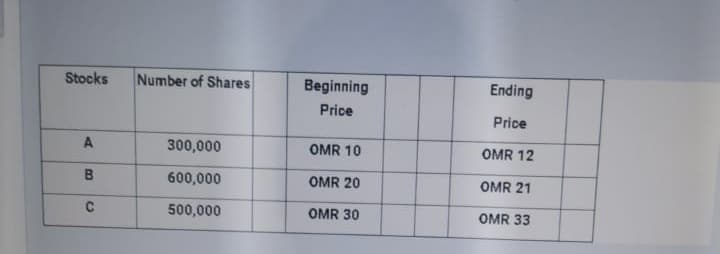

Calculate the Holding Period Return (HPR) for the portfolio of the three stocks mentioned in Table 1. Calculate the Holding Period Return (HPR) for each of the stock A, B, and C individually given in Table 1. C. Based upon your calculations, evaluate the Holding Period Return (HPR) to exhibit what change in wealth has taken place?

Calculate the Holding Period Return (HPR) for the portfolio of the three stocks mentioned in Table 1. Calculate the Holding Period Return (HPR) for each of the stock A, B, and C individually given in Table 1. C. Based upon your calculations, evaluate the Holding Period Return (HPR) to exhibit what change in wealth has taken place?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter8: Liabilities And Stockholders' Equity

Section: Chapter Questions

Problem 8.7MBA: Stock split Using the data from E8-22. indicate the effects on ne assets and EPS of the stock spilt.

Related questions

Question

Calculate the Holding Period Return (HPR) for the portfolio of the three stocks mentioned in Table 1.

Calculate the Holding Period Return (HPR) for each of the stock A, B, and C individually given in Table 1.

C. Based upon your calculations, evaluate the Holding Period Return (HPR) to exhibit what change in wealth has taken place?

Transcribed Image Text:Stocks

Number of Shares

Beginning

Ending

Price

Price

A

300,000

OMR 10

OMR 12

600,000

OMR 20

OMR 21

500,000

OMR 30

OMR 33

B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning