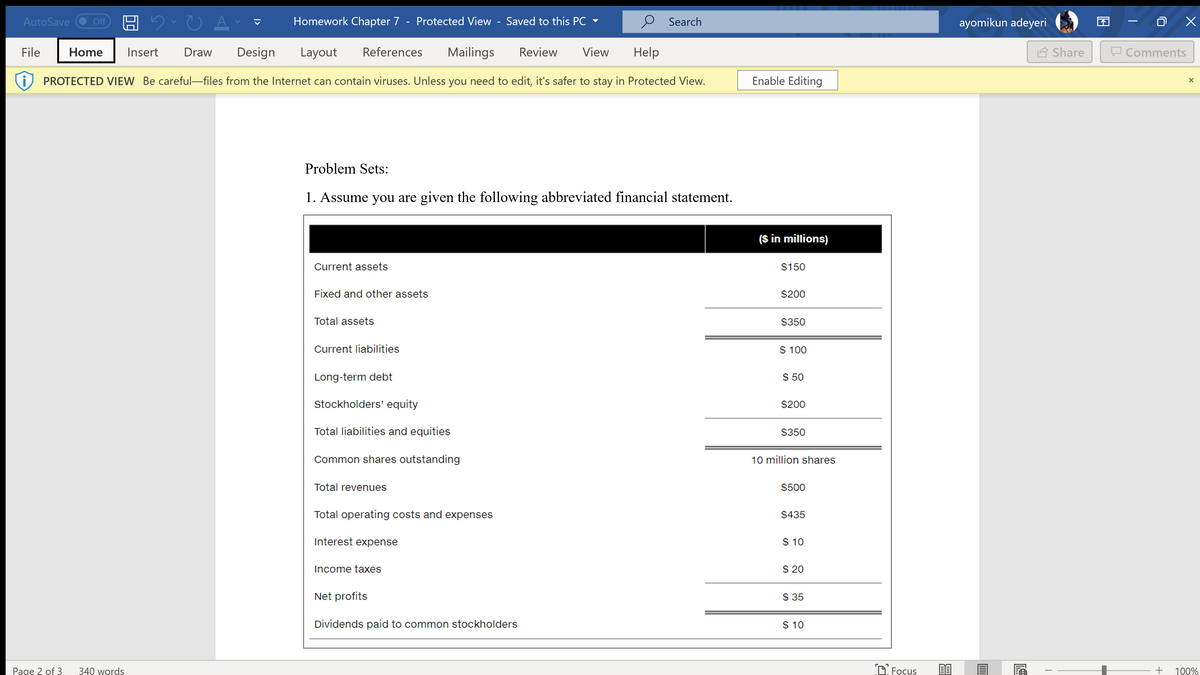

Assume you are given the following abbreviated financial statement. (look at the picture sent) On the basis of this information, calculate as many liquidity, activity, leverage, profitability, and common stock measures as you can. (Note: Assume the current market price of the common stock is $75 per share.)

Assume you are given the following abbreviated financial statement. (look at the picture sent) On the basis of this information, calculate as many liquidity, activity, leverage, profitability, and common stock measures as you can. (Note: Assume the current market price of the common stock is $75 per share.)

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

- Assume you are given the following abbreviated financial statement. (look at the picture sent)

On the basis of this information, calculate as many liquidity, activity, leverage, profitability, and common stock measures as you can. (Note: Assume the current market price of the common stock is $75 per share.)

Transcribed Image Text:AutoSave

Homework Chapter 7 - Protected View - Saved to this PC -

Search

ayomikun adeyeri

Off

File

Home

Insert

Draw

Design

Layout

References

Mailings

Review

View

Help

A Share

O Comments

i

PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View.

Enable Editing

Problem Sets:

1. Assume you are given the following abbreviated financial statement.

($ in millions)

Current assets

$150

Fixed and other assets

$200

Total assets

$350

Current liabilities

$ 100

Long-term debt

$ 50

Stockholders' equity

S200

Total liabilities and equities

$350

Common shares outstanding

10 million shares

Total revenues

$500

Total operating costs and expenses

$435

Interest expense

$ 10

Income taxes

$ 20

Net profits

$ 35

Dividends paid to common stockholders

$ 10

Page 2 of 3

340 words

C Focus

190%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education