Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter3: Risk And Return: Part Ii

Section: Chapter Questions

Problem 2P: APT

An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free...

Related questions

Question

a

0.07248

b

0.00386

c

0.26921

d

0.00939

e

0.05175

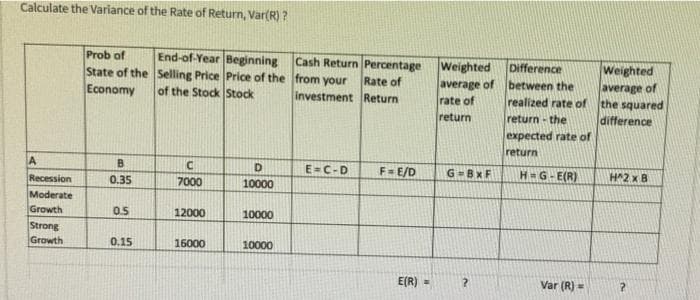

Transcribed Image Text:Calculate the Variance of the Rate of Return, Var(R)?

A

Recession

Moderate

Growth

Strong

Growth

Prob of

State of the

Economy

B

0.35

0.5

0.15

End-of-Year Beginning

Selling Price Price of the

of the Stock Stock

C

7000

12000

16000

D

10000

10000

10000

Cash Return Percentage

from your Rate of

investment Return

E=C-D

F=E/D

E(R) =

Weighted

average of

rate of

return

G=BxF

?

Difference

between the

realized rate of

return the

expected rate of

return

H=G-E(R)

Var (R) =

Weighted

average of

the squared

difference

H^2 x 8

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning