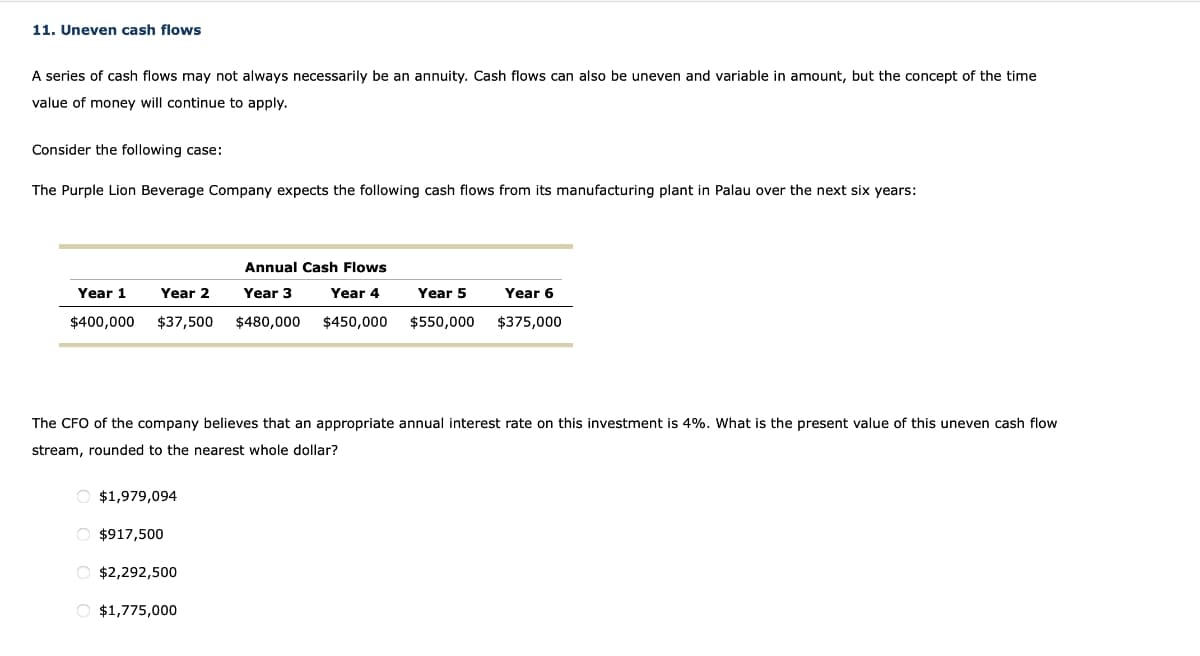

A series of cash flows may not always necessarily be an annuity. Cash flows can also be uneven and variable in amount, but the concept of the time value of money will continue to apply. Consider the following case: The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over the next six years: Annual Cash Flows Year 3 Year 4 Year 1 Year 2 $400,000 $37,500 $480,000 $450,000 The CFO of the company believes that an appropriate annual interest rate on this investment is 4%. What is the present value of this uneven cash flow stream, rounded to the nearest whole dollar? $1,979,094 $917,500 Year 5 Year 6 $550,000 $375,000 $2,292,500 $1,775,000

A series of cash flows may not always necessarily be an annuity. Cash flows can also be uneven and variable in amount, but the concept of the time value of money will continue to apply. Consider the following case: The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over the next six years: Annual Cash Flows Year 3 Year 4 Year 1 Year 2 $400,000 $37,500 $480,000 $450,000 The CFO of the company believes that an appropriate annual interest rate on this investment is 4%. What is the present value of this uneven cash flow stream, rounded to the nearest whole dollar? $1,979,094 $917,500 Year 5 Year 6 $550,000 $375,000 $2,292,500 $1,775,000

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 5MCQ: An investment of 1,000 produces a net cash inflow of 500 in the first year and 750 in the second...

Related questions

Question

Transcribed Image Text:11. Uneven cash flows

A series of cash flows may not always necessarily be an annuity. Cash flows can also be uneven and variable in amount, but the concept of the time

value of money will continue to apply.

Consider the following case:

The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over the next six years:

Year 1

$400,000

Year 2

$37,500

O $1,979,094

O $917,500

Annual Cash Flows

Year 3

$480,000

Year 4

$450,000

O $2,292,500

O $1,775,000

Year 5

The CFO of the company believes that an appropriate annual interest rate on this investment is 4%. What is the present value of this uneven cash flow

stream, rounded to the nearest whole dollar?

$550,000

Year 6

$375,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning