calculated the current ratio, acid test ratio, account receivable turnover ratio, net profit margin ratio, gross profit margin ratio, asset turnover ratio, asset turnover ratio, debt ratio, debt to total assets ratio.

calculated the current ratio, acid test ratio, account receivable turnover ratio, net profit margin ratio, gross profit margin ratio, asset turnover ratio, asset turnover ratio, debt ratio, debt to total assets ratio.

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 6DQ: LO.3, 4, 5 Contrast the income taxation of individuals and C corporations as to: a. Alternative...

Related questions

Question

calculated the

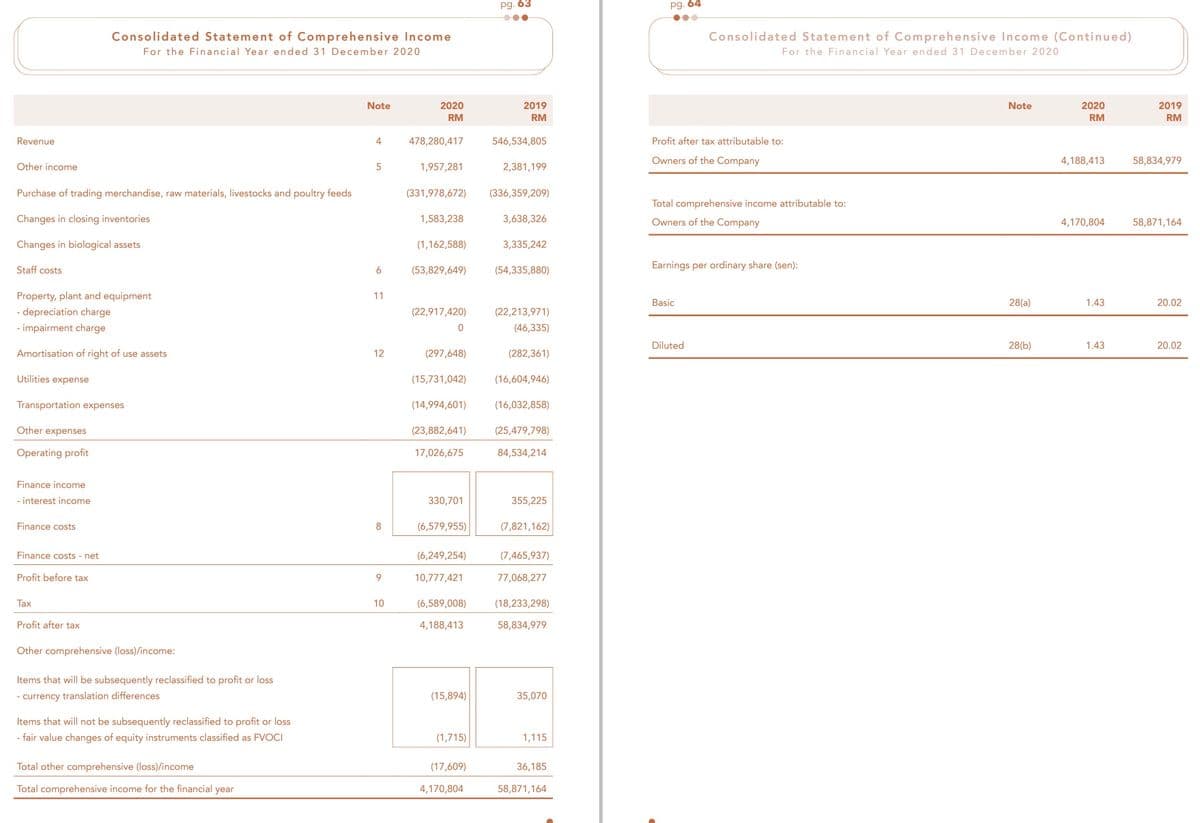

Transcribed Image Text:pg. 63

pg. 64

Consolidated Statement of Comprehensive Income

For the Financial Year ended 31 December 2020

Consolidated Statement of Comprehensive Income (Continued)

For the Financial Year ended 31 December 2020

Note

2020

2019

Note

2020

2019

RM

RM

RM

RM

Revenue

4

478,280,417

546,534,805

Profit after tax attributable to:

Owners of the Company

4,188,413

58,834,979

Other income

1,957,281

2,381,199

Purchase of trading merchandise, raw materials, livestocks and poultry feeds

(331,978,672)

(336,359,209)

Total comprehensive income attributable to:

Changes in closing inventories

1,583,238

3,638,326

Owners of the Company

4,170,804

58,871,164

Changes in biological assets

(1,162,588)

3,335,242

Staff costs

(53,829,649)

(54,335,880)

Earnings per ordinary share (sen):

Property, plant and equipment

11

Basic

28(a)

1.43

20.02

- depreciation charge

- impairment charge

(22,917,420)

(22,213,971)

(46,335)

Diluted

28(b)

1.43

20.02

Amortisation of right of use assets

12

(297,648)

(282,361)

Utilities expense

(15,731,042)

(16,604,946)

Transportation expenses

(14,994,601)

(16,032,858)

Other expenses

(23,882,641)

(25,479,798)

Operating profit

17,026,675

84,534,214

Finance income

- interest income

330,701

355,225

Finance costs

8

(6,579,955)

(7,821,162)

Finance costs - net

(6,249,254)

(7,465,937)

Profit before tax

9.

10,777,421

77,068,277

Tax

10

(6,589,008)

(18,233,298)

Profit after tax

4,188,413

58,834,979

Other comprehensive (loss)/income:

Items that will be subsequently reclassified to profit or loss

- currency translation differences

(15,894)

35,070

Items that will not be subsequently reclassified to profit or loss

fair value changes of equity instruments classified as FVOCI

(1,715)

1,115

Total other comprehensive (loss)/income

(17,609)

36,185

Total comprehensive income for the financial year

4,170,804

58,871,164

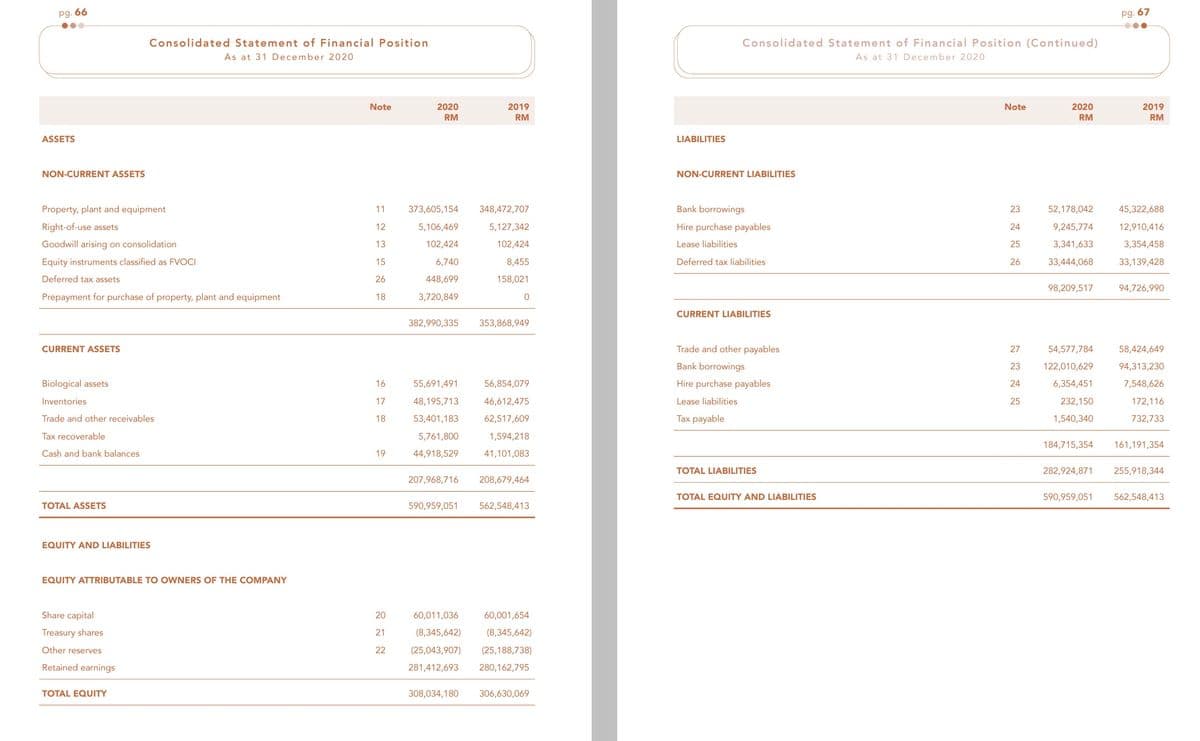

Transcribed Image Text:pg. 66

pg. 67

Consolidated Statement of Financial Position

Consolidated Statement of Financial Position (Continued)

As at 31 December 2020

As at 31 December 2020

Note

2020

2019

Note

2020

2019

RM

RM

RM

RM

ASSETS

LIABILITIES

NON-CURRENT ASSETS

NON-CURRENT LIABILITIES

Property, plant and equipment

11

373,605,154

348,472,707

Bank borrowings

23

52,178,042

45,322,688

Right-of-use assets

12

5,106,469

5,127,342

Hire purchase payables

24

9,245,774

12,910,416

Goodwill arising on consolidation

13

102,424

102,424

Lease liabilities

25

3,341,633

3,354,458

Equity instruments classified as FVOCI

15

6,740

8,455

Deferred tax liabilities

26

33,444,068

33,139,428

Deferred tax assets

26

448,699

158,021

98,209,517

94,726,990

Prepayment for purchase of property, plant and equipment

18

3,720,849

CURRENT LIABILITIES

382,990,335

353,868,949

CURRENT ASSETS

Trade and other payables

27

54,577,784

58,424,649

Bank borrowings

23

122,010,629

94,313,230

Biological assets

16

55,691,491

56,854,079

Hire purchase payables

24

6,354,451

7,548,626

Inventories

17

48,195,713

46,612,475

Lease liabilities

25

232,150

172,116

Trade and other receivables

18

53,401,183

62,517,609

Tax payable

1,540,340

732,733

Tax recoverable

5,761,800

1,594,218

184,715,354

161,191,354

Cash and bank balances

19

44,918,529

41,101,083

TOTAL LIABILITIES

282,924,871

255,918,344

207,968,716

208,679,464

TOTAL EQUITY AND LIABILITIES

590,959,051

562,548,413

TOTAL ASSETS

590,959,051

562,548,413

EQUITY AND LIABILITIES

EQUITY ATTRIBUTABLE TO OWNERS OF THE COMPANY

Share capital

20

60,011,036

60,001,654

Treasury shares

21

(8,345,642)

(8,345,642)

Other reserves

22

(25,043,907)

(25,188,738)

Retained earnings

281,412,693

280,162,795

TOTAL EQUITY

308,034,180

306,630,069

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT