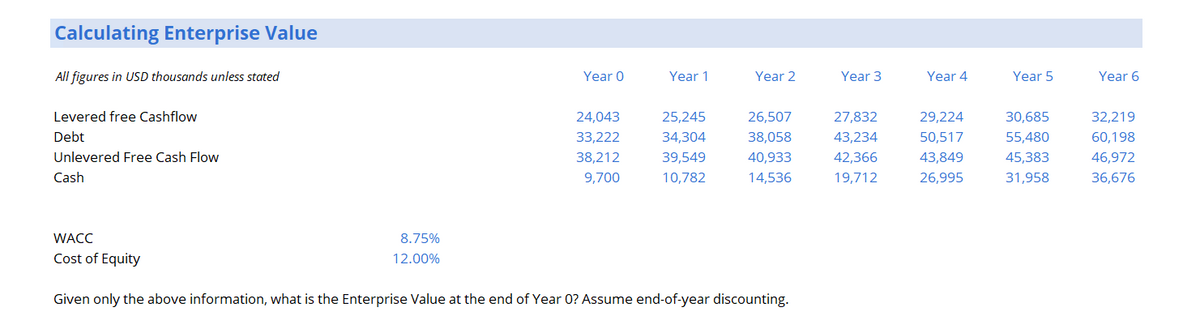

Calculating Enterprise Value All figures in USD thousands unless stated Levered free Cashflow Debt Unlevered Free Cash Flow Cash WACC Cost of Equity 8.75% 12.00% Year 0 24,043 33,222 38,212 9,700 Year 1 25,245 34,304 39,549 10,782 Year 2 26,507 38,058 40,933 14,536 Given only the above information, what is the Enterprise Value at the end of Year O? Assume end-of-year discounting. Year 3 27,832 43,234 42,366 19,712 Year 4 29.224 50,517 43,849 26,995 Year 5 30,685 55,480 45,383 31,958 Year 6 32,219 60,198 46,972 36,676

Calculating Enterprise Value All figures in USD thousands unless stated Levered free Cashflow Debt Unlevered Free Cash Flow Cash WACC Cost of Equity 8.75% 12.00% Year 0 24,043 33,222 38,212 9,700 Year 1 25,245 34,304 39,549 10,782 Year 2 26,507 38,058 40,933 14,536 Given only the above information, what is the Enterprise Value at the end of Year O? Assume end-of-year discounting. Year 3 27,832 43,234 42,366 19,712 Year 4 29.224 50,517 43,849 26,995 Year 5 30,685 55,480 45,383 31,958 Year 6 32,219 60,198 46,972 36,676

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 9EP

Related questions

Question

Discounted Cash Flow Valuation - Calculating Enterprise Value

A discounted cash flow can be used to calculate either enterprise value or equity value.

Open the attached Excel file found above the question and go to the worksheet labeled: EV (Blank)

Calculate the company’s enterprise value at the end of Year 0 given the information in the Excel file. Assume end-of-period-discounting.

Transcribed Image Text:Calculating Enterprise Value

All figures in USD thousands unless stated

Levered free Cashflow

Debt

Unlevered Free Cash Flow

Cash

WACC

Cost of Equity

8.75%

12.00%

Year 0

24,043

33,222

38,212

9,700

Year 1

25,245

34,304

39,549

10,782

Year 2

26,507

38,058

40,933

14,536

Given only the above information, what is the Enterprise Value at the end of Year O? Assume end-of-year discounting.

Year 3

27,832

43,234

42,366

19,712

Year 4

29,224

50,517

43,849

26,995

Year 5

30,685

55,480

45,383

31,958

Year 6

32,219

60,198

46,972

36,676

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning