Finance part b only : Prepare a schedule of cash payments on accounts payable for each month and in total for the first quarter. Note- read carefully. each month and the first quarter

Finance part b only : Prepare a schedule of cash payments on accounts payable for each month and in total for the first quarter. Note- read carefully. each month and the first quarter

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 19E: Schedule of cash payments for service company Horizon Financial Inc. was organized on February 28....

Related questions

Concept explainers

Question

Finance

part b only

: Prepare a schedule of cash payments on accounts payable for each month and in total for the first quarter.

Note- read carefully. each month and the first quarter

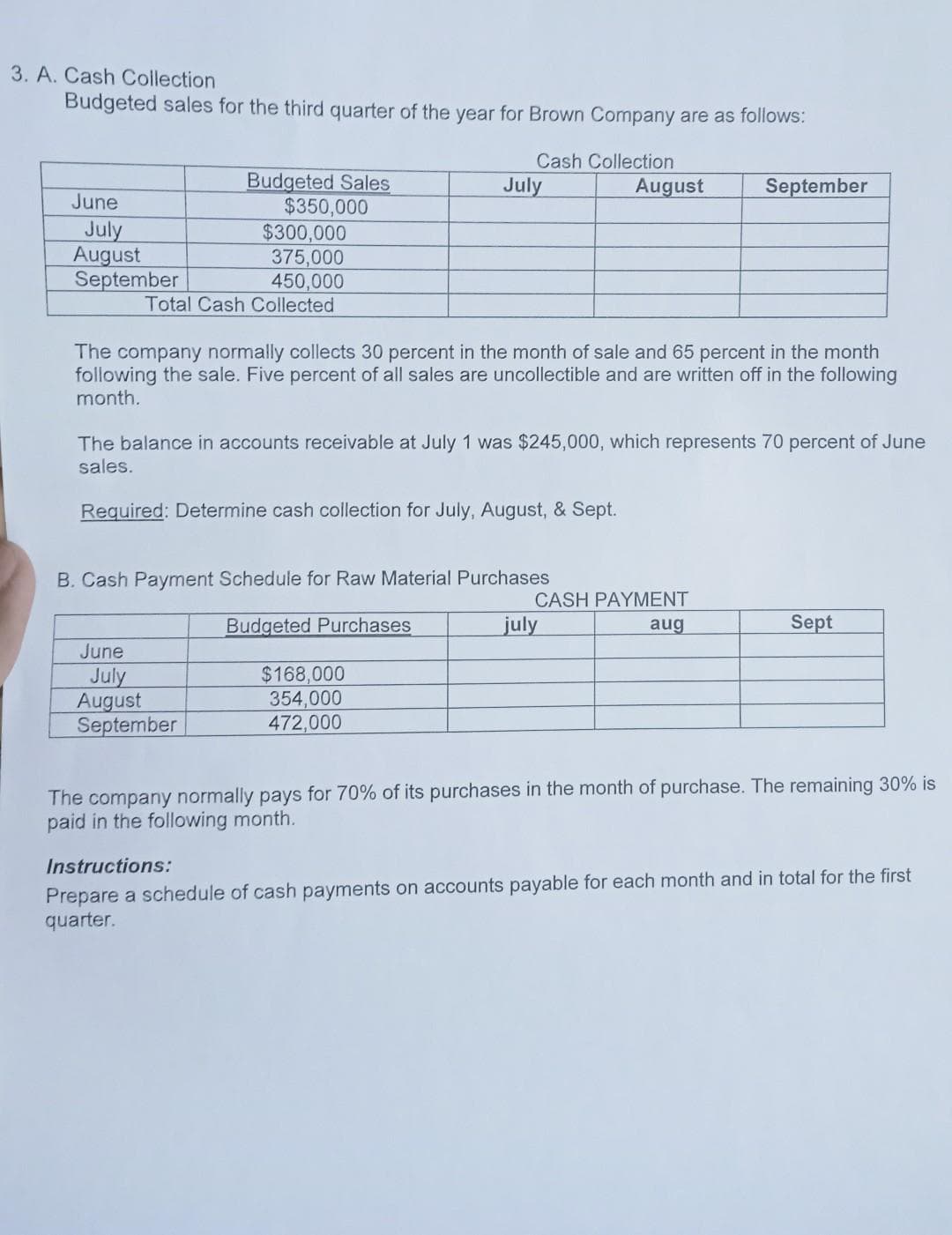

Transcribed Image Text:3. A. Cash Collection

Budgeted sales for the third quarter of the year for Brown Company are as follows:

Cash Collection

June

July

August

September

Budgeted Sales

$350,000

$300,000

375,000

450,000

Total Cash Collected

July

June

July

August

September

The company normally collects 30 percent in the month of sale and 65 percent in the month

following the sale. Five percent of all sales are uncollectible and are written off in the following

month.

B. Cash Payment Schedule for Raw Material Purchases

Budgeted Purchases

july

August

The balance in accounts receivable at July 1 was $245,000, which represents 70 percent of June

sales.

Required: Determine cash collection for July, August, & Sept.

$168,000

354,000

472,000

September

CASH PAYMENT

aug

Sept

The company normally pays for 70% of its purchases in the month of purchase. The remaining 30% is

paid in the following month.

Instructions:

Prepare a schedule of cash payments on accounts payable for each month and in total for the first

quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning