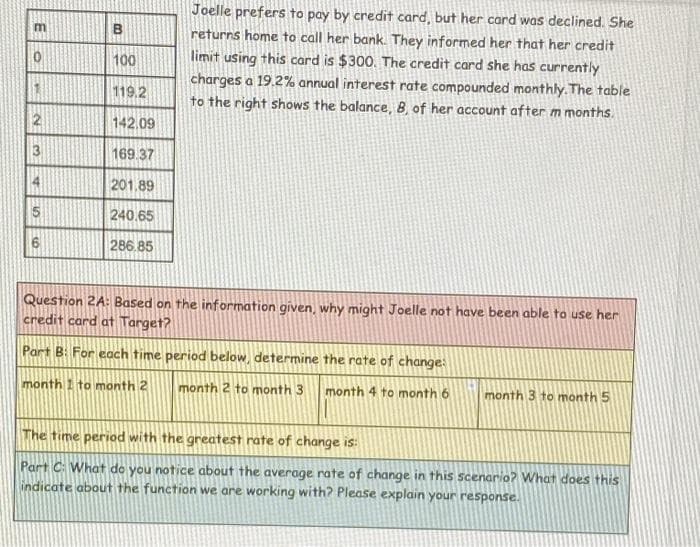

m 0 1 2 32 50 6 B 100 119.2 142.09 169.37 201.89 240.65 286.85 Joelle prefers to pay by credit card, but her card was declined. She returns home to call her bank. They informed her that her credit limit using this card is $300. The credit card she has currently charges a 19.2% annual interest rate compounded monthly. The table to the right shows the balance, 8, of her account after m months. Question 2A: Based on the information given, why might Joelle not have been able to use her credit card at Target? Part B: For each time period below, determine the rate of change: month I to month 2 month 2 to month 3 month 4 to month 6 month 3 to month 5 The time period with the greatest rate of change is: Part C: What do you notice about the average rate of change in this scenario? What does this indicate about the function we are working with? Please explain your response.

m 0 1 2 32 50 6 B 100 119.2 142.09 169.37 201.89 240.65 286.85 Joelle prefers to pay by credit card, but her card was declined. She returns home to call her bank. They informed her that her credit limit using this card is $300. The credit card she has currently charges a 19.2% annual interest rate compounded monthly. The table to the right shows the balance, 8, of her account after m months. Question 2A: Based on the information given, why might Joelle not have been able to use her credit card at Target? Part B: For each time period below, determine the rate of change: month I to month 2 month 2 to month 3 month 4 to month 6 month 3 to month 5 The time period with the greatest rate of change is: Part C: What do you notice about the average rate of change in this scenario? What does this indicate about the function we are working with? Please explain your response.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 89TPC

Related questions

Question

Transcribed Image Text:Joelle prefers to pay by credit card, but her card was declined. She

B

returns home to call her bank. They informed her that her credit

limit using this card is $300. The credit card she has currently

charges a 19.2% annual interest rate compounded monthly. The table

to the right shows the balance, 8, of her account after m months.

100

119.2

142.09

169.37

4

201.89

15

240.65

286.85

Question 2A: Based on the information given, why might Joelle not have been able to use her

credit card at Target?

Part B: For each time period below, determine the rate of change:

month 1 to month 2

month 2 to month 3

month 4 to month 6

month 3 to month 5

The time period with the greatest rate of change is:

Part C: What do you notice about the average rate of change in this scenario? What does this

indicate about the function we are working with? Please explain your response.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning