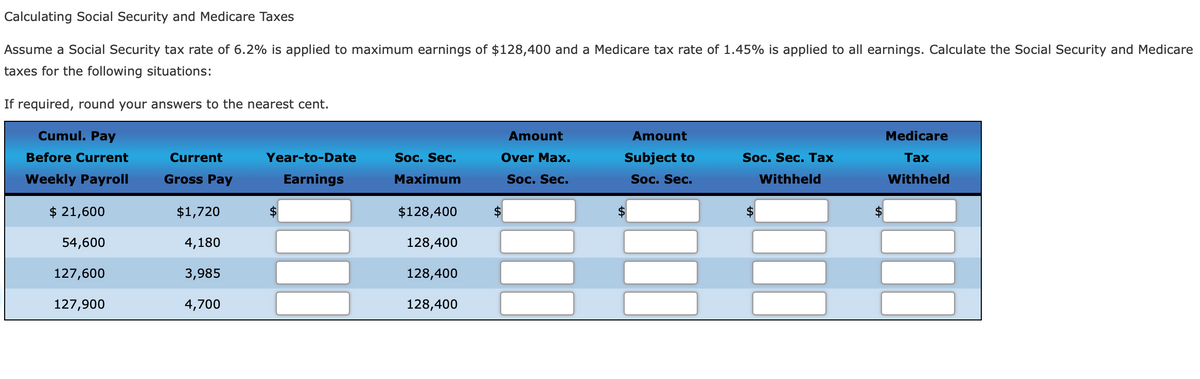

Calculating Social Security and Medicare Taxes Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare taxes for the following situations: If required, round your answers to the nearest cent. Cumul. Pay Amount Amount Medicare Soc. Sec. Soc. Sec. Tax Subject to Soc. Sec. Before Current Current Year-to-Date Over Max. Tax Weekly Payroll Gross Pay Earnings Maximum Soc. Sec. Withheld Withheld $ 21,600 $1,720 $128,400 54,600 4,180 128,400 127,600 3,985 128,400 127,900 4,700 128,400

Calculating Social Security and Medicare Taxes Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare taxes for the following situations: If required, round your answers to the nearest cent. Cumul. Pay Amount Amount Medicare Soc. Sec. Soc. Sec. Tax Subject to Soc. Sec. Before Current Current Year-to-Date Over Max. Tax Weekly Payroll Gross Pay Earnings Maximum Soc. Sec. Withheld Withheld $ 21,600 $1,720 $128,400 54,600 4,180 128,400 127,600 3,985 128,400 127,900 4,700 128,400

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.4BE

Related questions

Question

Transcribed Image Text:Calculating Social Security and Medicare Taxes

Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare

taxes for the following situations:

If required, round your answers to the nearest cent.

Cumul. Pay

Amount

Amount

Medicare

Before Current

Current

Year-to-Date

Soc. Sec.

Over Max.

Subject to

Soc. Sec. Tах

Тax

Weekly Payroll

Gross Pay

Earnings

Maximum

Soc. Sec.

Soc. Sec.

Withheld

Withheld

$ 21,600

$1,720

$128,400

2$

$

54,600

4,180

128,400

127,600

3,985

128,400

127,900

4,700

128,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College