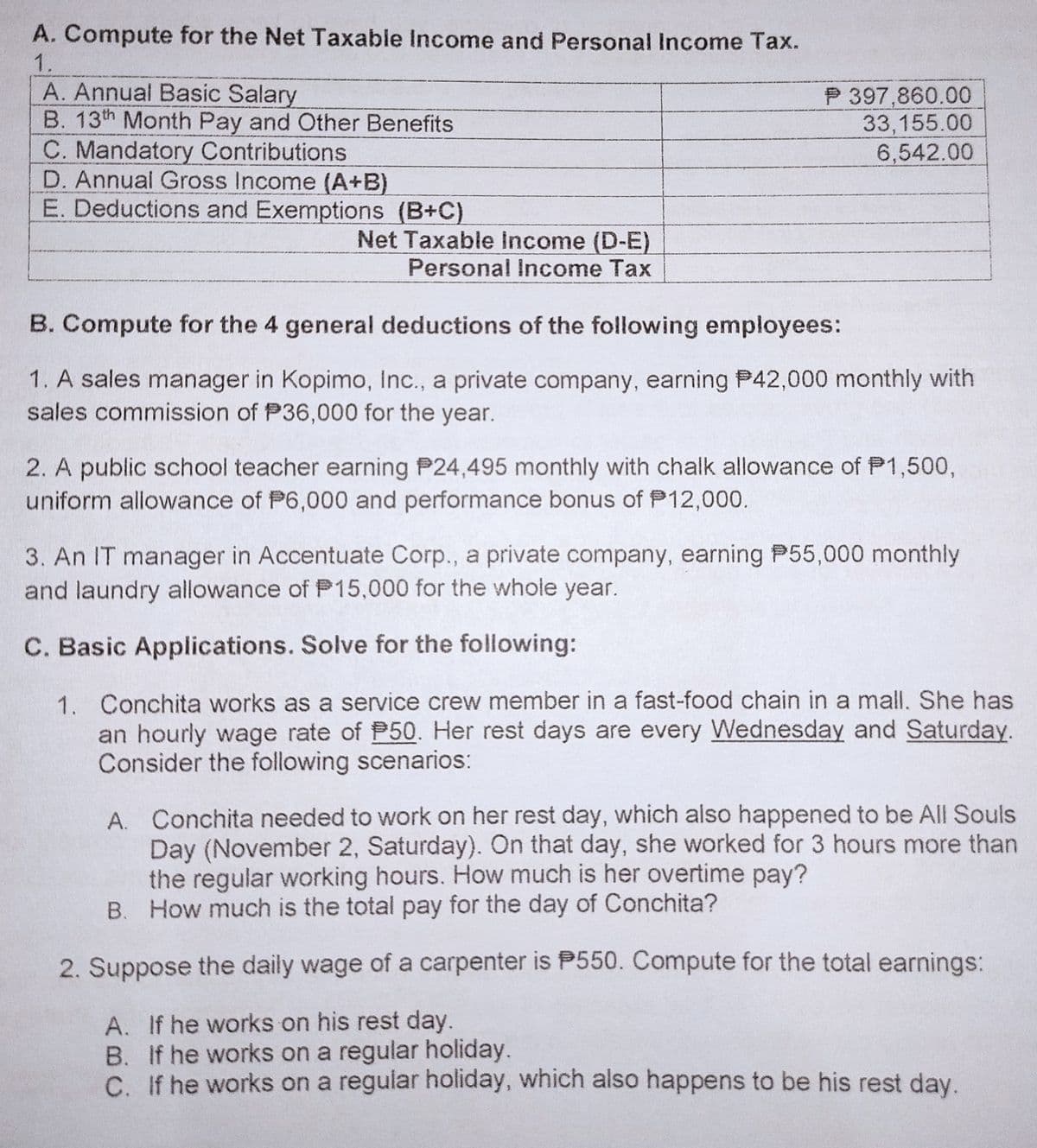

A. Compute for the Net Taxable Income and Personal Income Tax. 1. A. Annual Basic Salary B. 13th Month Pay and Other Benefits C. Mandatory Contributions D. Annual Gross Income (A+B) E. Deductions and Exemptions (B+C) P 397,860.00 33,155.00 6,542.00 Net Taxable Income (D-E) Personal Income Tax

A. Compute for the Net Taxable Income and Personal Income Tax. 1. A. Annual Basic Salary B. 13th Month Pay and Other Benefits C. Mandatory Contributions D. Annual Gross Income (A+B) E. Deductions and Exemptions (B+C) P 397,860.00 33,155.00 6,542.00 Net Taxable Income (D-E) Personal Income Tax

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

Transcribed Image Text:A. Compute for the Net Taxable Income and Personal Income Tax.

1.

A. Annual Basic Salary

B. 13th Month Pay and Other Benefits

C. Mandatory Contributions

D. Annual Gross Income (A+B)

E. Deductions and Exemptions (B+C)

P 397,860.00

33,155.00

6,542.00

Net Taxable income (D-E)

Personal Income Tax

B. Compute for the 4 general deductions of the following employees:

1. A sales manager in Kopimo, Inc., a private company, earning P42,000 monthly with

sales commission of P36,000 for the year.

2. A public school teacher earning P24,495 monthly with chalk allowance of P1,500,

uniform allowance of P6,000 and performance bonus of P12,000.

3. An IT manager in Accentuate Corp., a private company, earning P55,000 monthly

and laundry allowance of P15,000 for the whole year.

C. Basic Applications. Solve for the following:

1. Conchita works as a service crew member in a fast-food chain in a mall. She has

an hourly wage rate of P50. Her rest days are every Wednesday and Saturday.

Consider the following scenarios:

A. Conchita needed to work on her rest day, which also happened to be All Souls

Day (November 2, Saturday). On that day, she worked for 3 hours more than

the regular working hours. How much is her overtime pay?

B. How much is the total pay for the day of Conchita?

2. Suppose the daily wage of a carpenter is P550. Compute for the total earnings:

A. If he works on his rest day.

B. If he works on a regular holiday.

C. If he works on a regular holiday, which also happens to be his rest day.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College