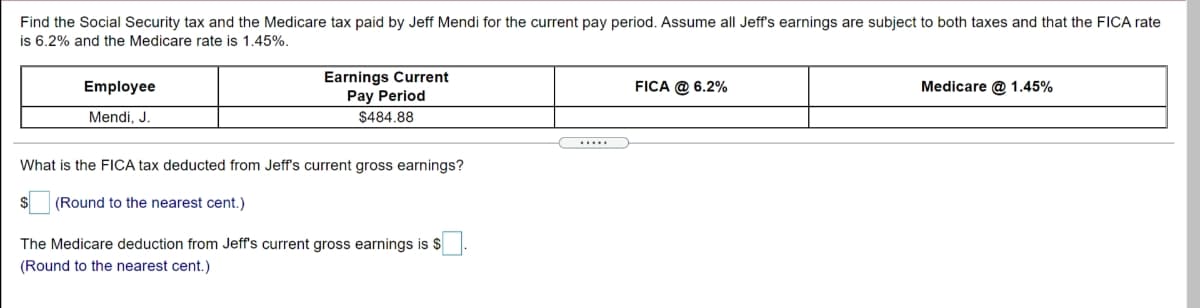

Find the Social Security tax and the Medicare tax paid by Jeff Mendi for the current pay period. Assume all Jeff's earnings are subject to both taxes and that the FICA rate is 6.2% and the Medicare rate is 1,45%. Earnings Current Pay Period $484.88 Employee FICA @ 6.2% Medicare @ 1.45% Mendi, J. .... What is the FICA tax deducted from Jeff's current gross earnings? (Round to the nearest cent.) The Medicare deduction from Jeff's current gross earnings is $ (Round to the nearest cent.)

Find the Social Security tax and the Medicare tax paid by Jeff Mendi for the current pay period. Assume all Jeff's earnings are subject to both taxes and that the FICA rate is 6.2% and the Medicare rate is 1,45%. Earnings Current Pay Period $484.88 Employee FICA @ 6.2% Medicare @ 1.45% Mendi, J. .... What is the FICA tax deducted from Jeff's current gross earnings? (Round to the nearest cent.) The Medicare deduction from Jeff's current gross earnings is $ (Round to the nearest cent.)

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 23CE

Related questions

Question

Transcribed Image Text:Find the Social Security tax and the Medicare tax paid by Jeff Mendi for the current pay period. Assume all Jeff's earnings are subject to both taxes and that the FICA rate

is 6.2% and the Medicare rate is 1.45%.

Earnings Current

Pay Period

$484.88

Employee

FICA @ 6.2%

Medicare @ 1.45%

Mendi, J.

....

What is the FICA tax deducted from Jeff's current gross earnings?

(Round to the nearest cent.)

The Medicare deduction from Jeff's current gross earnings is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning