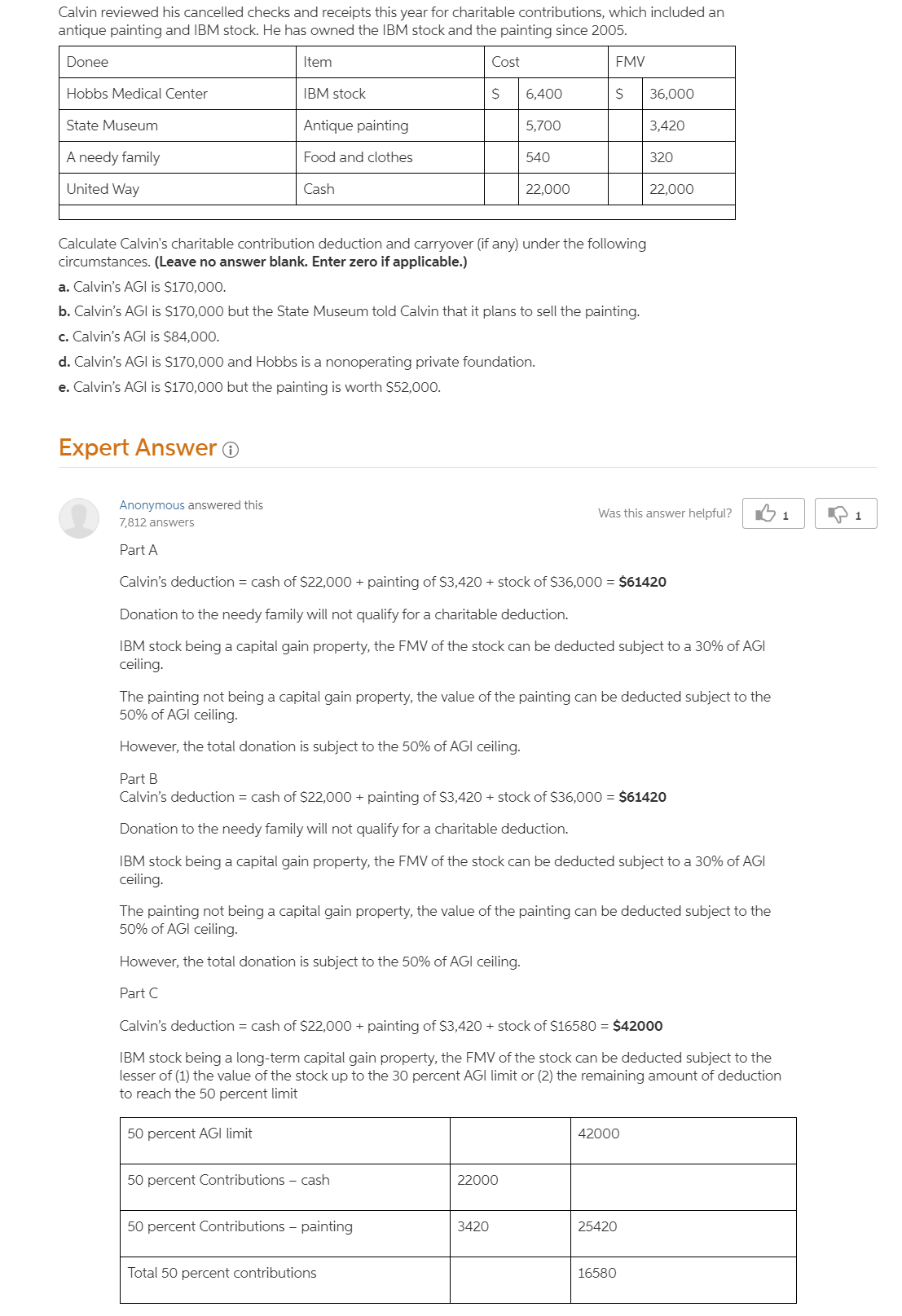

Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Item Cost $ 6,400 $36,000 5,700 540 FMV Hobbs Medical Center IBM stock Antique painting Food and clothes 3,420 320 State Museum A needy family United Way Cash 22,000 22,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. (Leave no answer blank. Enter zero if applicable.)

Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Item Cost $ 6,400 $36,000 5,700 540 FMV Hobbs Medical Center IBM stock Antique painting Food and clothes 3,420 320 State Museum A needy family United Way Cash 22,000 22,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. (Leave no answer blank. Enter zero if applicable.)

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 43P

Related questions

Question

Calvin’s AGI is $84,000.

charitable contribution deduction 42000

carryover ?

![[The following information applies to the questions displayed below.]

Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique

painting and IBM stock. He has owned the IBM stock and the painting since 2005.

Donee

Item

Cost

FMV

$ 6,400 $36,000

5,700

3,420

Hobbs Medical Center

IBM stock

Antique painting

Food and clothes

State Museum

A needy family

United Way

540

320

Cash

22,000

22,000

Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. (Leave no

answer blank. Enter zero if applicable.)

c. Calvin's AGI is $84,000.

X Answer is complete but not entirely correct.

Charitable contribution deduction

42,000

Carryover

$4

22,000 X](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Ff2db349d-44e2-4dc0-ad50-be44fa6802da%2F961b4962-e00b-4dca-906f-5025504447a4%2Ft0zixjn_processed.png&w=3840&q=75)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique

painting and IBM stock. He has owned the IBM stock and the painting since 2005.

Donee

Item

Cost

FMV

$ 6,400 $36,000

5,700

3,420

Hobbs Medical Center

IBM stock

Antique painting

Food and clothes

State Museum

A needy family

United Way

540

320

Cash

22,000

22,000

Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. (Leave no

answer blank. Enter zero if applicable.)

c. Calvin's AGI is $84,000.

X Answer is complete but not entirely correct.

Charitable contribution deduction

42,000

Carryover

$4

22,000 X

Transcribed Image Text:Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an

antique painting and IBM stock. He has owned the IBM stock and the painting since 2005.

Donee

Item

Cost

FMV

Hobbs Medical Center

IBM stock

6,400

36,000

State Museum

Antique painting

5,700

3,420

A needy family

Food and clothes

540

320

United Way

Cash

22,000

22,000

Calculate Calvin's charitable contribution deduction and carryover (if any) under the following

circumstances. (Leave no answer blank. Enter zero if applicable.)

a. Calvin's AGI is $170,000.

b. Calvin's AGI is $170,000 but the State Museum told Calvin that it plans to sell the painting.

c. Calvin's AGI is $84,000.

d. Calvin's AGI is $170,000 and Hobbs is a nonoperating private foundation.

e. Calvin's AGI is $170,000 but the painting is worth $52,000.

Expert Answer O

Anonymous answered this

Was this answer helpful?

1

1

7,812 answers

Part A

Calvin's deduction = cash of S22,000 + painting of $3,420 + stock of $36,000 = $61420

Donation to the needy family will not qualify for a charitable deduction.

IBM stock being a capital gain property, the FMV of the stock can be deducted subject to a 30% of AGI

ceiling.

The painting not being a capital gain property, the value of the painting can be deducted subject to the

50% of AGI ceiling.

However, the total donation is subject to the 50% of AGI ceiling.

Part B

Calvin's deduction = cash of S$22,000 + painting of $3,420 + stock of $36,000 = $61420

Donation to the needy family will not qualify for a charitable deduction.

IBM stock being a capital gain property, the FMV of the stock can be deducted subject to a 30% of AGI

ceiling.

The painting not being a capital gain property, the value of the painting can be deducted subject to the

50% of AGI ceiling.

However, the total donation is subject to the 50% of AGI ceiling.

Part C

Calvin's deduction = cash of S22,000 + painting of $3,420 + stock of $16580 = $42000

IBM stock being a long-term capital gain property, the FMV of the stock can be deducted subject to the

lesser of (1) the value of the stock up to the 30 percent AGI limit or (2) the remaining amount of deduction

to reach the 50 percent limit

50 percent AGI limit

42000

50 percent Contributions – cash

22000

50 percent Contributions – painting

3420

25420

Total 50 percent contributions

16580

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT