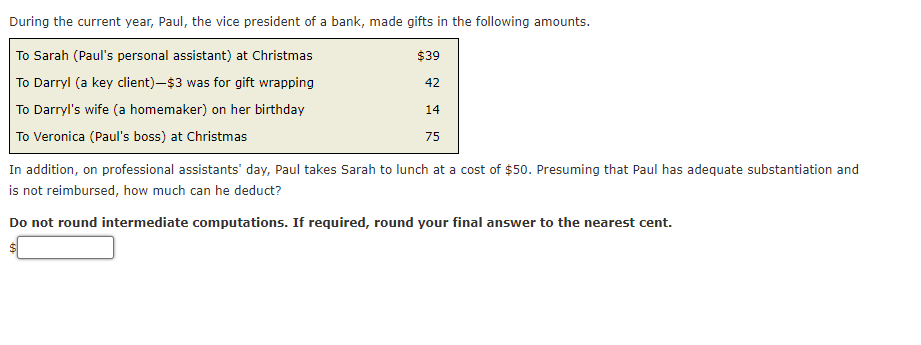

During the current year, Paul, the vice president of a bank, made gifts in the following amounts. To Sarah (Paul's personal assistant) at Christmas $39 To Darryl (a key client)-$3 was for gift wrapping 42 To Darryl's wife (a homemaker) on her birthday 14 To Veronica (Paul's boss) at Christmas 75 In addition, on professional assistants' day, Paul takes Sarah to lunch at a cost of $50. Presuming that Paul has adequate substantiation and is not reimbursed, how much can he deduct? Do not round intermediate computations. If required, round your final answer to the nearest cent.

During the current year, Paul, the vice president of a bank, made gifts in the following amounts. To Sarah (Paul's personal assistant) at Christmas $39 To Darryl (a key client)-$3 was for gift wrapping 42 To Darryl's wife (a homemaker) on her birthday 14 To Veronica (Paul's boss) at Christmas 75 In addition, on professional assistants' day, Paul takes Sarah to lunch at a cost of $50. Presuming that Paul has adequate substantiation and is not reimbursed, how much can he deduct? Do not round intermediate computations. If required, round your final answer to the nearest cent.

Chapter9: Deduct Ions: Employee And Self-employed - Related Expenses

Section: Chapter Questions

Problem 33P

Related questions

Question

Transcribed Image Text:During the current year, Paul, the vice president of a bank, made gifts in the following amounts.

To Sarah (Paul's personal assistant) at Christmas

$39

To Darryl (a key client)-$3 was for gift wrapping

42

To Darryl's wife (a homemaker) on her birthday

14

To Veronica (Paul's boss) at Christmas

75

In addition, on professional assistants' day, Paul takes Sarah to lunch at a cost of $50. Presuming that Paul has adequate substantiation and

is not reimbursed, how much can he deduct?

Do not round intermediate computations. If required, round your final answer to the nearest cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT