Can I please get help with this part of the question.\ ACE CONSTRUCTION COMPANY Unadjusted Trial Balance June 30 Number Account Title Debit Credit 101 Cash $ 16,500 126 Supplies 10,000 128 Prepaid insurance 7,000 167 Equipment 144,770 168 Accumulated depreciation—Equipment $ 24,500 201 Accounts payable 5,400 203 Interest payable 0 208 Rent payable 0 210 Wages payable 0 213 Property taxes payable 0 251 Long-term notes payable 23,000 301 V. Ace, Capital 77,500 302 V. Ace, Withdrawals 30,000 403 Construction revenue 150,000 612 Depreciation expense—Equipment 0 623 Wages expense 47,000 633 Interest expense 2,530 637 Insurance expense 0 640 Rent expense 12,000 652 Supplies expense 0 683 Property taxes expense 4,100 684 Repairs expense 2,700 690 Utilities expense 3,800 Totals $ 280,400 $ 280,400 Adjustments: Supplies available at the end of the current fiscal year total $3,600. Cost of expired insurance for the current fiscal year is $4,410. Annual depreciation on equipment is $8,300. June utilities expense of $540 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $540 amount owed must be recorded. Employees have earned $1,700 of accrued and unpaid wages at fiscal year-end. Rent expense incurred and not yet paid or recorded at fiscal year-end is $300. Additional property taxes of $700 have been assessed for this fiscal year but have not been paid or recorded at fiscal year-end. $230 of accrued interest for June has not yet been paid or recorded. Required: 1. Prepare a 10-column work sheet for the current fiscal year, starting with the unadjusted trial balance and including adjustments using the above additional information. 2a. Prepare the adjusting entries (all dated June 30). 2b. Prepare the closing entries (all dated June 30). 3a. Prepare the income statement for the year ended June 30. 3b. Prepare the statement of owner's equity for the year ended June 30. 3c. Prepare the classified balance sheet at June 30.

Can I please get help with this part of the question.\ ACE CONSTRUCTION COMPANY Unadjusted Trial Balance June 30 Number Account Title Debit Credit 101 Cash $ 16,500 126 Supplies 10,000 128 Prepaid insurance 7,000 167 Equipment 144,770 168 Accumulated depreciation—Equipment $ 24,500 201 Accounts payable 5,400 203 Interest payable 0 208 Rent payable 0 210 Wages payable 0 213 Property taxes payable 0 251 Long-term notes payable 23,000 301 V. Ace, Capital 77,500 302 V. Ace, Withdrawals 30,000 403 Construction revenue 150,000 612 Depreciation expense—Equipment 0 623 Wages expense 47,000 633 Interest expense 2,530 637 Insurance expense 0 640 Rent expense 12,000 652 Supplies expense 0 683 Property taxes expense 4,100 684 Repairs expense 2,700 690 Utilities expense 3,800 Totals $ 280,400 $ 280,400 Adjustments: Supplies available at the end of the current fiscal year total $3,600. Cost of expired insurance for the current fiscal year is $4,410. Annual depreciation on equipment is $8,300. June utilities expense of $540 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $540 amount owed must be recorded. Employees have earned $1,700 of accrued and unpaid wages at fiscal year-end. Rent expense incurred and not yet paid or recorded at fiscal year-end is $300. Additional property taxes of $700 have been assessed for this fiscal year but have not been paid or recorded at fiscal year-end. $230 of accrued interest for June has not yet been paid or recorded. Required: 1. Prepare a 10-column work sheet for the current fiscal year, starting with the unadjusted trial balance and including adjustments using the above additional information. 2a. Prepare the adjusting entries (all dated June 30). 2b. Prepare the closing entries (all dated June 30). 3a. Prepare the income statement for the year ended June 30. 3b. Prepare the statement of owner's equity for the year ended June 30. 3c. Prepare the classified balance sheet at June 30.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 5PEA: Using the income statement for Ousel Travel Service shown in Practice Exercise 1-4A, prepare a...

Related questions

Topic Video

Question

Can I please get help with this part of the question.\

| ACE CONSTRUCTION COMPANY | |||

| Unadjusted |

|||

| June 30 | |||

| Number | Account Title | Debit | Credit |

|---|---|---|---|

| 101 | Cash | $ 16,500 | |

| 126 | Supplies | 10,000 | |

| 128 | Prepaid insurance | 7,000 | |

| 167 | Equipment | 144,770 | |

| 168 | Accumulated |

$ 24,500 | |

| 201 | Accounts payable | 5,400 | |

| 203 | Interest payable | 0 | |

| 208 | Rent payable | 0 | |

| 210 | Wages payable | 0 | |

| 213 | Property taxes payable | 0 | |

| 251 | Long-term notes payable | 23,000 | |

| 301 | V. Ace, Capital | 77,500 | |

| 302 | V. Ace, Withdrawals | 30,000 | |

| 403 | Construction revenue | 150,000 | |

| 612 | Depreciation expense—Equipment | 0 | |

| 623 | Wages expense | 47,000 | |

| 633 | Interest expense | 2,530 | |

| 637 | Insurance expense | 0 | |

| 640 | Rent expense | 12,000 | |

| 652 | Supplies expense | 0 | |

| 683 | Property taxes expense | 4,100 | |

| 684 | Repairs expense | 2,700 | |

| 690 | Utilities expense | 3,800 | |

| Totals | $ 280,400 | $ 280,400 |

Adjustments:

- Supplies available at the end of the current fiscal year total $3,600.

- Cost of expired insurance for the current fiscal year is $4,410.

- Annual depreciation on equipment is $8,300.

- June utilities expense of $540 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $540 amount owed must be recorded.

- Employees have earned $1,700 of accrued and unpaid wages at fiscal year-end.

- Rent expense incurred and not yet paid or recorded at fiscal year-end is $300.

- Additional property taxes of $700 have been assessed for this fiscal year but have not been paid or recorded at fiscal year-end.

- $230 of accrued interest for June has not yet been paid or recorded.

Required:

1. Prepare a 10-column work sheet for the current fiscal year, starting with the unadjusted trial balance and including adjustments using the above additional information.

2a. Prepare the

2b. Prepare the closing entries (all dated June 30).

3a. Prepare the income statement for the year ended June 30.

3b. Prepare the statement of owner's equity for the year ended June 30.

3c. Prepare the classified balance sheet at June 30.

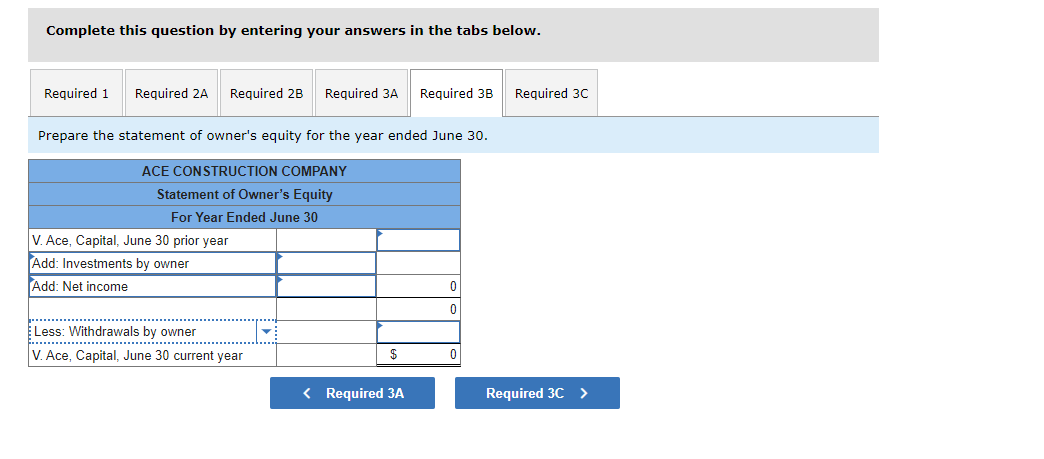

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2A Required 2B Required 3A Required 3B

Prepare the statement of owner's equity for the year ended June 30.

ACE CONSTRUCTION COMPANY

Statement of Owner's Equity

For Year Ended June 30

V. Ace, Capital, June 30 prior year

Add: Investments by owner

Add: Net income

Less: Withdrawals by owner

E…......…..

V. Ace, Capital, June 30 current year

$

< Required 3A

0

0

0

Required 3C

Required 3C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

the part of the problem(owner equity) does not seem to be answered

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning