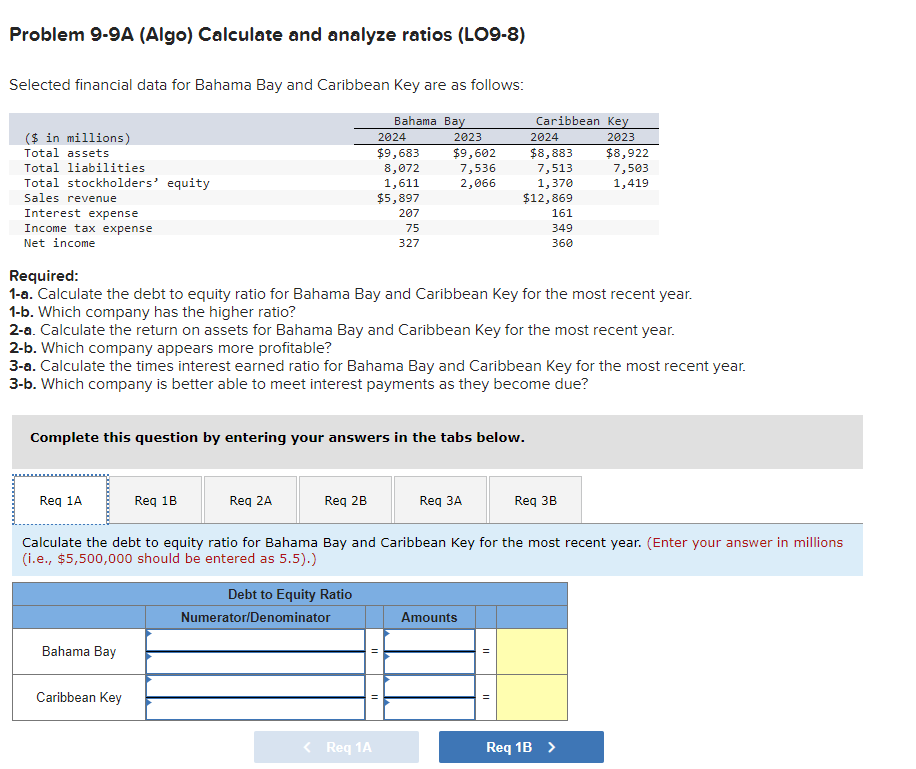

Problem 9-9A (Algo) Calculate and analyze ratios (LO9-8) Selected financial data for Bahama Bay and Caribbean Key are as follows: ($ in millions) Total assets Total liabilities Total stockholders' equity Sales revenue Interest expense Income tax expense Net income Req 1A Reg 1B Bahama Bay Req 2A 2024 $9,683 8,072 1,611 $5,897 Req 2B 207 75 327 Complete this question by entering your answers in the tabs below. 2023 $9,602 7,536 2,066 Required: 1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. 1-b. Which company has the higher ratio? 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Caribbean Key 2023 2024 $8,883 7,513 1,370 $12,869 Req 3A 161 349 360 $8,922 7,503 1,419 Req 3B

Problem 9-9A (Algo) Calculate and analyze ratios (LO9-8) Selected financial data for Bahama Bay and Caribbean Key are as follows: ($ in millions) Total assets Total liabilities Total stockholders' equity Sales revenue Interest expense Income tax expense Net income Req 1A Reg 1B Bahama Bay Req 2A 2024 $9,683 8,072 1,611 $5,897 Req 2B 207 75 327 Complete this question by entering your answers in the tabs below. 2023 $9,602 7,536 2,066 Required: 1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. 1-b. Which company has the higher ratio? 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Caribbean Key 2023 2024 $8,883 7,513 1,370 $12,869 Req 3A 161 349 360 $8,922 7,503 1,419 Req 3B

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 49E

Related questions

Question

Please do not give solution in image format thanku

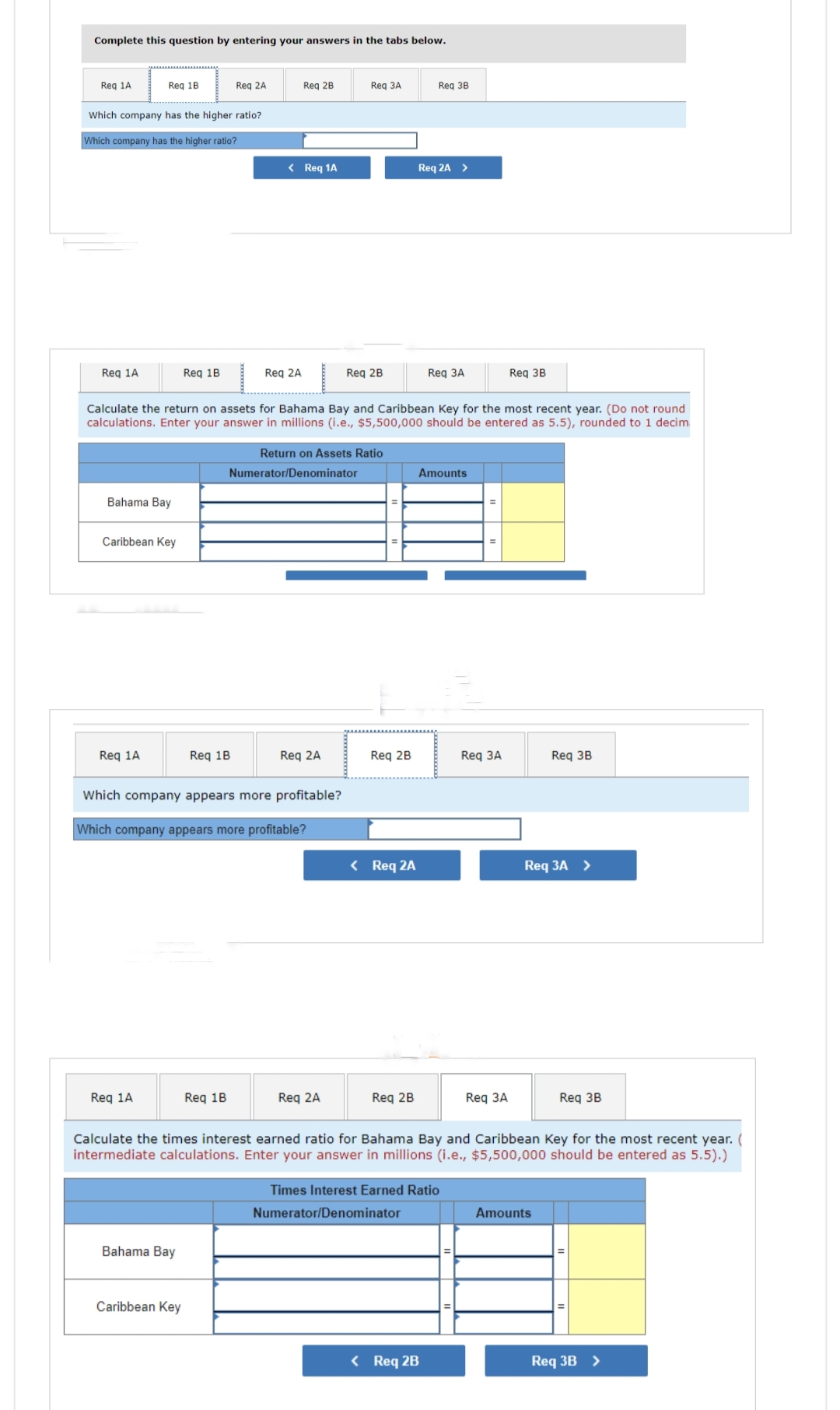

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1A

Req 1A

Which company has the higher ratio?

Which company has the higher ratio?

Req 1B

Bahama Bay

Caribbean Key

Req 1A

Req 1A

Req 1B

Bahama Bay

Req 2A

Caribbean Key

Req 1B

Req 1B

Req 2B

< Req 1A

Req 2A

Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. (Do not round

calculations. Enter your answer in millions (i.e., $5,500,000 should be entered as 5.5), rounded to 1 decim

Which company appears more profitable?

Which company appears more profitable?

Numerator/Denominator

Return on Assets Ratio

Req 2A

Req 3A

Req 2B

Req 2A

Req 2B

< Req 2A

Req 2B

Req 3B

Req 2A >

Req 3A

< Req 2B

Amounts

Times Interest Earned Ratio

Numerator/Denominator

Reg 3A

Req 3B

Req 3A

Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. (

intermediate calculations. Enter your answer in millions (i.e., $5,500,000 should be entered as 5.5).)

Req 3B

Req 3A >

Amounts

Req 3B

Req 3B >

Transcribed Image Text:Problem 9-9A (Algo) Calculate and analyze ratios (LO9-8)

Selected financial data for Bahama Bay and Caribbean Key are as follows:

($ in millions)

Total assets

Total liabilities

Total stockholders' equity

Sales revenue

Interest expense

Income tax expense

Net income

Req 1A

Bahama Bay

Req 1B

Caribbean Key

Required:

1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year.

1-b. Which company has the higher ratio?

2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year.

Complete this question by entering your answers in the tabs below.

Req 2A

2-b. Which company appears more profitable?

3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year.

3-b. Which company is better able to meet interest payments as they become due?

Req 2B

2024

$9,683

8,072

1,611

$5,897

Debt to Equity Ratio

Bahama Bay

Numerator/Denominator

207

75

327

II

< Req 1A

2023

$9,602

7,536

2,066

II

Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. (Enter your answer in millions

(i.e., $5,500,000 should be entered as 5.5).)

Req 3A

Caribbean Key

2024

2023

$8,883

7,513

1,370

$12,869

Amounts

161

349

360

11

II

$8,922

7,503

1,419

Req 3B

Req 1B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning