Can you help me with this? I don’t know how to find the total direct selling expense. I also don’t know how to find the total indirect selling expense. I think I’m having trouble figuring out what is considered direct and indirect but also what would be considered “a sales representatives compensation”. The first picture that I uploaded labeled 3A and 3B is my main focus I’ve uploaded a second photo labeled 2A and 2B because I also couldn’t figure out what the indirect cost was in that one either.

Can you help me with this? I don’t know how to find the total direct selling expense. I also don’t know how to find the total indirect selling expense. I think I’m having trouble figuring out what is considered direct and indirect but also what would be considered “a sales representatives compensation”. The first picture that I uploaded labeled 3A and 3B is my main focus I’ve uploaded a second photo labeled 2A and 2B because I also couldn’t figure out what the indirect cost was in that one either.

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 4PB: West Island distributes a single product. The companys sales and expenses for the month of June are...

Related questions

Question

Can you help me with this? I don’t know how to find the total direct selling expense. I also don’t know how to find the total indirect selling expense. I think I’m having trouble figuring out what is considered direct and indirect but also what would be considered “a sales representatives compensation”. The first picture that I uploaded labeled 3A and 3B is my main focus I’ve uploaded a second photo labeled 2A and 2B because I also couldn’t figure out what the indirect cost was in that one either.

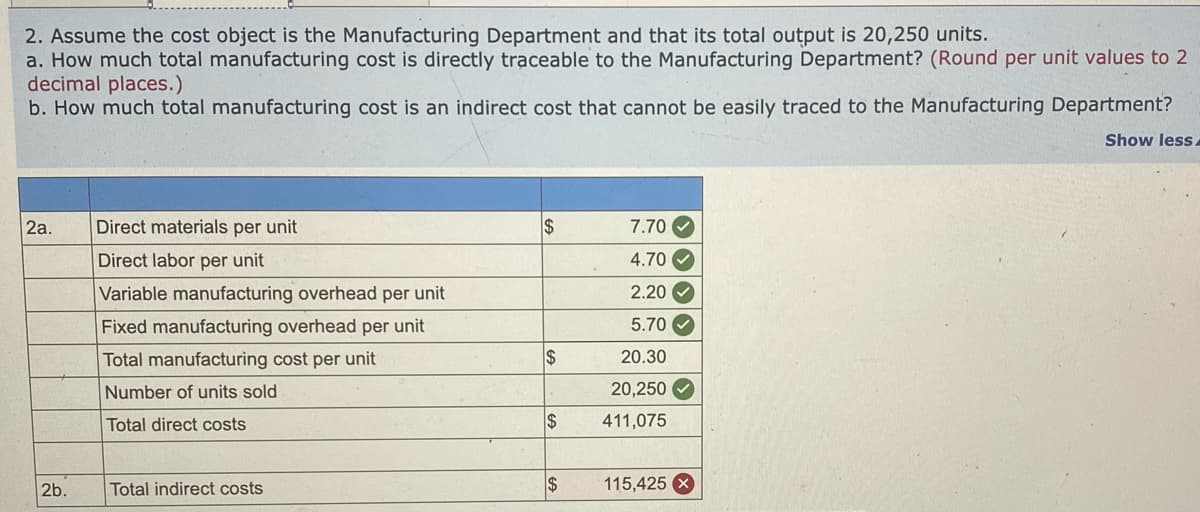

Transcribed Image Text:2. Assume the cost object is the Manufacturing Department and that its total output is 20,250 units.

a. How much total manufacturing cost is directly traceable to the Manufacturing Department? (Round per unit values to 2

decimal places.)

b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department?

Show less.

2a.

Direct materials per unit

$

7.70 O

Direct labor per unit

4.70 V

Variable manufacturing overhead per unit

2.20 V

Fixed manufacturing overhead per unit

5.70 V

Total manufacturing cost per unit

$

20.30

Number of units sold

20,250 O

Total direct costs

2$

411,075

2b.

Total indirect costs

$

115,425 X

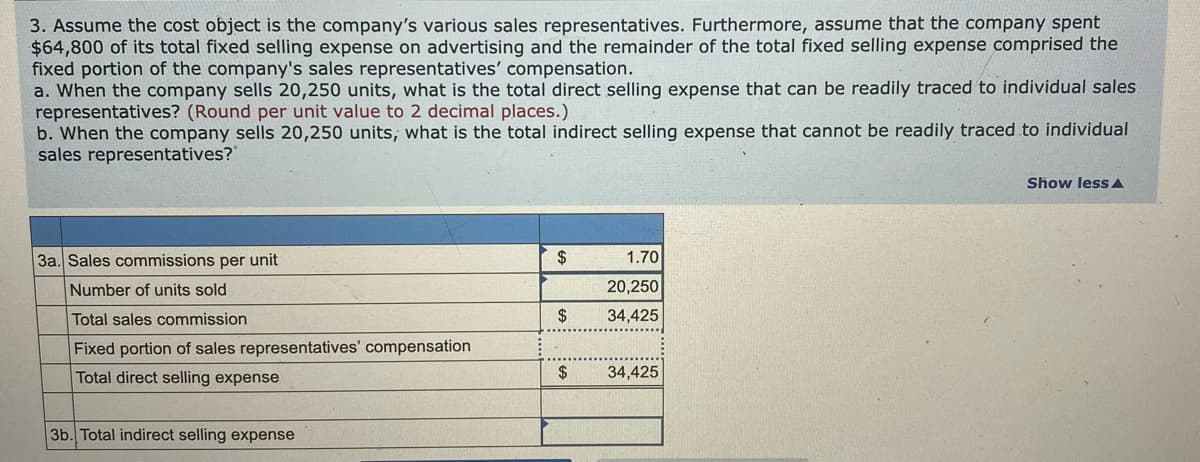

Transcribed Image Text:3. Assume the cost object is the company's various sales representatives. Furthermore, assume that the company spent

$64,800 of its total fixed selling expense on advertising and the remainder of the total fixed selling expense comprised the

fixed portion of the company's sales representatives' compensation.

a. When the company sells 20,250 units, what is the total direct selling expense that can be readily traced to individual sales

representatives? (Round per unit value to 2 decimal places.)

b. When the company sells 20,250 units, what is the total indirect selling expense that cannot be readily traced to individual

sales representatives?

Show less A

3a. Sales commissions per unit

2$

1.70

Number of units sold

20,250

Total sales commission

2$

34,425

Fixed portion of sales representatives' compensation

Total direct selling expense

2$

34,425

3b. Total indirect selling expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub