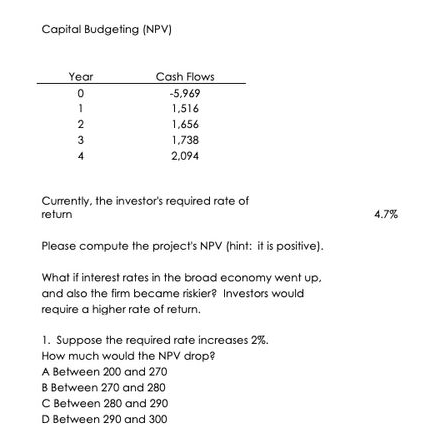

Capital Budgeting (NPV) Year Cash Flows -5,969 1 1,516 2 1,656 3 1,738 4 2.094 Currently, the investor's required rate of return 4.7% Please compute the projects NPV (hint: it is positive). What if interest rates in the broad economy went up. and also the firm became riskier? Investors would require a higher rate of return. 1. Suppose the required rate increases 2%. How much would the NPV drop? A Between 200 and 270 B Between 270 and 280 C Between 280 and 290 D Between 290 and 300

Q: 3. A company is considering a project with the following cash flows. The external interest rate is…

A: Rate of return can be computed using IRR formula in excel.

Q: Estimating the cash flow generated by $1 invested in investment The profitability index (PI) is a…

A: Net present value The variance of the cash inflows (PV) and cash outflows (PV) over time.

Q: What is Optimal Capital Budget and Capital Rationing? Explain briefly Calculate Optimal Capital…

A: Optimal Capital Budget The optimal capital budget refers to the investment contributing to the…

Q: Basic Capital Budgeting Techniques; Uneven Net Cash Inflows with Taxes; SpreadsheetApplication Use…

A: Given, The Year Pre-tax Cash Inflow Year Pre-tax Cash Inflow is given below as,

Q: A firm wants to start a project. A team of financial analysts estimated the following cash flows…

A: Net Present Value is the difference between the Present Value of Future Cash flow at the required…

Q: Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to…

A: 1. Solution 1):- Identify which project(s) is/are unacceptable and briefly state the conceptual…

Q: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital…

A: As per the honor code, we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit…

Q: 1.) Accounting measures of performance Consider an asset with the following cash flows: Cash flows…

A: Book Rate of Return is calculated as the ratio of the book income of the firm to the book asset.…

Q: A capital budgeting project is expected to have the following cash flows: Year Cash Flows 0…

A: Project present value is the net current value of cash inflows and outflows during the period of the…

Q: Company Rapid Growth is considering the following project: Year 0 1 2 3 4 5 Cash Flows -$87800…

A: Profitability Index: It is the tool that measures the relationship between PV(Present Value) of cash…

Q: Capital Budgeting with Inflation. For questions 7 and 8 use the following information. Consider the…

A: NPV is the sum of present value of future cashflows less initial investment

Q: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital…

A: WACC = 8% Cash Flows: Year Cash Flow - A Cash Flow - B 0 -980 -980 1 620 220 2 310 245 3…

Q: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital…

A: The payback period refers to the duration in which the company recovered there invested amount from…

Q: CAPITAL BUDGETING 3. How much will you need to invest today at 10% to have $10,000 six years from…

A: SOLUTION- FORMULA= X*(1+R)^6 HERE, N= LIFE = 6 R= INTEREST RATE =10% X= INVEST TODAY = $10000

Q: A. Payback. The company requires all projects to payback within 3 years. Calculate the payback…

A: Payback period = Year of last negative cash flow + (Absolute value of last negative cash flow/Next…

Q: Perform capital budgeting technique based on Equivalent Annual Cost (EAC) to advise the Company…

A: Equivalent Annual Cost: The Equivalent annual cost is calculated as the present value of all costs…

Q: 13. Herbilux Botanicals forecasts the following cash flows at the end of each year for a project. If…

A: Solution:- Present value means the value in today’s terms. It is calculated by discounting the…

Q: ll amounts are in $AUD. In order to satisfy the sharp increase in demand KGN is evaluating investing…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Your firm is evaluating a capital budgeting project. The estimated cash flows appear below. The…

A: When a company decides whether or not to invest, it employs tools such as the IRR and NPV methods.…

Q: Capital Budgeting (NPV) Year Cash Flows -5,969 1,516 1,656 1,738 2.094 Currently, the investor's…

A: Net present value (NPV) is the difference between the present value of cash inflows and the present…

Q: Quantitative Problem: Belinger Industries is considering two projects for inclusion in its cepital…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: a firm wants to start a project. a team of financial analysts estimated the following cash flows.

A: Discounted cash flow (DCF) helps determine the value of an investment based on its future cash…

Q: Cash Flows Project A ($ in millions) Project B ($ in millions) Initial Outflow – 211 – 82…

A: Note: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts…

Q: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital…

A: NPV is a sum of cash inflows from an investment project over the particular periods.

Q: 21. Funds Alpha and Beta have the following as shown below. If you will invest $5,000,000 and expect…

A: Solution- Option (A) is correct answer Particulars Working Alpha Beta Investment 50,00,000…

Q: Table 17-A-1 Payback Method Input Year Cash Flow 0 (70,000) Balance (70,000)

A: Pay back period is one of the basic and simple method of capital budgeting in which time required to…

Q: 1 Scenario AnalysisShao Industries is considering a proposed project for its capital budget.…

A: The NPV refers to the discount present value method of capital budgeting. It helps in the…

Q: Capital Budgeting (NPV) Year Cash Flows -5,969 1,516 1,656 1,738 2,094 Currently, the investor's…

A: Year Cash Flows ($) PVF @4.7% PV of cash flows ($) PVF @6.7% PV of Cash flows ($) 0 -5,969 1…

Q: Capital budgeting problems and what king of you used for solving (NPV and IRR PROBLEMS ) A firm has…

A: The question has 6 sub parts and we’re entitled to solve only 3 sub parts in one question. So,…

Q: Your firm is evaluating a capital budgeting project. The estimated cash flows appear below. The…

A: Net Present Value(NPV) refers to one of the concepts from the modern techniques of capital budgeting…

Q: The Potential for Multiple IRRs A proposed investment has the following projected after-taxcash…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: 50. An investment of $773,640 is expected to generate cash flows of $200,000 in Year 1, $300,000 in…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: as « Question 15 of 50 > Clayton Industries is planning its operations for next year. Ronnie…

A: Formula used: AFN = Projected increase in assets – spontaneous increase in liabilities – Any…

Q: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital…

A: IRR is the Internal rate of return. It is that rate at which the NPV of a project is zero ie: the…

Q: -2 CAPITAL BUDGETING CRITERIA You must analyze two projects, X and Y. Each project costs $10,000,…

A: NPV is the sum of present value of cash flows in the project WACC= 12% Year Cash Flows - X…

Q: our firm is evaluating a capital budgeting project. The estimated cash flows appear below. The board…

A: Net present value is the difference between the present value of cash flow and initial investment…

Q: CAPITAL BUDGETING CRITERIA You must analyze two projects, X and Y. Each project costs $10,000, and…

A: Capital budgeting is a method an investment appraisal method. It is used for finding the worthiness…

Q: CAPITAL BUDGETING CRITERIA A firm with a 14% WACC is evaluating two projects for this year’s capital…

A: NPV is the net present value of cash flows at a given required rate of return. IRR is internal rate…

Q: Analyze the two independent projects, X and Y. Each project costs $10,000, and the firm’s required…

A: Capital projects are spread across multiple years. Financial viability of the capital projects could…

Q: CAPITAL BUDGETING CRITERIA You must analyze two projects, X and Y. Each project costs $10,000, and…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts for you. Please…

Q: YOUR Directions: Evaluate the following projects. Which is the best among them using the different…

A: Calculation of Annual Rate of Return(ARR) Calculation of Average net income Project A Project B…

Q: Capital budgeting problems and what king of you used for solving (NPV and IRR PROBLEMS ) A firm has…

A: All the financials in this solution are in $. Figures in parenthesis mean negative values.Based on…

Q: QUESTION 1 Suppose that you are working as a capital budgeting analyst in a finance department of a…

A: Please note that we have answered the Question 1 Part 1 here. Please resubmit the other questions…

Q: 9OUR Directions: Evaluate the following projects. Which is the best among them using the different…

A: Note:- Here last year cash flows are included with Salvage value. To Find: Payback period

Q: 21. An investment of $894,168 promises to return $180,000 each year for the next eight years. If…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: A firm wants to start a project. A team of financial analysts estimated the following cash flows…

A: A firm is planning to make a capital expenditure in different projects, and the nominal return is…

Q: Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts for you. Please…

Q: Capital Budgeting (NPV) Year Cash Flows -5.969 1,516 2 1,656 3 1,738 2.094 Currently, the investor's…

A: Capital budgeting: When a firm makes a large investment on an asset for a long period of time, it is…

Step by step

Solved in 4 steps with 2 images

- Your firm is evaluating a capital budgeting project. The estimated cash flows appear below. The board of directors wants to know the expected impact on shareholder wealth. Knowing that the estimated impact on shareholder wealth equates to net present value (NPV), you use your handy calculator to compute the value. What is the project's NPV? Assume that the cash flows occur at the end of each year. The discount rate (i.e., required rate of return, hurdle rate) is 17.4%. (Round to nearest penny) Year 0 cash flow -132,000 Year 1 cash flow 52,000 Year 2 cash flow 31,000 Year 3 cash flow 42,000 Year 4 cash flow 39,000 Year 5 cash flow 18,000A capital budgeting project is expected to have the following cash flows: Year Cash Flows 0 -$500,000 1 $300,000 2 $300,000 3 $200,000 4 $100,000 What is the project's net present value at a 12% required rate of return? Group of answer choices $276,475 $225,868 $212,923 $200,373Capital budgeting problems and what king of you used for solving (NPV and IRR PROBLEMS ) A firm has the following investment alternative. Each one lasts a year Investment A B C Cach inflow $1,150 $560 $600 Cash outflow $1000 $500 $500 The firm's cost capital 7 percent. A and B are mutually exclusive, and B and C are mutually exclusive. a. What is the net value of investment A? Investment B? investment C? B. W hat is the internal rate on investment A? investment B? INvestment C? c. Which invedstment(s) should the firm make? Why? d. If the firm had unlimited sources of funds, which investments should it make? Why? e. If there another alternative, investment D, with an internal rate of return of 6 percent, would that alter your anser to question (d)? why? f. If the firm's cost of…

- Capital budgeting problems and what king of you used for solving (NPV and IRR PROBLEMS ) A firm has the following investment alternative. Each one lasts a year Investment A B C Cach inflow $1,150 $560 $600 Cash outflow $1000 $500 $500 The firm's cost capital 7 percent. A and B are mutually exclusive, and B and C are mutually exclusive. d. If the firm had unlimited sources of funds, which investments should it make? Why? e. If there another alternative, investment D, with an internal rate of return of 6 percent, would that alter your anser to question (d)? why? f. If the firm's cost of capital rose to 10 percent, what effect would that have on investment A's internal rate return?A firm wants to start a project. A team of financial analysts estimated the following cash flows year cash flow 0 -$100,000 1 55,000 2 43,000 3 45,000 Suppose that the discount rate (interest rate) is 12%. The profitability index (PI) is Group of answer choices 15,416.59 1.15 0.87 2.15. Capital budgeting is the process of identifying, analyzing and selecting investment projects whose returns are expected to extend beyond one year. This capital budgeting decision for an investment requires the analysis of some factors. 1. List and explain three (3) of these factors. 2. You have an investment opportunity that requires an initial investment of GH¢5,000 today and will pay GH¢6,000 in a year’s time. If an alternative investment with similar risk pays 25%, should you invest? 3. You will retire in 18 years and you currently have GH¢250,000 saved, and your plan is to have GH¢1,000,000 at your retirement. What annual interest rate must you earn to reach this goal, assuming you do not save any additional funds? 4. With practical example(s), differentiate between compounding and discounting. 5. As a Business Finance student, what is the essence of the valuation principle in your personal life?

- 1 Scenario AnalysisShao Industries is considering a proposed project for its capital budget. Thecompany estimates the project’s NPV is $12 million. This estimate assumesthat the economy and market conditions will be average over the next fewyears. The company’s CFO, however, forecasts there is only a 50% chancethat the economy will be average. Recognizing this uncertainty, she has alsoperformed the following scenario analysis: Economic Scenario Probability of Outcome NPVRecession 0.05 -$70 millionBelow average 0.20 -25 millionAverage 0.50 12 millionAbove average 0.20 20 millionBoom 0.05 30 millionWhat are the project’s expected NPV, standard deviation,…a. Capital budgeting is the process of identifying, analyzing and selecting investment projects whose returns are expected to extend beyond one year. This capital budgeting decision for an investment requires the analysis of some factors. List and explain three (3) of these factors. b. You have an investment opportunity that requires an initial investment of GH¢5,000 today and will pay GH¢6,000 in a year’s time. If an alternative investment with similar risk pays 25%, should you invest? c. You will retire in 18 years and you currently have GH¢250,000 saved, and your plan is to have GH¢1,000,000 at your retirement. What annual interest rate must you earn to reach this goal, assuming you do not save any additional funds? d. With practical example(s), differentiate between compounding and discounting. e. As a Business Finance student, what is the essence of the valuation principle in your personal life?Suppose that you are working as a capital budgeting analyst in a finance department of a firm and you are going to evaluate two mutually exclusive projects by implementing different capital budgeting techniques. The cash flows for these two projects are given below. YEAR CASH FLOW (A) CASH FLOW (B) 0 -$17,000 -$17,000 1 8,000 2,000 2 7,000 5,000 3 5,000 9,000 4 3,000 9,500 1) Suppose that the discount rate is 11%. Calculate the Net Present Values (NPV) of both projects. Which project should you accept according to NPV? Evaluate your findings.

- XYZ Corporation is considering a capital budgeting project and requires a detailed analysis. The company has provided youwith the following financial information and ratios:Return on Investment (ROI): 15%Payback Period: 3 yearsNet Present Value (NPV): R50,000Internal Rate of Return (IRR): 12%Cash Flows:Year 1: R20 000Year 2: R30 000Year 3: R40 0001.4 Calculate the ARR for XYZ Corporation. Assume depreciation is calculated on the straight-linemethod and that the project has a scrap value of R5000The Potential for Multiple IRRs A proposed investment has the following projected after-taxcash flows over its 3-year life:Initial outlay (time 0) = ($1,000)End of year 1 = $2,000End of year 2 = $2,000End of year 3 = ($3,700) Required 1. In a capital budgeting context, explain the difference between a normal and a non-normal cash flowpattern. What is the importance of this distinction for estimating the internal rate of return (IRR) of aproposed investment? 2. For the proposed investment project just described, how many IRRs will there be? Why?3. Use Excel to prepare a graph of the net present value (NPV) profile of the proposed investment describedherein. On the X-axis, show discount rates from 0% to 120%, in increments of 5%. On the Y-axis, showthe estimated NPV of the project for each of the specified discount rates. (Use the built-in NPV functionin Excel to estimate the NPVs.) Based on a visual examination of the graph, what are the two estimatedIRRs for the proposed investment? 4.…A project has the following cash inflows $34,444; $39,877; $25,000; and $52,800 for years 1 through 4, respectively. The initial cash outflow is $140,000. The firm has decided to assume that the appropriate cost of capital is 10% and the appropriate risk-free rate is 6%. what is the internal rate of return (IRR) of the Project? * 10