Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 17P: EQUIVALENT ANNUAL ANNUITY A firm has two mutually exclusive investment projects to evaluate. The...

Related questions

Question

capital expenditure budgets concepts. One of the methods used is the payback period method.

what it means to have a project with a 3.5 years as payback period? Explain. If nvesting in this project, would you prefer a lower payback period (let's say 2.5 years for example) or a higher payback period (let's say 4.5 years for example)? and why?

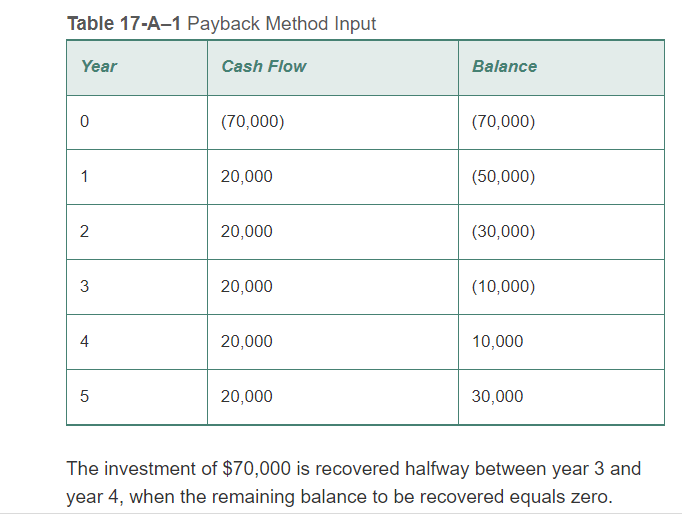

Transcribed Image Text:Table 17-A-1 Payback Method Input

Year

0

1

2

3

4

5

Cash Flow

(70,000)

20,000

20,000

20,000

20,000

20,000

Balance

(70,000)

(50,000)

(30,000)

(10,000)

10,000

30,000

The investment of $70,000 is recovered halfway between year 3 and

year 4, when the remaining balance to be recovered equals zero.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning