Capital Budgeting using Net Present Value Method PV of Cost of Investment PV of Net Cashflow: Net Present Value Year 1 2 3 4 5 Initial investment = 2,700,000 Net Income + Depreciation 424,136.33 518,972.18 655,465.06 804,369.79 944,783.16 PV Factor of 12% 0.8929 0.7972 0.7118 0.6355 0.5674 Present Value of Net Cashflow 2,807,294.61 631,449.13 703,622.11 366,400.07 351,076.44 335,063.91 2,387,611.66 -419,682.95

Q: d. The percentage of total revenue made up by corporate income taxes is e. The percentage of total…

A: Formulas: The percentage of total revenue made up of corporate income taxes = corporate income…

Q: An individual is consuming two goods, good x and good y. His utility function is given as Perfect…

A: The usefulness of goods and services to consumers can be assessed using the utility. While new…

Q: Let E X, and let MU, denote the marginal utility for good i E {1, 2} at r. (a) Suppose some good i…

A: A utility function is said to have non-satiation properties if more of any good always leads to a…

Q: For the Utility function and demand functions: U(x, y) = x0.5 + y0.5 I x(px, Py, 1) = Px (1 +PxPy¹)…

A: Price elasticity of demand: It measures the percentage change in the quantity demanded for a 1%…

Q: Suppose the consumer's utility is given by u(x) = x² + (1 + x2)², and their income and prices are…

A: Since you have posted a question with multiple sub-parts, we will provide the solution to only the…

Q: hy were banks originally created? How has their purpose evolved over time?

A: A bank is a type of financial institution that takes client deposits and lends or invests the money.…

Q: 2. a. In an economy, the CPI went from 150 in 2014 to 130 in 2015. Did this economy have inflation…

A: Consumer Price Index refers to the change in prices paid by the individual or consumer for the goods…

Q: Identify which curve on the previous graph corresponds to each of the following descriptions. If the…

A: Aggregate Demand (AD) curve shows the relationship between the price level and the quantity of goods…

Q: Calculating the price elasticity of supply Antonio is a retired teacher living in San Diego who…

A: Price elasticity depicts the responsiveness of the quantity of a product or service demanded (Qd) or…

Q: For the Utility function and demand functions: U(x, y) = x0.5 + y0.5 I x(px,Py, 1): Px(1+PxPy¹) I…

A: Price Elasticity of demand measures the percentage change in the quantity demanded for a one percent…

Q: 3. The Keynesian and classical views of aggregate supply Complete the following table by matching…

A: The supply curve is a graphical representation of the relationship between the quantity of a good or…

Q: Consider the following utility function: U(x, y) = = xy x-y (a) Derive the MRS of x to y. Show your…

A: The utility function is the mathematical relationship between the utility and different bundles of…

Q: Ms. Blume and Mr. Simon both live in Iowa. In February, a car dealer in Iowa bought a new,…

A: GDP: GDP or gross domestic product is the sum of the value of all end commodities produced within…

Q: 5. How can lowering replacement rates or increasing the retirement age affect the Social Security…

A: The Social Security tax rate refers to the percentage of an individual's earnings that is paid as…

Q: Consider a type of product whose market structure is monopolistic competition. In the shift from no…

A: Product differentiation refers to the process by which firms in a monopolistically competitive…

Q: PESTLE analysis can provide answers to the following specific global market entry questions Multiple…

A: The important external factors that could have an impact on a company's business operations and…

Q: Howard Bowen is a large-scale cotton farmer. The land and machinery he owns has a current market…

A: Accounting Cost vs. Opportunity Cost: Accountants keep trace of out-of-pocket costs, also known as…

Q: why do credit cards charge higher interest than home and car loans? please help me with this…

A: A credit card is a type of payment card that enables the cardholder to borrow money from a bank or…

Q: If the costs of producing tomatoes increase, what is the likely impact on the supply and demand…

A: The quantity of an item or service that suppliers are willing and able to offer for sale at various…

Q: Suppose Devon is a fan of young-adult fiction and buys only young-adult books. Devon deposits $2,000…

A: Inflation is when the prices of products and services keep rising over a certain period. It results…

Q: The monthly market basket for consumers consists of pizza, t-shirts, and rent. The table below shows…

A: The Consumer Price Index (CPI) measures the average change in the prices overtime which are paid by…

Q: Many years of past economic growth mean that the most-developed countries have ______. Group of…

A: The increase in the production of commodities and services in an economy over time is termed…

Q: If the federal tax rate is 21% and the state tax rate is 10%, determine the combined tax rate (do…

A: Note: Since you have posted multiple questions, we will provide the solution only to the first five…

Q: tional voter ignorance of the following statements regarding rational ignorance are true? Check all…

A: Anthony Downs coined the expression "rational voter ignorance". The public choice theory in…

Q: Consider a market that is perfectly competitive and has no externalities. Which, if any, of these…

A: Many people imagine free markets as having minimal to no government influence. Governments really…

Q: The economy grows 3.59 percent per year over a 20 year period. 0.67 percent per year is attributed…

A: Technological progress refers to the advancement of technology over time. This includes improvements…

Q: Price Per Unit $20 $16 Answer: $14 100 Supply Demand The graph above shows the demand and supply of…

A: Consumer surplus is the area below demand curve and above price. Producer surplus is the area below…

Q: Firm B Low Price High Price Firm A rm B receives $ Low Price A: $14 million B: $14 million High…

A: A pareto outcome is the payoff where by deviating from the strategy no player can be better off…

Q: The primary inducement for new firms to enter an industry is: A. increased technology. B.…

A: Total revenue is the product of price and quantity. Total cost is the total cost of producing…

Q: I Numerical Analysis 1. Suppose that the money demand function is (4) = 1000 - 100r where r is the…

A: Monetary policy has taken numerous shapes. Whatever the case appears to be, the underlying task is…

Q: Why is the demand curve downward sloping?

A: The demand curve is downward sloping because of the law of demand, which states that as the price of…

Q: “The co-winners of [the 2011] Nobel economics prize are two Americans whose work shows how important…

A: According to the economic theory known as Ricardian equivalence, consumers respond to changes in…

Q: If foreigners investing in the United States (.e. Di) exceeds U.S. investors investing abroad (.e.…

A: Relative Price of USA Exports = (Nominal Exchange Rate x Foreign Price Index) / Domestic Price Index…

Q: A country's Central Bank is characterised by the following Loss function (L) and Phillips Curve…

A:

Q: Health Sector Reform is an on-going process designed to meet the growing and changing demands of the…

A: In the field of economics, the production and consumption of products and services related to health…

Q: Why is the supply curve upward sloping? Group of answer choices It isn't. it is downward sloping. -A…

A: The supply curve is the curve between quantity supplied and price and it represents the relationship…

Q: In March 2016 American employers added 215,000 positions to their payrolls, bringing the average job…

A: The unemployment rate depicts the proportion of unemployed individuals in the total labor force. The…

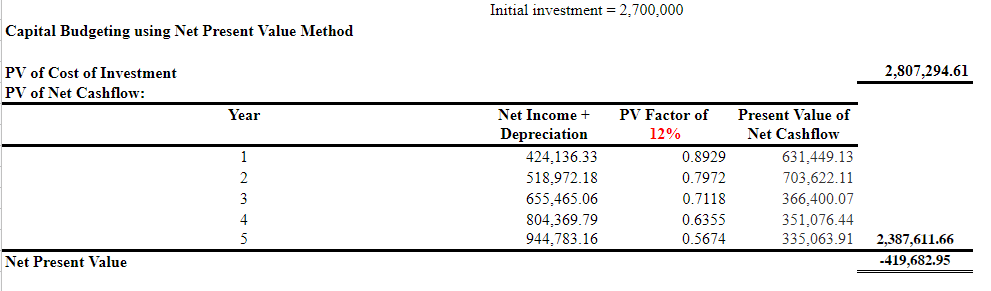

Q: Could you use formulas instead of tables? please

A: To determine the present value the flows of cash in future will be discounted at the given rate of…

Q: Cobb-Douglas: u(x₁, x₂) = x5x25; mo = 200; p₁ = 10; P₂ = 20; p₁ = 8. Solve for the CV and EV due to…

A:

Q: In the model SIM of chapter 3 of the book of Godley, Wynne, and Marc Lavoie. 2012. Monetary…

A: To simulate the effect of an increase in government expenditure in the SIM model with simple…

Q: Fill in the blanks to make the following statements correct. a. Macroeconomic equilibrium occurs at…

A: Aggregate demand refers to the term used in macroeconomics to tell us the total demand for products…

Q: The labour market in an economy is characterised by the following equations: Wage setting: Price…

A: Wage determination in the labor market is characterized by the WS equation. There is a negative link…

Q: To choose the best alternative among the given alternatives in the annual cash flow analysis method,…

A: The equivalent uniform annual worth refers to the value of a series of cashflows at some point in…

Q: Consider a Duopoly model, in which two firms decide a quantity simultaneously. The market demand is…

A: Cournot equilibrium is a concept in economics that describes a situation in which two or more firms…

Q: The average cost of a firm producing a product in an area declines as the output of that firm's…

A: Economies of scale that occur outside of a company but within the same sector are known as external…

Q: The total price of purchasing a basket of goods in the United States over four years is: year…

A: Given information: The total price of purchasing a basket of goods over four years is as follows:…

Q: Which of the following do economists not generally regard as a legitimate reason for the government…

A: Classical economists contend the role of government should be small and on second thought the…

Q: Plot an Isocost line for a firm that is spending $10,000 on labor and capital. Then, draw a…

A: A graphic representation of all potential combinations of two inputs, such as labor and capital,…

Q: For each demand function, find an expression for the price elasticity of demand. 1. D(p)=60−p 2.…

A: Price elasticity measures the percentage change in quantity due to percentage change in price. Ed =…

Q: Suppose marginal benefits and marginal costs are given by B(Y) = 100 − 16Y and C(Y) = 20Y. What…

A: Net benefit is the difference between total benefits and total cost. Net benefit is maximum when…

can u explain how did they get this digit, use excel and pls pic the formula

Step by step

Solved in 2 steps with 3 images

- Debbie's Cookies has a return on assets of 8.1 percent and a cost of equity of 12.5 percent. What is the pretax cost of debt if the debt–equity ratio is .87? Ignore taxes.Consider company ABC. Today it is 1st of January 2023 and ABC has just paid a dividend of £3 million. The expected earnings of ABC for the next 30 years are forecast to grow at a rate of 15% per annum. From 1st of January 2053 and onwards the earnings of ABC are expected to grow at a rate of 5%. The required rate of return of ABC is 12% per annum. The current dividend policy of ABC is such that they pay out 50% of its earnings as dividends (assume that they pay their dividends on 1st of January every year). a) Suppose that the dividend payout ratio is expected to stay constant in the future. What is the value of ABC stock? Show and explain your calculations and any assumptions you make. b) Just after the dividend payment on 1st of January 2043, ABC is planning to reduce their dividends and only pay out 40% of its earnings. What is the value of ABC under the new dividend policy? c) Provide a recommendation to the management of ABC as to whether they should increase/cut back on…Suppose you purchased a corporate bond with a 10-year maturity, a $1,000 par value, a 9% coupon rate ($45 interest payment every six months), and semiannual interest payments. Five years after the bonds were purchased, the going rate of interest on new bonds fell to 6% (or 6% compounded semiannually). What is the current market value (P) of the bond (five years after the purchase)?(a) P = $890(b) p = $1,223(c) P = $1,090(d) p = $1,128

- Armor Investment Company is considering the acquisition of a heavily depreciated building on 10 acres of land. It expects to rent the building as a storage facility and expects to collect cash flows equal to $100,000 next year. However, because depreciation is expected to increase, Armor expects cash flows to decline at a rate of 4 percent per year indefinitely. Armor expects to earn an IRR on investment return (r) at 13 percent. a. What is the value of this property? b. Assume that after 5 years the building could be demolished and the land could be redeveloped with a strip retail improvement. The latter would produce NOI of $200,000 per year, grow at 3 percent per year, and cost $1 million to build. Investors currently earn a 10 percent IRR on such investments. How would this affect your estimate of value in (a)?The Duo Growth Company just paid a dividend of $1.00 per share. The dividend is expected to grow at a rate of 26% per year for the next three years and then to level off to 5% per year forever. You think the appropriate market capitalization rate is 21% per year. Required: a. What is your estimate of the intrinsic value of a share of the stock? Note: Use intermediate calculations rounded to 4 decimal places. Round your answer to 2 decimal places. b. If the market price of a share is equal to this intrinsic value, what is the expected dividend yield? Note: Use intermediate values rounded to 2 decimal places. Round your answer to 2 decimal places. c. What do you expect its price to be one year from now? Note: Use intermediate values rounded to 4 decimal places. Round your answer to 2 decimal places. d-1. What is the implied capital gain? Note: Use intermediate values rounded to 2 decimal places. Round your answer to 4 decimal places. d-2. Is the implied capital gain…You invested $100,000 in a project and received $40,000 at n = 1, $40,000 atn = 2, and $30,000 at n = 3 years. You need to terminate the project at the end of year 3. Your interest rate is 10%; what is the project balance at the time of termination?(a) Gain of $10,000(b) Loss of $8,039(c) Loss of $10,700(d) Just break even

- What is capital recovery? A.The income recognized from insurance proceeds received after a capital asset is lost due to a casualty such as theft or fire. B. Matching the income you make from using capital assets with the expenses representing the use of the assets producing the income. C.Using a capital asset that had been previously taken out of service, but is now in use again. D. When the cost of capital assets exceed the gross revenue in the acquisition year.A stock now trades for 11 TL per share and distributes 0.16 TL in dividends annually. What is the stock worth to an investor if she anticipates selling it for 14 TL in a year and demands a 10% return on equity investments? a. 12,89%b. 12,73%c. 12,87%d. 10%Which of the following investment options willmaximize your future wealth at the end of 18 years?Assume any funds that remain invested will earn anominal rate of 12% compounded monthly.(a) Deposit $8,000 now.(b) Deposit $120 at the end of each month for thefirst 12 years.(c) Deposit $105 at the end of each month for 18years.(d) Deposit a lump sum in the amount of $35,000 atthe end of year 12.

- Racine Tire Co. manufactures tires for all-terrain bicycles, The tires sell for P60 and variable cost per tire is P45; monthly fixed cost is P450,000. Requirement: 1. Calculate the firm's break-even point in sales pesos 2. What will be the new net income? 3. If the company can increase sales volume by 15 percent above the current level, 8,400,000 tires monthly What will be the increase in net income?"All growth models. You are evaluating the potential purchase of a small company that currently generates $42,500 in cash flow after taxes (D0 = $42,500). Based on a review of similar risk investment opportunities, you should earn a return rate of 18% from the proposed purchase. Since you're not very sure about future cash flows, you decide to calculate the value of the company assuming some possibilities for the cash flow growth rate. a) What is the value of the company if cash flows are expected to grow at an annual rate of 0% from now on? b) What is the value of the company if cash flows are expected to grow at a constant annual rate of 7% from now on? c) What is the value of the company if cash flows are expected to grow at an annual rate of 12% for the first 2 years and then, starting from year 3, the growth rate decreases to a constant annual rate of 7%?"8. A businessman purchases a common stock worth P1,000 every year for a period of 10 years. At the of the 10th year just after his last purchase, he sold all his stock to a prospective buyer for P12,000. Find the rate of return he received on the investment. a. 3% b. 4% c. 5% d. 8%