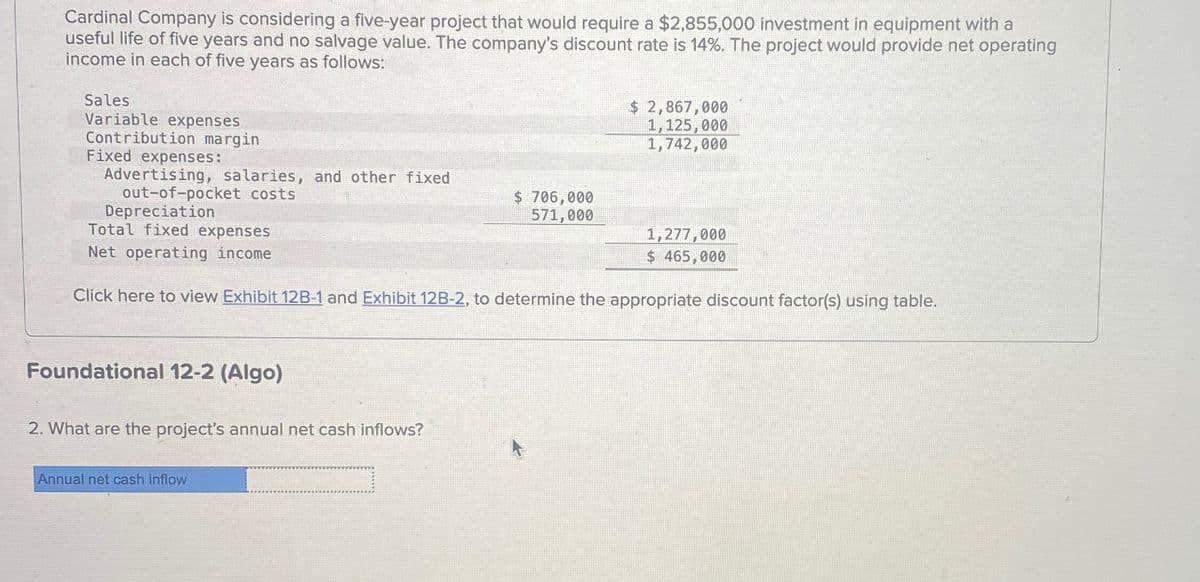

Cardinal Company is considering a five-year project that would require a $2,855,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs. Depreciation Total fixed expenses $ 2,867,000 1,125,000 1,742,000 $ 706,000 571,000 1,277,000 $ 465,000 Net operating income Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Foundational 12-2 (Algo) 2. What are the project's annual net cash inflows? Annual net cash inflow

Cardinal Company is considering a five-year project that would require a $2,855,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs. Depreciation Total fixed expenses $ 2,867,000 1,125,000 1,742,000 $ 706,000 571,000 1,277,000 $ 465,000 Net operating income Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Foundational 12-2 (Algo) 2. What are the project's annual net cash inflows? Annual net cash inflow

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

Hardev

Transcribed Image Text:Cardinal Company is considering a five-year project that would require a $2,855,000 investment in equipment with a

useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating

income in each of five years as follows:

Sales

Variable expenses

Contribution margin

Fixed expenses:

Advertising, salaries, and other fixed

out-of-pocket costs.

Depreciation

Total fixed expenses

$ 2,867,000

1,125,000

1,742,000

$ 706,000

571,000

1,277,000

$ 465,000

Net operating income

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table.

Foundational 12-2 (Algo)

2. What are the project's annual net cash inflows?

Annual net cash inflow

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning