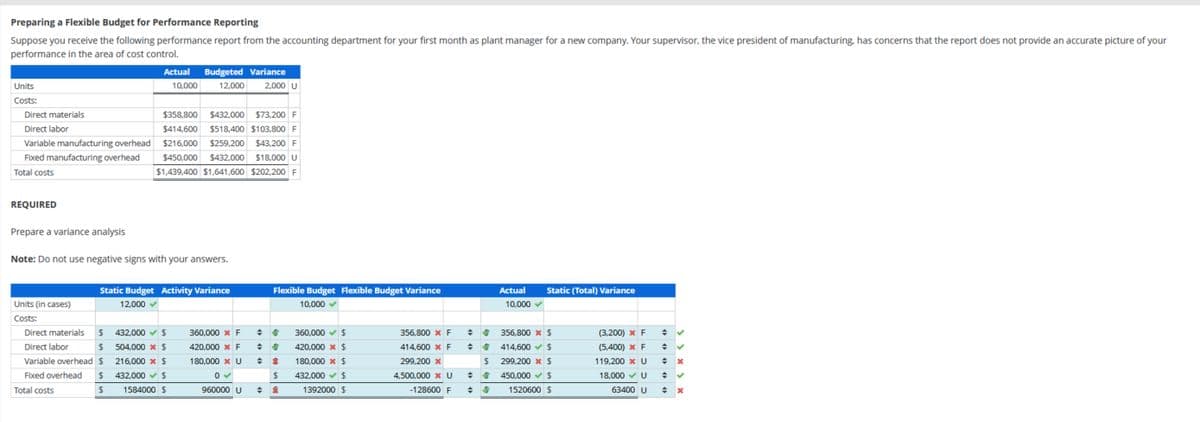

Preparing a Flexible Budget for Performance Reporting Suppose you receive the following performance report from the accounting department for your first month as plant manager for a new company. Your supervisor, the vice president of manufacturing, has concerns that the report does not provide an accurate picture of your performance in the area of cost control. Actual Budgeted Variance Units Costs: 10,000 12,000 2,000 U Direct materials $358,800 Direct labor $414,600 Variable manufacturing overhead $216,000 Fixed manufacturing overhead Total costs $432,000 $73,200 F $518,400 $103,800 F $259,200 $43,200 F $450,000 $432,000 $18,000 U $1,439,400 $1,641,600 $202,200 F REQUIRED Prepare a variance analysis Note: Do not use negative signs with your answers. Static Budget Activity Variance Flexible Budget Flexible Budget Variance Units (in cases) 12,000 10,000 Actual 10,000 ✓ Static (Total) Variance Costs: Direct materials Direct labor Variable overhead $ $ 432,000 $ $ 504,000 x $ 360,000 * F 420,000 x F ÷ $ $ 360,000 $ 420,000 * $ 216,000 * $ 180,000 * U $ 180,000 * $ 356,800 x F ÷ $ 414,600 x F ÷ $ 299,200 x 356,800 x $ 414,600 $ (3,200) x F $ 299,200 x $ (5,400) x F 119,200 x U ÷ く ÷ く ÷ × Fixed overhead $ 432,000 $ 0 ✓ $ 432,000 $ 4,500,000 U = $ 450,000 $ 18,000 U ÷ く Total costs $ 1584000 $ 960000 U ÷ * 1392000 $ -128600 F ÷ $ 1520600 $ 63400 U ÷

Preparing a Flexible Budget for Performance Reporting Suppose you receive the following performance report from the accounting department for your first month as plant manager for a new company. Your supervisor, the vice president of manufacturing, has concerns that the report does not provide an accurate picture of your performance in the area of cost control. Actual Budgeted Variance Units Costs: 10,000 12,000 2,000 U Direct materials $358,800 Direct labor $414,600 Variable manufacturing overhead $216,000 Fixed manufacturing overhead Total costs $432,000 $73,200 F $518,400 $103,800 F $259,200 $43,200 F $450,000 $432,000 $18,000 U $1,439,400 $1,641,600 $202,200 F REQUIRED Prepare a variance analysis Note: Do not use negative signs with your answers. Static Budget Activity Variance Flexible Budget Flexible Budget Variance Units (in cases) 12,000 10,000 Actual 10,000 ✓ Static (Total) Variance Costs: Direct materials Direct labor Variable overhead $ $ 432,000 $ $ 504,000 x $ 360,000 * F 420,000 x F ÷ $ $ 360,000 $ 420,000 * $ 216,000 * $ 180,000 * U $ 180,000 * $ 356,800 x F ÷ $ 414,600 x F ÷ $ 299,200 x 356,800 x $ 414,600 $ (3,200) x F $ 299,200 x $ (5,400) x F 119,200 x U ÷ く ÷ く ÷ × Fixed overhead $ 432,000 $ 0 ✓ $ 432,000 $ 4,500,000 U = $ 450,000 $ 18,000 U ÷ く Total costs $ 1584000 $ 960000 U ÷ * 1392000 $ -128600 F ÷ $ 1520600 $ 63400 U ÷

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter7: The Master Budget And Flexible Budgeting

Section: Chapter Questions

Problem 8P: Preparing a performance report Use the flexible budget prepared in P7-6 for the 29,000-unit level of...

Related questions

Question

Transcribed Image Text:Preparing a Flexible Budget for Performance Reporting

Suppose you receive the following performance report from the accounting department for your first month as plant manager for a new company. Your supervisor, the vice president of manufacturing, has concerns that the report does not provide an accurate picture of your

performance in the area of cost control.

Actual

Budgeted Variance

Units

Costs:

10,000

12,000

2,000 U

Direct materials

$358,800

Direct labor

$414,600

Variable manufacturing overhead

$216,000

Fixed manufacturing overhead

Total costs

$432,000 $73,200 F

$518,400 $103,800 F

$259,200 $43,200 F

$450,000 $432,000 $18,000 U

$1,439,400 $1,641,600 $202,200 F

REQUIRED

Prepare a variance analysis

Note: Do not use negative signs with your answers.

Static Budget Activity Variance

Flexible Budget Flexible Budget Variance

Units (in cases)

12,000

10,000

Actual

10,000 ✓

Static (Total) Variance

Costs:

Direct materials

Direct labor

Variable overhead $

$

432,000

$

$

504,000 x $

360,000 * F

420,000 x F

÷ $

$

360,000 $

420,000 * $

216,000 * $

180,000 * U

$

180,000 * $

356,800 x F ÷ $

414,600 x F ÷ $

299,200 x

356,800 x $

414,600 $

(3,200) x F

$ 299,200 x $

(5,400) x F

119,200 x U

÷ く

÷ く

÷ ×

Fixed overhead

$

432,000 $

0 ✓

$

432,000 $

4,500,000 U

=

$

450,000 $

18,000 U

÷ く

Total costs

$

1584000 $

960000 U

÷

*

1392000 $

-128600 F ÷ $

1520600 $

63400 U

÷

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning