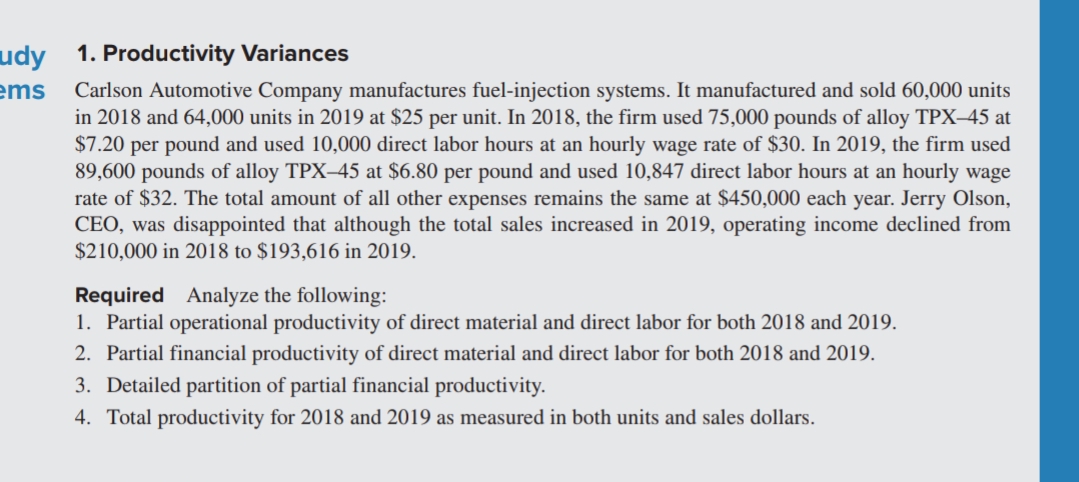

Carlson Automotive Company manufactures fuel-injection systems. It manufactured and sold 60,000 units in 2018 and 64,000 units in 2019 at $25 per unit. In 2018, the firm used 75,000 pounds of alloy TPX–45 at $7.20 per pound and used 10,000 direct labor hours at an hourly wage rate of $30. In 2019, the firm used 89,600 pounds of alloy TPX-45 at $6.80 per pound and used 10,847 direct labor hours at an hourly wage rate of $32. The total amount of all other expenses remains the same at $450,000 each year. Jerry Olson, CEO, was disappointed that although the total sales increased in 2019, operating income declined from $210,000 in 2018 to $193,616 in 2019. Required Analyze the following: 1. Partial operational productivity of direct material and direct labor for both 2018 and 2019. 2. Partial financial productivity of direct material and direct labor for both 2018 and 2019. 3. Detailed partition of partial financial productivity. 4. Total productivity for 2018 and 2019 as measured in both units and sales dollars.

Carlson Automotive Company manufactures fuel-injection systems. It manufactured and sold 60,000 units in 2018 and 64,000 units in 2019 at $25 per unit. In 2018, the firm used 75,000 pounds of alloy TPX–45 at $7.20 per pound and used 10,000 direct labor hours at an hourly wage rate of $30. In 2019, the firm used 89,600 pounds of alloy TPX-45 at $6.80 per pound and used 10,847 direct labor hours at an hourly wage rate of $32. The total amount of all other expenses remains the same at $450,000 each year. Jerry Olson, CEO, was disappointed that although the total sales increased in 2019, operating income declined from $210,000 in 2018 to $193,616 in 2019. Required Analyze the following: 1. Partial operational productivity of direct material and direct labor for both 2018 and 2019. 2. Partial financial productivity of direct material and direct labor for both 2018 and 2019. 3. Detailed partition of partial financial productivity. 4. Total productivity for 2018 and 2019 as measured in both units and sales dollars.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 33E: A companys controller is adjusting next years budget to reflect the impact of an expected 3 percent...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

100%

Transcribed Image Text:udy 1. Productivity Variances

ems

Carlson Automotive Company manufactures fuel-injection systems. It manufactured and sold 60,000 units

in 2018 and 64,000 units in 2019 at $25 per unit. In 2018, the firm used 75,000 pounds of alloy TPX–45 at

$7.20 per pound and used 10,000 direct labor hours at an hourly wage rate of $30. In 2019, the firm used

89,600 pounds of alloy TPX–45 at $6.80 per pound and used 10,847 direct labor hours at an hourly wage

rate of $32. The total amount of all other expenses remains the same at $450,000 each year. Jerry Olson,

CEO, was disappointed that although the total sales increased in 2019, operating income declined from

$210,000 in 2018 to $193,616 in 2019.

Required Analyze the following:

1. Partial operational productivity of direct material and direct labor for both 2018 and 2019.

2. Partial financial productivity of direct material and direct labor for both 2018 and 2019.

3. Detailed partition of partial financial productivity.

4. Total productivity for 2018 and 2019 as measured in both units and sales dollars.

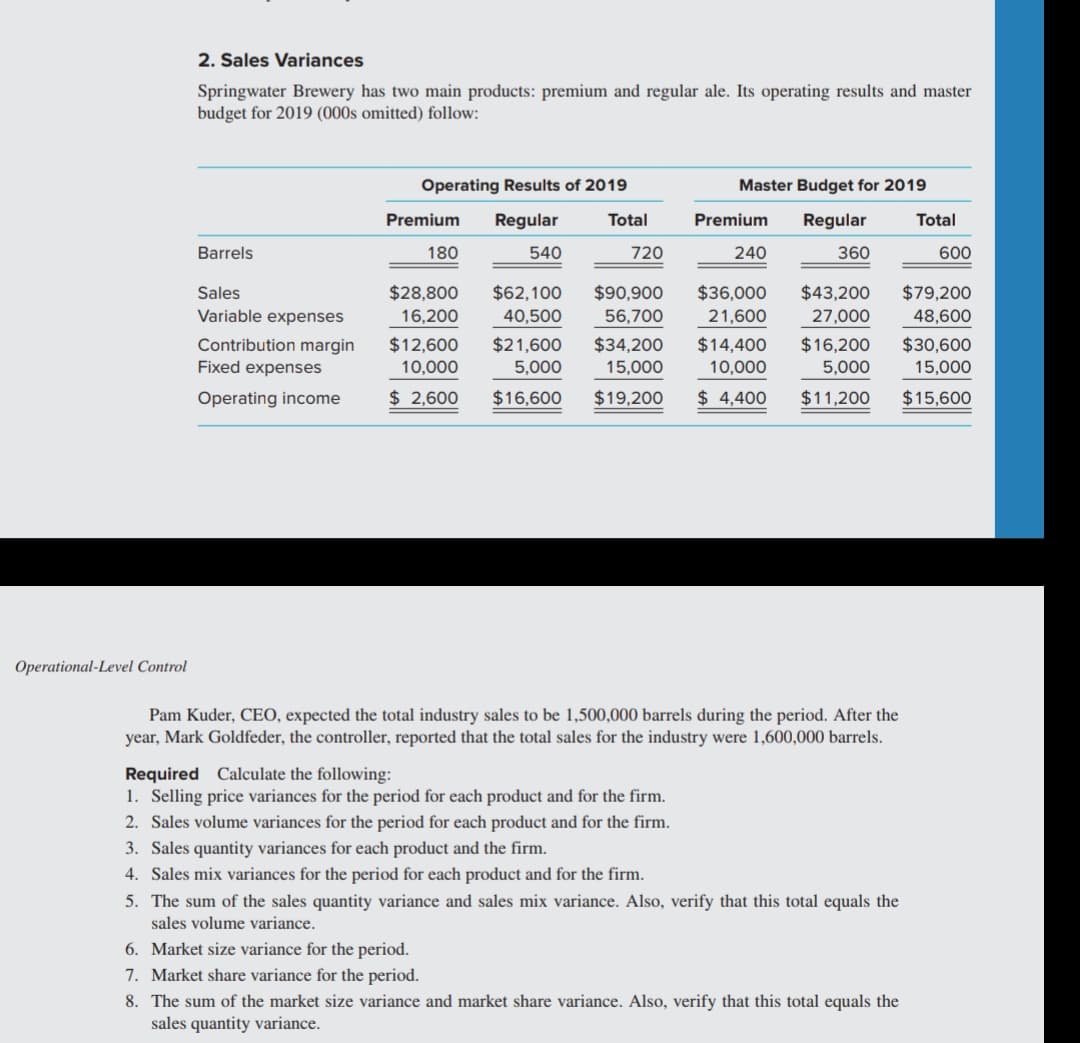

Transcribed Image Text:2. Sales Variances

Springwater Brewery has two main products: premium and regular ale. Its operating results and master

budget for 2019 (000s omitted) follow:

Operating Results of 2019

Master Budget for 2019

Premium

Regular

Total

Premium

Regular

Total

Barrels

180

540

720

240

360

600

$28,800

$62,100

40,500

$90,900

56,700

Sales

$36,000

$43,200

$79,200

Variable expenses

16,200

21,600

27,000

48,600

Contribution margin

Fixed expenses

$12,600

10,000

$21,600

5,000

$34,200

15,000

$14,400

10,000

$16,200

5,000

$30,600

15,000

Operating income

$ 2,600

$16,600

$19,200

$ 4,400

$11,200

$15,600

Operational-Level Control

Pam Kuder, CEO, expected the total industry sales to be 1,500,000 barrels during the period. After the

year, Mark Goldfeder, the controller, reported that the total sales for the industry were 1,600,000 barrels.

Required Calculate the following:

1. Selling price variances for the period for each product and for the firm.

2. Sales volume variances for the period for each product and for the firm.

3. Sales quantity variances for each product and the firm.

4. Sales mix variances for the period for each product and for the firm.

5. The sum of the sales quantity variance and sales mix variance. Also, verify that this total equals the

sales volume variance.

6. Market size variance for the period.

7. Market share variance for the period.

8. The sum of the market size variance and market share variance. Also, verify that this total equals the

sales quantity variance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning