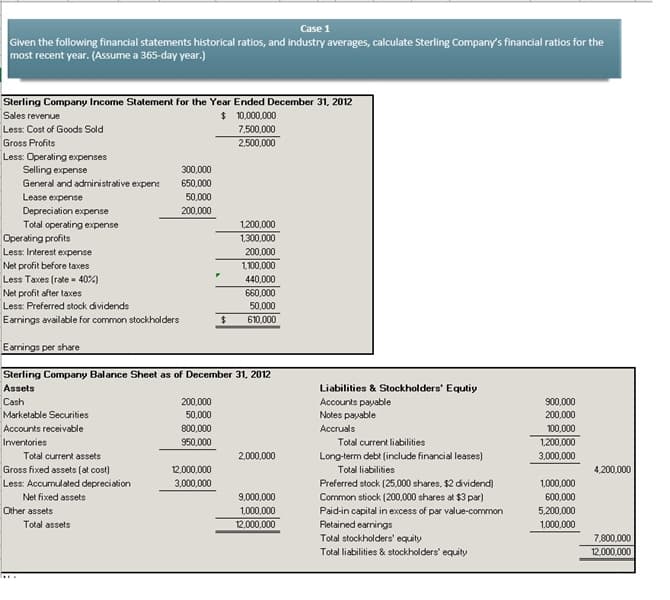

Case 1 Given the following financial statements historical ratios, and industry averages, calculate Sterling Company's financial ratios for the most recent year. (Assume a 365-day year.) Sterling Company Income Statement for the Year Ended December 31, 2012 $ 10,000,000 7,500,000 Sales revenue Less: Cost of Goods Sold Gross Profits 2,500,000 Less: Operating expenses Selling expense General and administrative expens 300,000 650,000 Lease expense 50,000 Depreciation expense Total operating expense 200,000 1,200,000 Operating profits 1,300,000 Less: Interest expense 200,000 Net profit before taxes 1100,000 Less Taxes (rate - 40%) 440.000 Net profit after taxes Less: Preferred stock dividends 660,000 50,000 Earnings available for common stockholders 610,000 Earnings per share Sterling Company Balance Sheet as of December 31, 2012 Assets Liabilities & Stockholders' Equtiy Cash 200,000 Accounts payable Notes payable 900,000 Marketable Securities 50,000 200,000 Accounts receivable 800,000 Accruals 100,000 Inventories 950,000 Total current liabilities 1.200,000 Total current assets 2.000.000 Long-term debt (include financial leases) Total liabilities 3,000,000 12,000,000 Gross fixed assets (at cost) Less: Accumulated depreciation 4,200,000 3,000,000 Preferred stock (25,000 shares, $2 dividend) 1,000,000 Net fixed assets 9.000.000 Common stiock (200,000 shares at $3 par) 600,000 Paid-in capital in excess of par value-common Retained earrings Other assets 1,000,000 5,200,000 Total assets 12,000,000 1,000,000 Total stockholders' equity Total liabilities & stockholders' equity 7,800,000 12,000,000

Case 1 Given the following financial statements historical ratios, and industry averages, calculate Sterling Company's financial ratios for the most recent year. (Assume a 365-day year.) Sterling Company Income Statement for the Year Ended December 31, 2012 $ 10,000,000 7,500,000 Sales revenue Less: Cost of Goods Sold Gross Profits 2,500,000 Less: Operating expenses Selling expense General and administrative expens 300,000 650,000 Lease expense 50,000 Depreciation expense Total operating expense 200,000 1,200,000 Operating profits 1,300,000 Less: Interest expense 200,000 Net profit before taxes 1100,000 Less Taxes (rate - 40%) 440.000 Net profit after taxes Less: Preferred stock dividends 660,000 50,000 Earnings available for common stockholders 610,000 Earnings per share Sterling Company Balance Sheet as of December 31, 2012 Assets Liabilities & Stockholders' Equtiy Cash 200,000 Accounts payable Notes payable 900,000 Marketable Securities 50,000 200,000 Accounts receivable 800,000 Accruals 100,000 Inventories 950,000 Total current liabilities 1.200,000 Total current assets 2.000.000 Long-term debt (include financial leases) Total liabilities 3,000,000 12,000,000 Gross fixed assets (at cost) Less: Accumulated depreciation 4,200,000 3,000,000 Preferred stock (25,000 shares, $2 dividend) 1,000,000 Net fixed assets 9.000.000 Common stiock (200,000 shares at $3 par) 600,000 Paid-in capital in excess of par value-common Retained earrings Other assets 1,000,000 5,200,000 Total assets 12,000,000 1,000,000 Total stockholders' equity Total liabilities & stockholders' equity 7,800,000 12,000,000

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.1EX: Vertical analysis of income statement Revenue and expense data for Innovation Quarter Inc. for two...

Related questions

Question

Notes:

a. The firm has an 8-year financial lease requiring annual beginning-of-year payments of $50,000. Five years of the lease have yet to run.

b. Annual credit purchases of $6,200,000 were made during the year.

c. The annual principal payment on the long-term debt is $100,000.

d. On December 31, 2012, the firm’s common stock closed at $39.50 per share.

Question:

1. What is the

2. What is the

Transcribed Image Text:Case 1

Given the following financial statements historical ratios, and industry averages, calculate Sterling Company's financial ratios for the

most recent year. (Assume a 365-day year.)

Sterling Company Income Statement for the Year Ended December 31, 2012

$ 10,000,000

7,500,000

Sales revenue

Less: Cost of Goods Sold

Gross Profits

2,500,000

Less: Operating expenses

Selling expense

General and administrative expens

300,000

650,000

Lease expense

50,000

Depreciation expense

Total operating expense

200,000

1,200,000

Operating profits

1,300,000

200,000

Less: Interest expense

Net profit before taxes

1,100,000

Less Taxes (rate - 40%)

440,000

Net profit after taxes

Less: Preferred stock dividends

660,000

50,000

Earnings available for common stockholders

24

610,000

Earnings per share

Sterling Company Balance Sheet as of December 31, 2012

Assets

Liabilities & Stockholders' Equtiy

Cash

200,000

Accounts payable

Notes payable

900,000

Marketable Securities

50,000

200,000

Accounts receivable

800,000

Accruals

100,000

Inventories

950,000

Total current liabilities

1,200,000

Total current assets

2.000,000

Long-term debt (include financial leases)

Total liabilities

3,000,000

Gross fixed assets (at cost)

12,000,000

4,200,000

Less: Accumulated depreciation

3,000,000

Preferred stock (25,000 shares, $2 dividend)

1,000,000

Net fixed assets

9,000,000

Common stiock (200,000 shares at $3 par)

Paid-in capital in excess of par value-common

600,000

Other assets

1,000,000

5,200,000

Total assets

12,000,000

Retained earrings

Total stockholders' equity

Total liabilities & stockholders' equity

1,000,000

7,800,000

12,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning